Additionally on this letter:

■ BluSmart FY24 income jumps

■ Drop in renewal offers troubles IT cos

■ Ola Cabs CEO Hemant Bakshi resigns

Paytm Funds Financial institution’s cell pockets enterprise in a spot

Paytm Funds Financial institution is watching an unsure future after the Reserve Financial institution of India (RBI) requested the financial institution to cease providing primary banking providers. Now, information from the RBI exhibits transactions within the financial institution’s numerous enterprise areas are dying down.

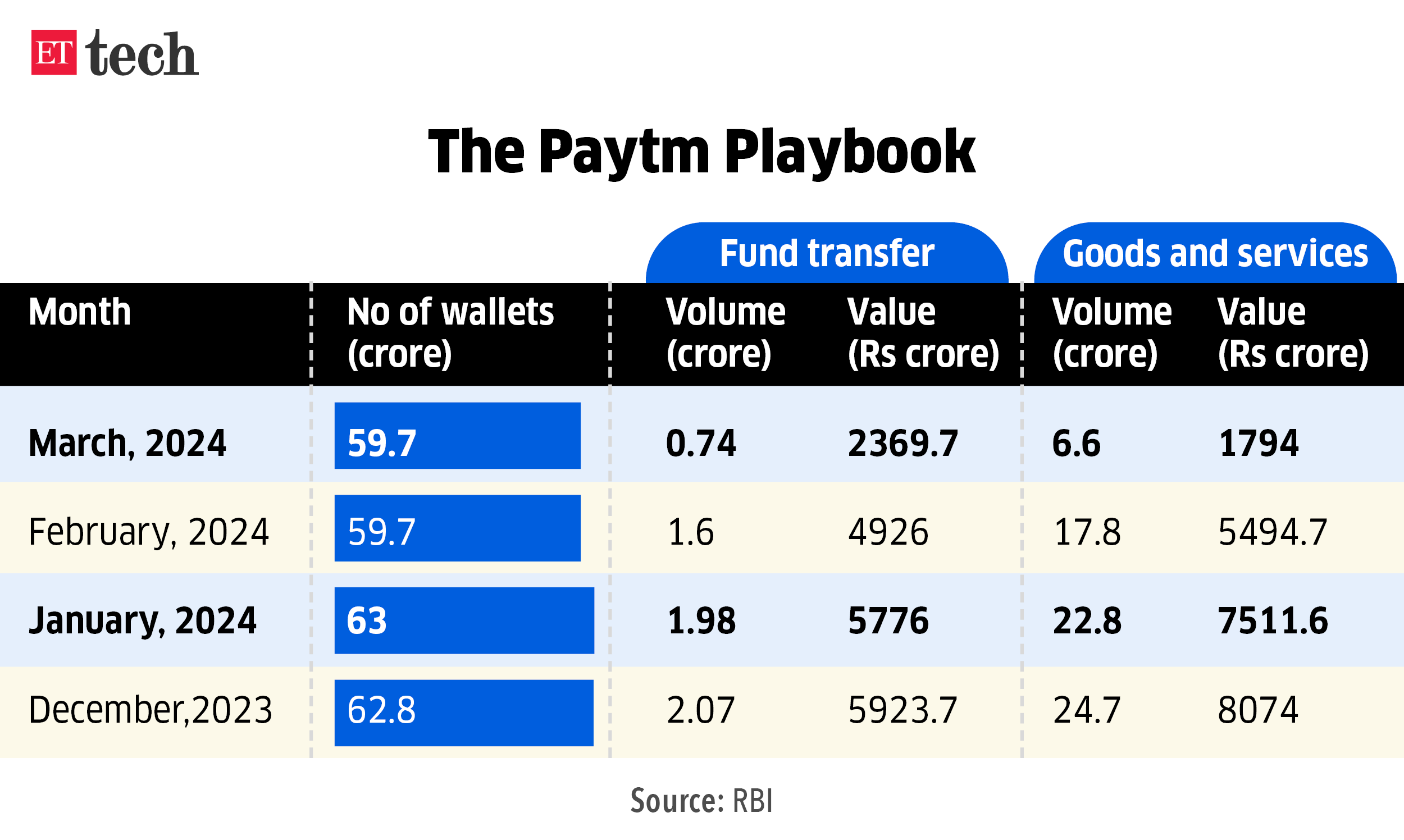

Driving the information: Throughout each cell wallets and UPI funds originating from Paytm Funds Financial institution accounts, transactions have plummeted 60 to 70%. The utilization of wallets for fund switch, when it comes to transactions, declined 64%, whereas the variety of occasions these wallets have been used for getting items and providers fell by 74%.

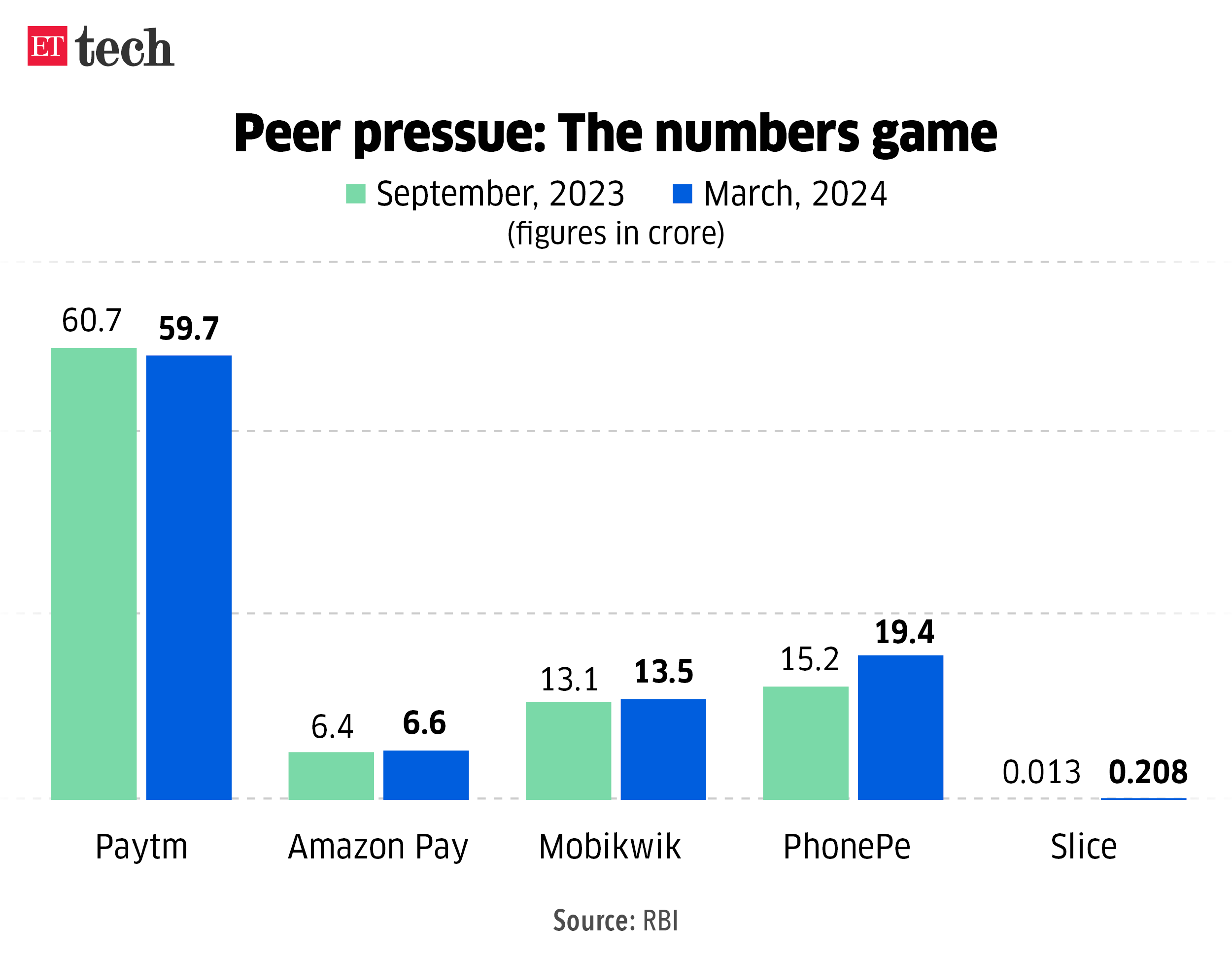

Missed alternative: One 97 Communications, which runs fintech app Paytm, had constructed its pockets enterprise during the last decade. Boasting nearly 600 million wallets, it was the nation’s largest cell pockets participant. Now all these wallets are set to fall right into a state of disuse. Whereas Paytm has moved its enterprise from the beleaguered funds financial institution to different industrial lenders, wallets have been a revenue-generating product for the Noida-headquartered fintech.

Catch up fast: Paytm Funds Financial institution landed in bother after the banking regulator ordered it to cease providing primary banking providers from end-February, ultimately extending the deadline to mid-March. Paytm founder Vijay Shekhar Sharma stepped down as chairman of the financial institution’s board on February 26. Your entire board of the financial institution was changed. On April 8, Paytm Funds Financial institution CEO Surinder Chawla resigned as nicely, successfully leaving the financial institution rudderless.

Tribe Capital’s new India car set to take a position $75 million extra in Shiprocket

Tribe Capital cofounder Arjun Sethi

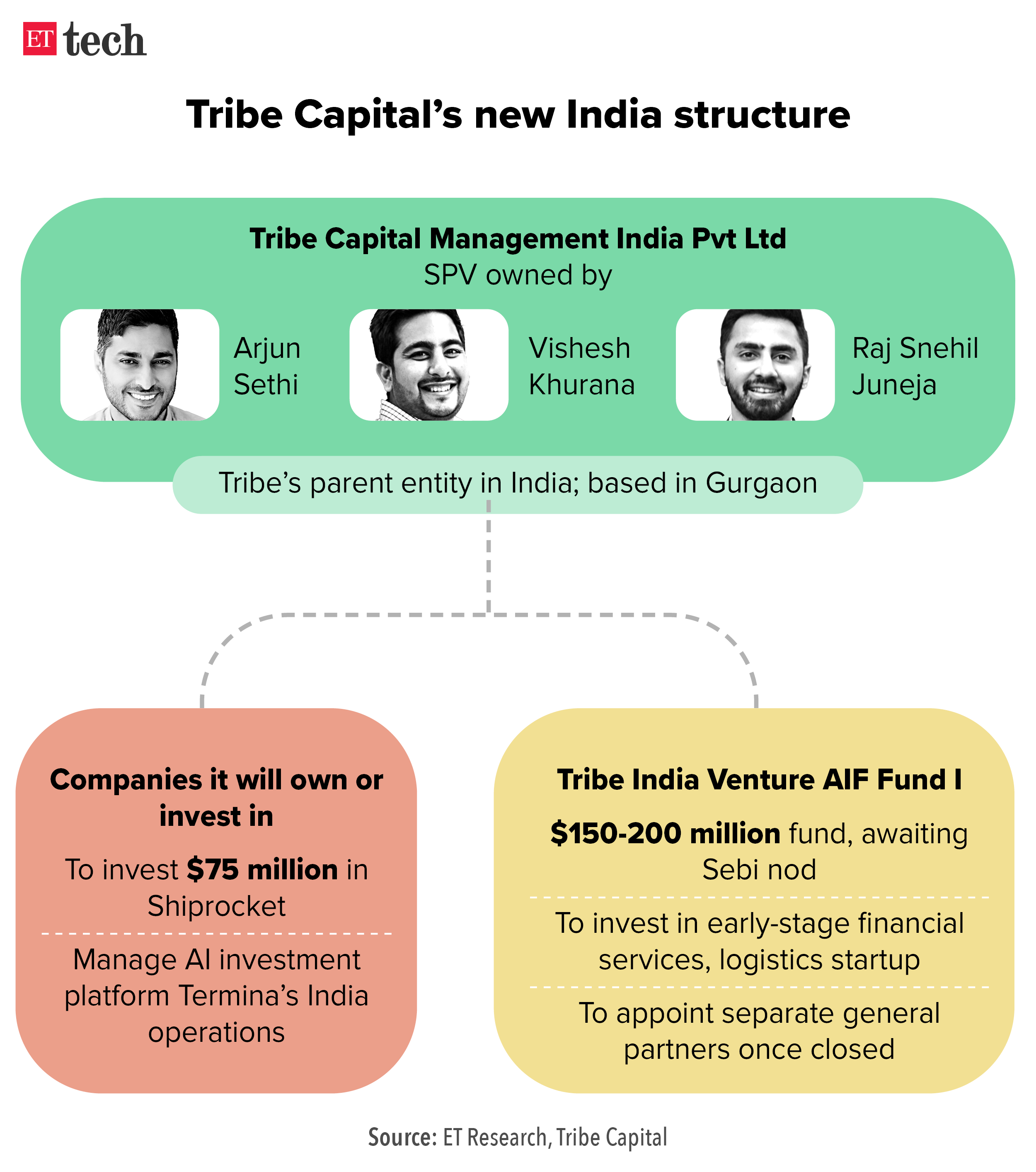

Silicon Valley-based investor Tribe Capital has arrange an intricately structured India entity to drive its presence within the nation. Its first funding of $75 million from this car is being made in its largest guess right here — logistics startup Shiprocket — cofounder Arjun Sethi informed us in an interplay.

Go deeper: Tribe Capital Administration India, a particular objective car (SPV) co-owned by Sethi, Shiprocket cofounder Vishesh Khurana and Raj Snehil Juneja, would be the umbrella entity for Tribe’s India presence. In addition to investing in startups, the SPV will even construct and purchase firms right here.

Additionally learn | Unique: Silicon Valley’s Tribe Capital plans to lift $250 million India-dedicated fund

Inform me extra: The SPV will even handle an alternate funding fund (AIF), which can be $150-200 million in dimension. ET reported in regards to the AIF in Might final yr. Tribe utilized with the nation’s capital markets regulator Sebi for an approval. This fund will take a look at investing in segments equivalent to monetary providers, logistics and transport, and commerce.

Quote, unquote: “For Tribe Capital India, transferring ahead, over the following 5 years, we might most likely make a most of 5 to eight investments the place we might be deploying a whole lot of hundreds of thousands of {dollars} per firm, if we’re doing it the appropriate manner,” Sethi stated.

BluSmart FY24 income jumps to Rs 390 crore

Anmol Singh Jaggi, cofounder and CEO, BluSmart

All-electric ride-hailing startup BluSmart exited FY24 with over Rs 390 crore in income, from about Rs 160 crore in FY23, stated cofounder Punit Goyal.

Driving the information: BluSmart has additionally reached Rs 500 crore in annualised income run charge (ARR). The corporate, based in 2019, is now aiming to cross Rs 800 crore in income in FY25.

Amidst giants: With solely two operational cities, BluSmart is way smaller than incumbents Ola and Uber. Whereas Ola Cabs noticed its whole income develop 58% to Rs 2,135 crore in FY23, Uber reported a 54% improve in working income to Rs 2,666 crore in the identical interval.

Competitors heats up: In addition to incumbents like Uber and Ola, BluSmart additionally competes with new entrants like Rapido and Namma Yatri within the cab-based ride-hailing ecosystem. In April, Namma Yatri, which was targeted on auto rickshaws, launched cab providers in its largest market, Bengaluru. In December, bike-taxi-focused platform Rapido additionally expanded into cab providers.

Want for funds: In mid-2022, the agency had stated it was seeking to elevate $250 million from traders together with BP’s enterprise capital division. Nonetheless, it ended up conducting two smaller fundraises totaling about $66 million in 2023, together with a rights challenge later final yr that noticed its founders improve their stake within the agency. BluSmart additionally raised $25 million in a mixture of debt and fairness in January this yr.

Different High Tales By Our Reporters

Drop in renewal offers poses income problem for prime IT companies | Regardless of document offers introduced within the remaining quarter of 2023-24, the deal momentum for prime IT companies has slowed down from a yr in the past with shoppers signing extra internet new and transformational offers somewhat than renewing previous offers, stated analysts.

Ola Cabs CEO Hemant Bakshi resigns; firm to put off 200 staff | Ola Cabs chief govt Hemant Bakshi is leaving simply three months after his appointment on the ride-hailing agency was made public, individuals within the know informed ET. The corporate will even undertake a restructuring that can see at the very least a ten% discount within the crew dimension, impacting about 200 staff, sources added.

Ex-ante regime will damage person expertise, innovation: Massive Tech firm | The ex-ante rules proposed within the draft Digital Competitors Invoice to pre-empt sure practices is a big departure from the present system and can include trade-offs that have an effect on person expertise and innovation just like the European Union’s Digital Markets Act (DMA) had with its inflexible guidelines, executives at a Massive Tech firm informed ET.

International Picks We Are Studying

■ Recruiters are going analog to combat the AI software overload (Wired)

■ Traders are showering AI startups with money. One drawback: They don’t have a lot of a enterprise (WSJ)

■ ‘Every thing has modified’: international auto teams embrace native expertise in China (FT)