Additionally on this letter:

■ Disruption in inventory broking area

■ Tata closes semicon cope with Tesla

■ All you should find out about Airchat

Unique: Byju’s India CEO Arjun Mohan resigns, founder Raveendran to move day by day ops

Byju’s founder Byju Raveendran (left) and former India CEO Arjun Mohan

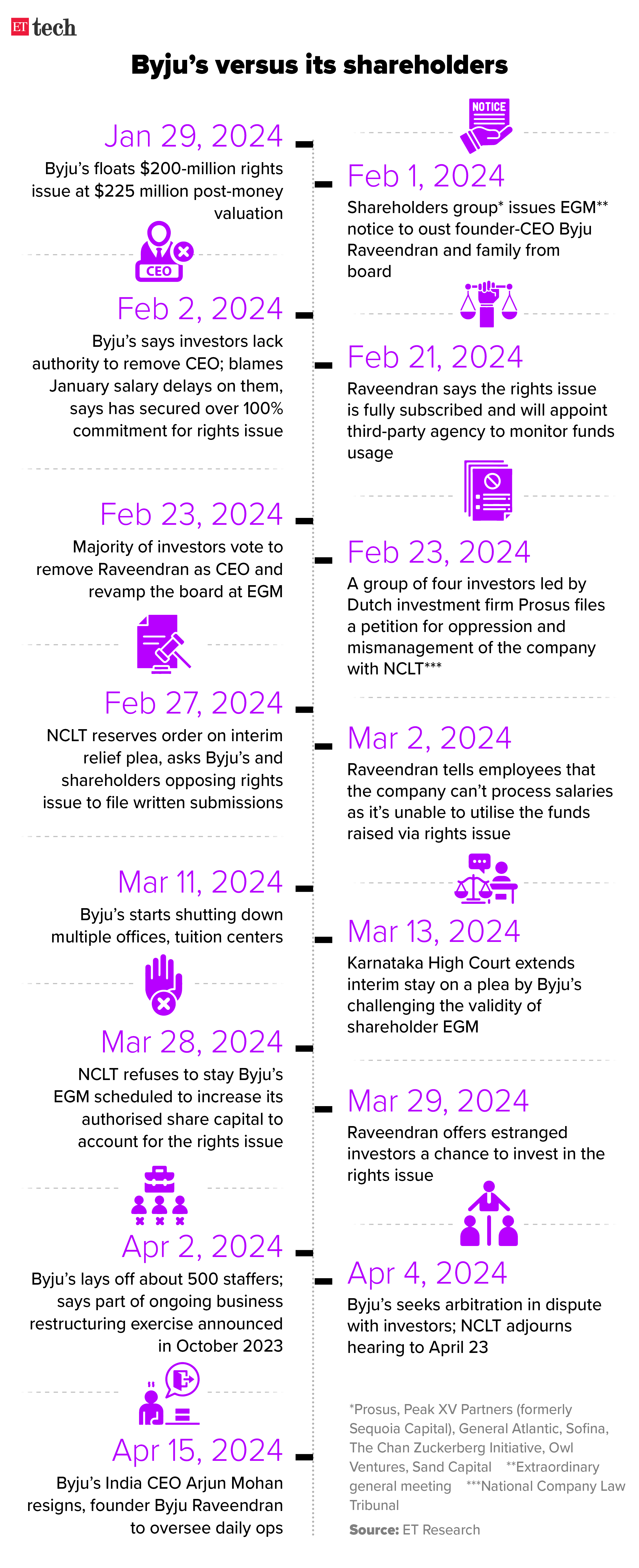

In a serious top-level rejig at troubled edtech agency Byju’s, its India CEO Arjun Mohan has resigned, after just a bit over six months within the place. Founder Byju Raveendran will likely be returning to the helm of affairs to supervise day-to-day operations. ETtech first broke the information on Monday morning, citing sources.

Driving the information: “By specializing in our core strengths with three specialised enterprise models, we’ll unlock new development alternatives whereas persevering with to concentrate on profitability,” Raveendran, group CEO at Byju’s, stated, including that the restructuring will pave the best way for ‘Byju’s 3.0’.

“Arjun has performed an excellent job steering Byju’s via a difficult interval. We’re grateful for his management and stay up for his continued contributions as a strategic advisor,” he stated.

What’s the importance? Raveendran’s plan to return as operational CEO on the agency assumes significance as a bunch of the corporate’s buyers voted in February, at a unprecedented common assembly (EGM), to oust him because the chief government. The end result of this EGM is being challenged within the Karnataka Excessive Courtroom and the matter is beneath an interim keep. Due to this fact, the resolutions can’t be enforced.

What occurred with Mohan? Mohan, who joined Byju’s in September final yr, led the enterprise restructuring and clean-up of a big worker base and was spearheading the ‘Byju’s 2.0’ marketing strategy. He was additionally carefully concerned within the day by day affairs of the Byju’s-owned bricks-and-mortar teaching agency Aakash, a key asset for the edtech group.

Mohan was within the working for the CEO’s publish at Aakash, however Byju’s appointed Deepak Mehrotra because the managing director and CEO.

Byju’s troubles: The event, signalling a deepening of the disaster on the agency, comes at a time when Raveendran is grappling with a number of points which have hit the corporate over the previous yr.

Byju’s, in a separate assertion, stated it obtained the unbiased scrutiniser’s report on the EGM to extend the share capital. The report stated shareholders have accredited the decision with a majority 55% of the full votes polled being in favour of accelerating the share capital for the rights difficulty.

A majority of its workers are but to be paid salaries for the previous two months, and several other senior executives have left amid a extreme money crunch on the agency.

ShareChat valuation drops 60% to beneath $2 billion publish new funding

Ankush Sachdeva, cofounder and CEO, ShareChat

The valuation of homegrown social media platform ShareChat has plummeted by greater than 60% to $2 billion after a current debt fundraise of $49 million by way of convertible debentures. The platform had a peak valuation of $5 billion in 2022.

Why the funds? In response to the agency, the funding will assist make investments additional in its Advert focusing on know-how and proceed the expansion of client transactions enterprise on ShareChat and Moj. It claimed ShareChat – as a standalone enterprise – is operationally worthwhile, and Moj is predicted to realize the identical over the following few months.

Convertible notes in play: For funding via convertible notes, a sure value vary is decided for when the following spherical of money infusion occurs in an organization. “For ShareChat, it’s under $2 billion now. At any time when the following liquidity occasion occurs it will not be above this value,” a collaborating investor within the newest funding spherical stated.

Why the funds? A spokesperson for the corporate denied the event saying there is no such thing as a “ceiling provision made within the documentation,” including that “the conversion will likely be linked to future valuation with none ceiling.”

Trimming bills: Mohalla Tech–which homes ShareChat and short-video app Moj–has been slicing working prices over the previous yr in a bid to show worthwhile amid intensifying competitors from rivals like Meta’s Instagram Reels and YouTube’s Shorts. Over the previous yr, it has undertaken a number of rounds of layoffs to chop prices. Presently, it has greater than 800 workers from a peak of round 2,700 individuals.

Sources stated it’s estimated to shut FY24 with a income of round Rs 750 crore.

Additionally learn | ShareChat mum or dad’s FY23 losses bounce 38% to Rs 4,000 crore

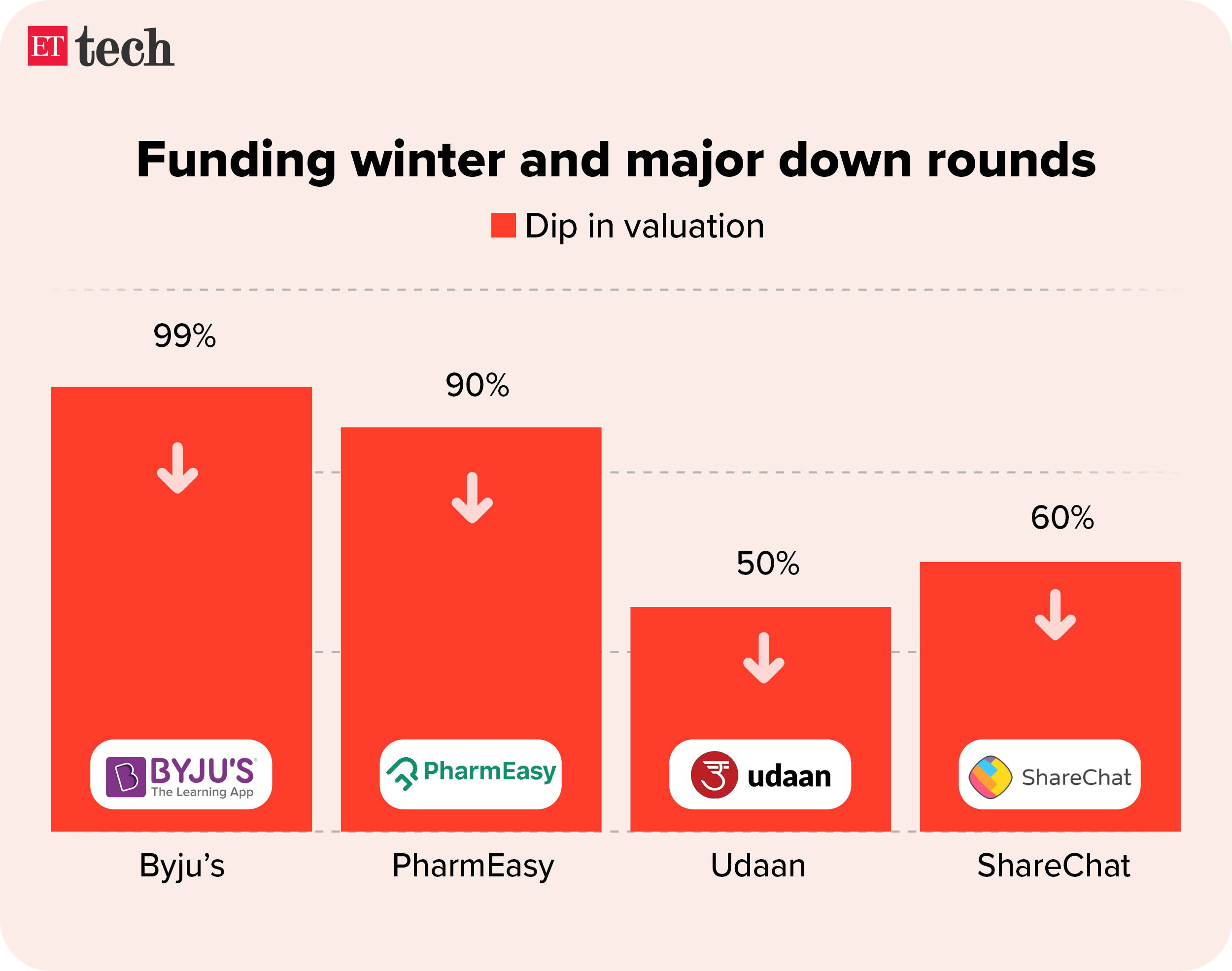

When Bharat locations a purchase on India, D-Road can thank low cost brokers

A decade in the past, low cost brokers started democratising fairness publicity and since then they’ve harnessed the cellular knowledge revolution to inform India’s eye-popping development story to unusual savers in Madurai, Moradabad or Mangaluru. At this time, they wrest a three-fifths share of the investing market by including the equal of Australia’s inhabitants to their lively shopper lists in only some years.

A driving pressure: The Massive 4 on this enterprise – Groww, Zerodha, Angel One and Upstox – proceed to displace conventional brokers with a 63% mixed market share of lively purchasers by the top of FY24, up 4 proportion factors in a yr, NSE knowledge confirmed.

What’s behind the positive aspects? These positive aspects come on the expense of conventional brokerage companies that proceed to see a decline within the variety of purchasers and market share. Analysts attribute the development to the new-age savers’ familiarity with complicated merchandise, skill to do their analysis, and optimistic price arbitrage on low cost platforms.

Verbatim: “Low cost brokers supply merchandise 90-95% cheaper than conventional brokers with a easy and quick buying and selling platform with all important providers,” stated the CEO of a reduction broking agency. “Conventional brokers present analysis experiences and extra providers like a relationship supervisor, which the brand new era doesn’t prioritise.”

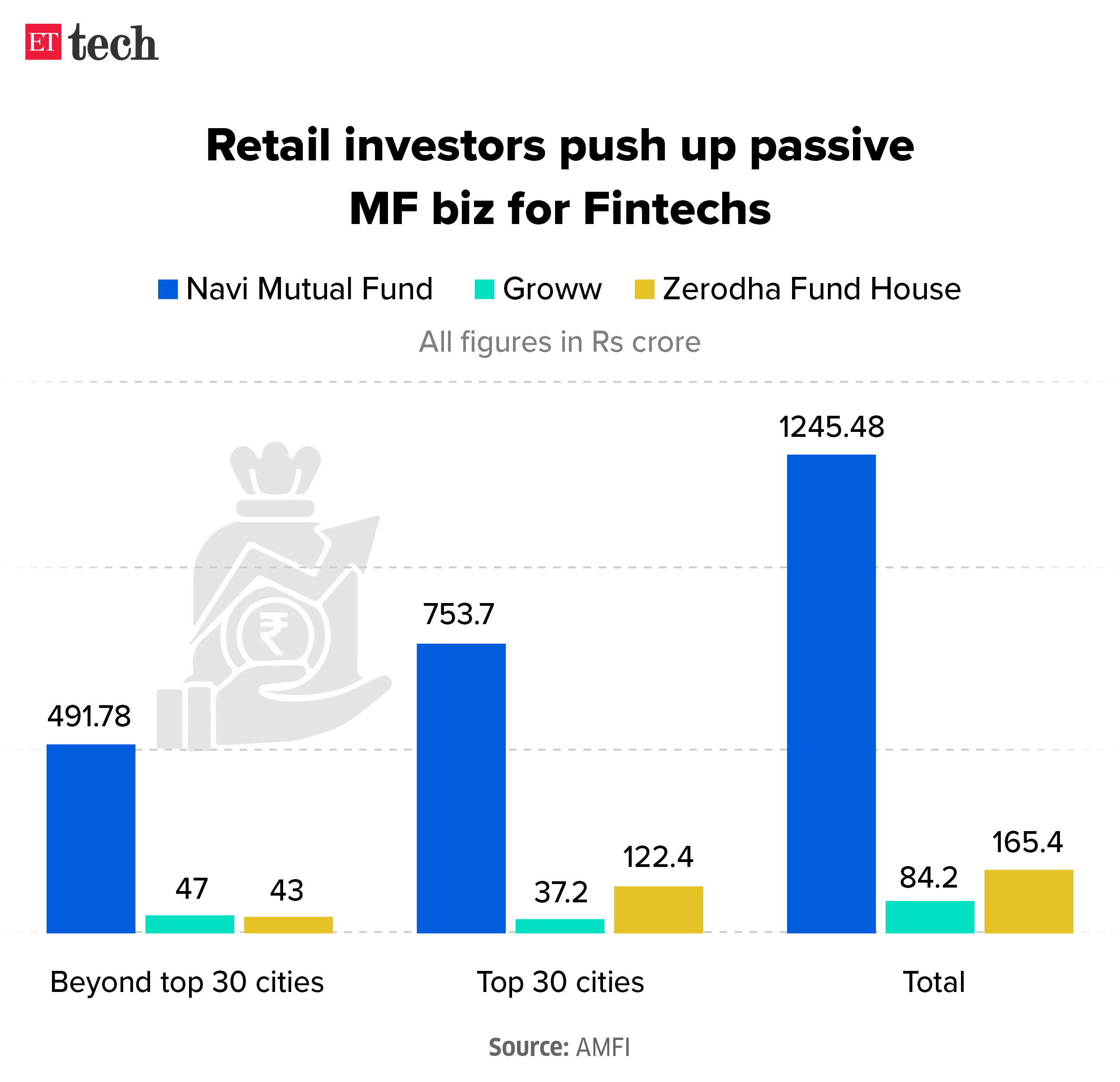

Catch-up fast: ET reported on Monday that these new-age brokers are diversifying from broking into fund administration. They’re betting huge on two points of this enterprise: passive funds and retail buyers.

Information sourced from the Affiliation of Mutual Funds of India (AMFI) exhibits that round 70% to 80% of the AUMs created by these fintechs are from retail buyers, and a sizeable portion is from past the highest 30 cities in India.

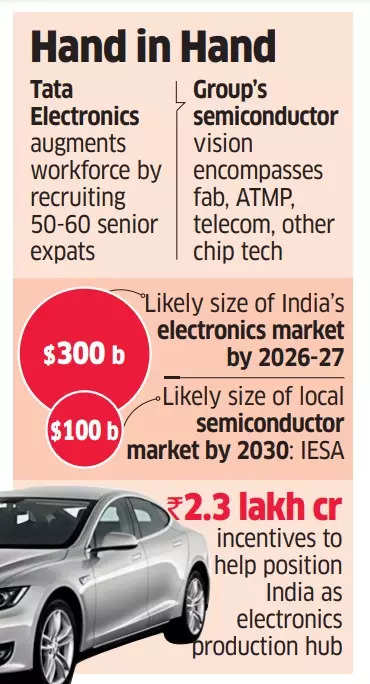

Tata Electronics seals semicon cope with Tesla

Tesla is known to have signed a strategic cope with Tata Electronics to obtain semiconductor chips for its worldwide operations, officers near the event advised ET.

Inform me extra: The deal underscores the electrical carmaker’s growing curiosity in India past native income era.

Executed discreetly just a few months in the past, the deal is important because it positions Tata Electronics as a dependable provider for top-tier world purchasers in search of to determine a pivotal phase of their semiconductor worth chain inside India. The US-based electrical automobile (EV) main is eager to enter India, the world’s fastest-expanding main automotive market.

Meet with Modi: Tesla promoter Elon Musk will likely be visiting India this month for a gathering with Prime Minister Narendra Modi.

Musk is predicted to announce the corporate’s potential Indian investments, together with a dedication of funds towards EV manufacturing amenities.

Though estimates fluctuate, most trade specialists imagine Tesla is prone to make investments no less than $2-3 billion in India to fabricate electrical automobiles, which have a small however increasing share within the native private mobility market.

Catch up fast: Latest coverage adjustments have allowed automakers to import EVs priced at $35,000 or increased at a diminished import obligation of 15%. This could, nonetheless, be contingent on automakers committing to take a position $500 million inside three years to determine manufacturing vegetation in India.

In the meantime, Tesla will lay off greater than 10% of its workforce.

ET Explainer: How Airchat works, and what its relaunch means for the social audio phase

AngelList founder Naval Ravikant and former Tinder government Brian Norgard have relaunched their voice-centric social media software, Airchat, for iOS and Android customers. The app has rapidly gained traction, rating among the many prime 24 social networking apps on Apple’s App Retailer. Listed here are the main points.

How does it work? Whereas it visually resembles acquainted social networking apps, providing options equivalent to following different customers, scrolling via publish feeds and interesting with posts via replies, likes, and shares, Airchat is accessible solely by invitation, and focuses on audio recordings which might be transcribed inside the app.

Is it the primary? No. Social networking platforms have beforehand explored the potential of voice-based interactions, as seen with Clubhouse, which noticed excessive consumer curiosity initially, however struggled to maintain and capitalise on that momentum.

Airchat’s strategy with asynchronous, threaded posts is geared toward providing customers a distinct expertise in comparison with the reside chat rooms, which briefly gained reputation on Clubhouse.

At this time’s ETtech High 5 e-newsletter was curated by Gaurab Dasgupta in New Delhi.