Additionally on this letter:

■ ET Interview: TCS CEO Krithivasan

■ Ola’s ONDC plans

■ HP’s gaming ambitions

Binny Bansal, CaratLane’s Mithun Sacheti again Xeed as Indian founders grow to be massive sponsors of funds

(From left) Binny Bansal, Mithun Sacheti, and Sailesh Tulshan

For the previous few years, Indian founders are more and more ploughing capital into home funds, which spend money on startups. The most recent such transfer is by Flipkart’s cofounder Binny Bansal and CaratLane’s founder Mithun Sacheti who’ve grow to be anchor LPs (restricted companions) in Xeed Ventures.

Driving the information: Xeed Ventures, an early-stage fund run by Sailesh Tulshan, which was previously generally known as 021 Capital, has additionally roped in Premji Make investments as an LP. The funding committee (IC) for Xeed will include Tulshan, Bansal and Sacheti. Xeed is aiming to make a ultimate shut of Rs 600 crore and has already snagged 70% of the goal corpus, in line with folks within the know.

Go deeper: Whereas Bansal is a sponsor in a dozen different funds, Sacheti, who bought 27% stake in CaratLane to Titan for Rs 4,621 crore final 12 months, has been actively deploying capital throughout totally different automobiles. He’s additionally a common associate and LP in Singularity Development, a fund backed by ace capital markets investor Madhu Kela.

Zoom in: Xeed plans to chop cheques beneath $1 million in 20-25 corporations with a deal with enterprise, B2B, and fintechs. It has already closed a couple of investments like direct-to-consumer model Charcoal.inc, and monetary providers startup Kredit.pe.

Apart from Bansal and Sacheti, there are different founders who’ve additionally deployed money,” mentioned an individual conscious of the matter.

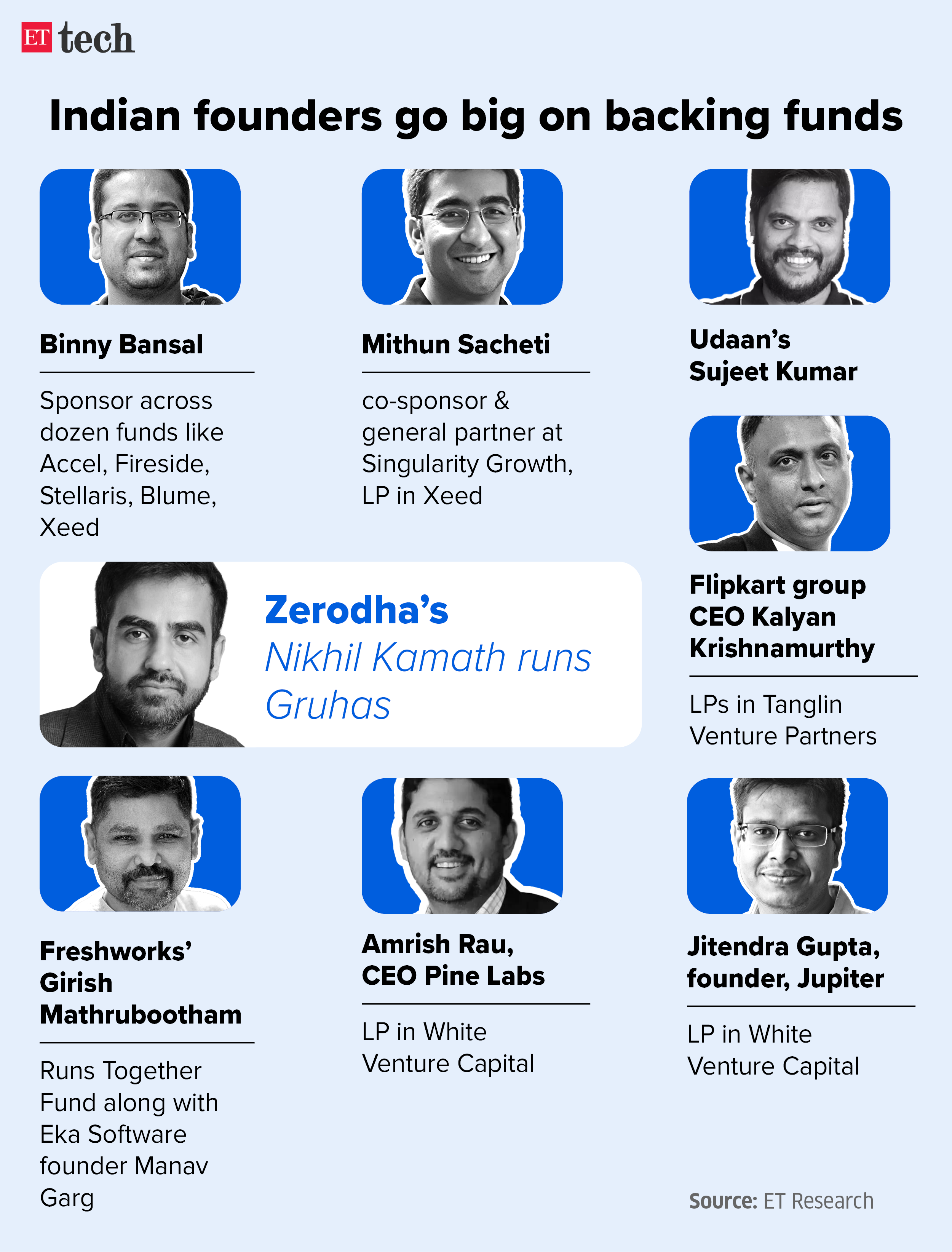

Founders flip funders: The listing of influential founders who’ve floated or backed funds embody:

- Zerodha’s Nikhil Kamath (Gruhas)

- Udaan’s Sujeet Kumar, Flipkart group CEO Kalyan Krishnamurthy (LPs in Tanglin Enterprise Companions)

- Freshworks’ Girish Mathrubootham and Eka Software program founder Manav Garg (Collectively Fund)

- Amrish Rau, CEO, Pine Labs and Jitendra Gupta, founder, Jupiter (LPs in White Enterprise Capital)

- Myntra and Curefit founder Mukesh Bansal (Meraki Labs)

- Snapdeal founders Kunal Bahl and Rohit Bansal (Titan Capital)

Small cities, retail buyers central to fintech’s AMC enterprise

New-generation fintech startups like Groww, Zerodha and Navi are constructing a brand new line of enterprise: asset administration. They’re betting large on two features of fund administration: passive funds and retail buyers, thereby taking a route much less travelled.

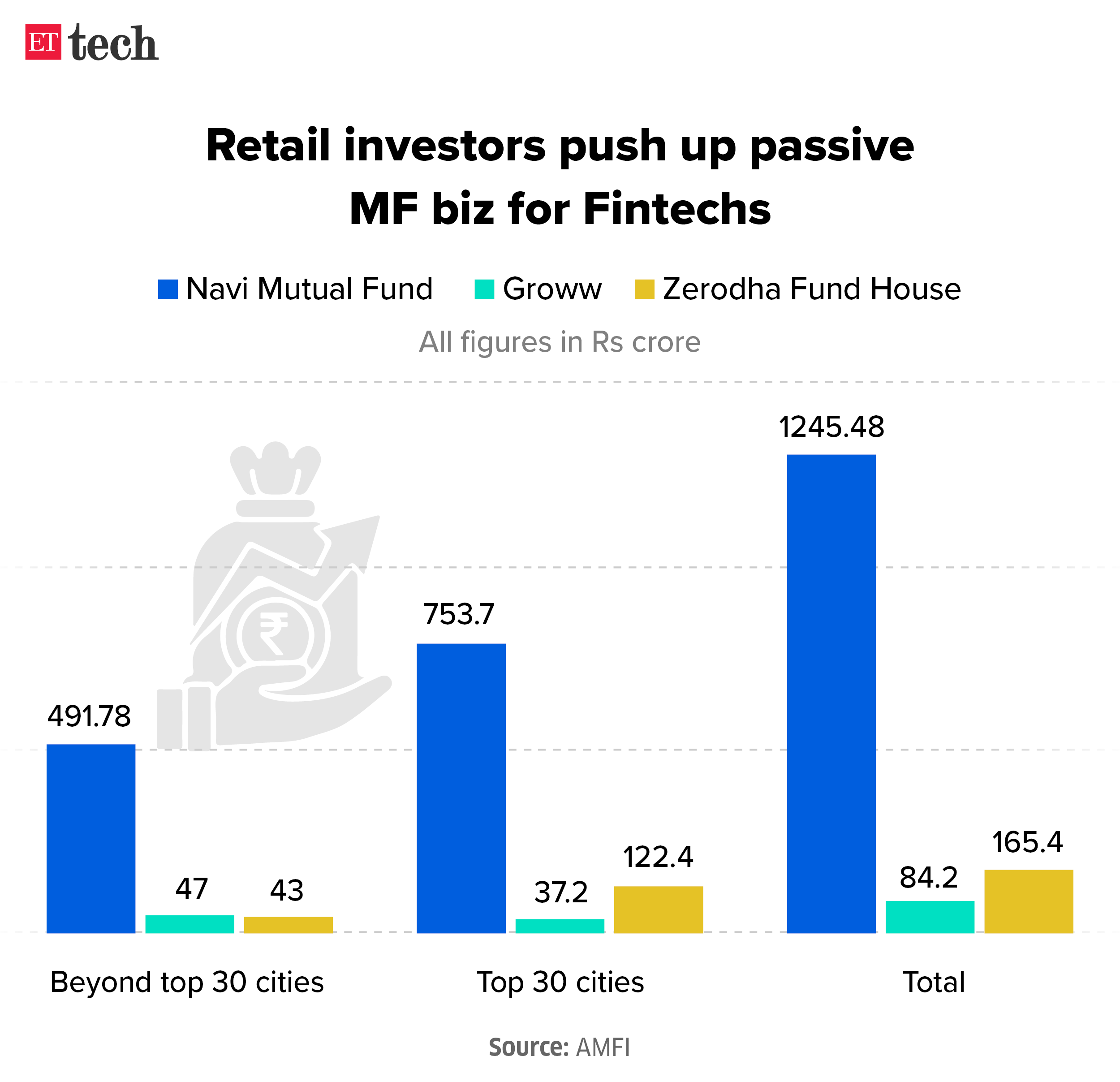

Quantity crunching: Knowledge sourced from the Affiliation of Mutual Funds of India (AMFI) exhibits that round 70% to 80% of the AUMs created by these fintechs are from retail buyers, and a sizeable portion is from past the highest 30 cities in India. Whereas their measurement is puny in comparison with their conventional friends, these are early days for new-generation fintechs.

Quote, unquote: “There are solely 4.2 crore distinctive PAN holders investing available in the market, however there are 85 crore ecommerce customers within the nation. There’s a massive market past the metros which wants passive investing choices,” mentioned Vishal Jain, chief govt officer, Zerodha Fund Home.

Challenges stacked: Producing income by way of passive investing is hard, given a fund relies on the bigger indices for returns.

Secondly, there may be extreme competitors amongst gamers who can undercut one another when it comes to pricing. Lastly, in India how many individuals have the disposable earnings to spend money on mutual funds continues to be an enormous query mark.

In a household, there is likely to be a number of folks shopping for on Amazon, however there may be sometimes just one one that is investing within the inventory markets, so there may be debate on the potential measurement of the market, in line with some sections of the business.

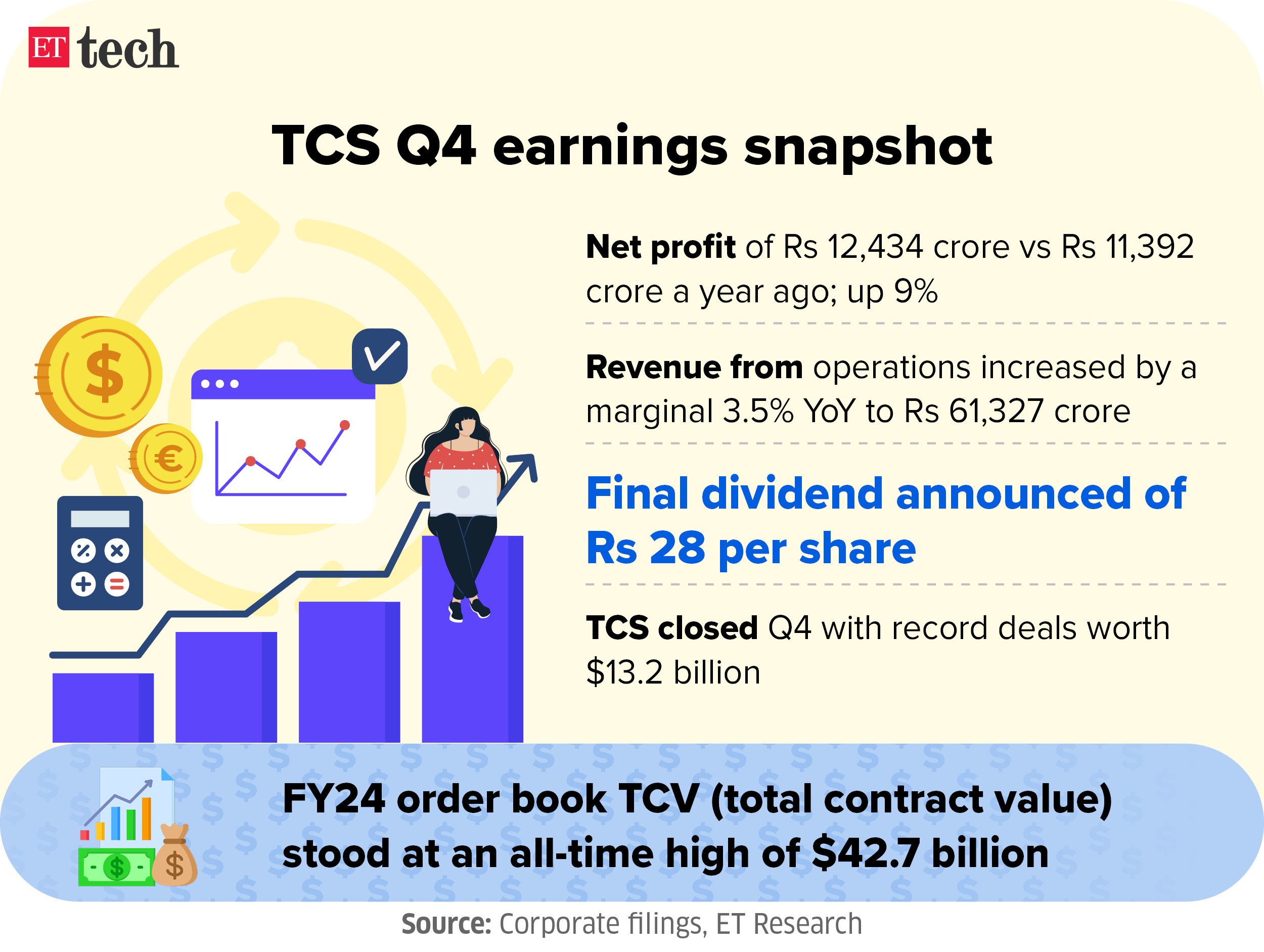

Interview: TCS CEO on India alternative, mega deal wins and extra

India’s largest software program providers exporter Tata Consultancy Providers is worked up about alternatives in its house market pushed by large deal wins. Chief govt Okay Krithivasan, who will full a 12 months on the helm of TCS in June, advised us that his agenda is to convey again development for the $29-billion firm.

Development steerage: “We imagine India’s anticipated development to be 7-8%, (it) has so many alternatives. If you happen to do not take part in India, then you may be lacking out in an enormous approach over a time period.”

Give attention to new markets: Along with India—the place TCS’s enterprise grew by over 37% within the fourth quarter of fiscal 2024—the corporate can be growing its deal with new markets just like the Center East, Africa and Latin America. “We anticipate these markets to develop sooner on a sustained foundation for an extended time period. So, we’ll truly be growing our focus (there), the CEO mentioned.

Demand revival: The ache within the sector is “bottoming out” since key verticals of banking and monetary providers haven’t shrunk considerably whilst demand stays underneath stress. “I do not wish to name out if it is going to occur or flip optimistic within the rapid quarter, however within the medium time period we have gotten extra optimistic,” he mentioned in a post-earnings dialog.

This autumn recap: TCS mentioned its internet revenue grew 9.1% on 12 months at Rs 12,434 crore within the ultimate quarter of monetary 12 months 2024, beating expectations. The robust efficiency got here on the again of elevated effectivity, productiveness features and decrease subcontracting prices. It recorded a rise in income by 3.5% y-o-y to Rs 61,237 crore for the fourth quarter.

For full-year 2023-24, TCS reported income of Rs 2,40,893 crore, up 6.8% YoY and three.4% in fixed foreign money. Web earnings got here in at Rs 45,908 crore, up 8.9% YoY.

Additionally learn | TCS studies dip in This autumn hiring, full-year attrition cools to 12.5%

Different High Tales By Our Reporters

Ola eyes grocery and style foray on ONDC: Experience-hailing firm Ola will quickly provide its clients the choice to buy groceries and style and attire on Open Community for Digital Commerce (ONDC) through its app, broadening the suite of ecommerce choices to its 75 million month-to-month energetic customers. At present, clients can solely order meals and drinks on ONDC by way of the Ola app.

HP betting large on development of gaming section gross sales: IT {hardware} maker HP is betting large on gaming as a class to broaden its gross sales within the nation. Gross sales from the section at the moment contribute to 22% to 25% of its general shopper enterprise, and the corporate goals to develop it additional after it launched the brand new vary of AI-enabled gaming laptops final week.

Talent hole in workforce, AI developments make cyberattacks extra threatening in India: Firms are weaving in AI to sharpen cyber safety efforts in an more and more digital world — and bridge the abilities hole. “Contemplating the fast tempo of change within the cyber safety business, companies should put together their workforce for an AI+ safety norm,” Pradeep Vasudevan, nation head, safety software program, IBM India, advised ET.

Casting a watch on India’s Web3 panorama throughout crypto, gaming: India has emerged as one of many fastest-growing adopters of cryptocurrency investments in 2024, as on-chain worth acquired by Indians reached $270 billion in 2024, up 60% year-on-year. This compares to 10% for the US, 8% for the UK, and 18% for Vietnam, a brand new examine by enterprise capital agency Hashed Emergent has revealed.

International Picks We Are Studying

■ Tech Leaders As soon as Cried for AI Regulation. Now the Message Is ‘Sluggish Down’ (Wired)

■ How Google misplaced floor within the AI race (FT)

■ New Tech That Asks ‘Are You Positive About Sending a Nude Photograph?’ (WSJ)