Leasing is including to the momentum in electrical car gross sales, at the same time as car worth stays a dampener in EV adoption, business executives and specialists mentioned.

The EV leasing enterprise has grown considerably over the previous 8-12 months, they mentioned. With the bottom nonetheless remaining low, this phase is predicted to proceed its fast progress.

Greater than a dozen firms are concerned within the EV leasing enterprise. These embrace Mahindra Finance-promoted Quiklyz, Ayvens (part of the merged entity of ALD Automotive and Leaseplan), Yamaha Motor subsidiary Moto Enterprise Service, Alt Mobility and Lithium City Applied sciences.

Fleet operators in addition to logistics and worker transportation firms are more and more taking the leasing path to deploy electrical automobiles, as a substitute of buying them as a result of excessive upfront value.

Leasing is extra economical. For example, a Tata Nexon EV is priced at INR 14.49 lakh. For a tenure of 48 months, the outflow on an outright buy, together with curiosity on mortgage, works out to INR 12.2 lakh after accounting for the resale worth. Leasing is cheaper at INR 10.94 lakh, as a result of the price of upkeep, repairs and insurance coverage are borne by the leasing firm, in accordance with estimates by Ayvens. Additionally, no down cost is required in leasing.

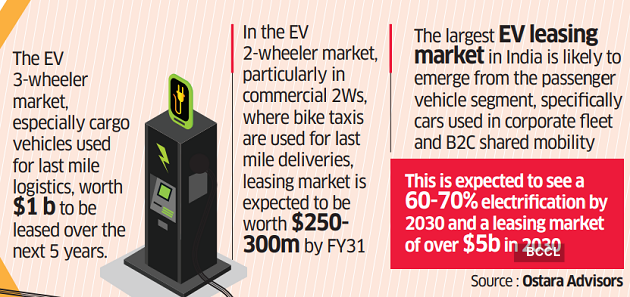

Because the “complete value of possession stays compelling, leasing will kind an vital approach to make EV adoption friction-less”, mentioned Vasudha Madhavan, founder and chief government of Ostara Advisors, an EV-focused funding financial institution.

In keeping with Sanjay Krishnan, founder and CEO of Lithium City Applied sciences, “Leasing firms are extra malleable than a financial institution.”

Leasing permits fleet operators to be asset gentle and channel the capital to different elements of their enterprise, as a substitute of spending on buying automobiles. Typically, they get an choice to additionally purchase the automobiles after the lease interval.

As financial institution financing for electrical automobiles continues to be not simply out there, the leasing mannequin is seeing sturdy demand.

Whereas leasing offers flexibility of possession, it additionally absolves the person from know-how danger, because the EV business is evolving rapidly, mentioned Dev Arora, cofounder and CEO of ALT Mobility, an EV leasing platform which has deployed greater than 7,500 electrical 3/4 wheelers (cargo) within the final 24 months.

Many firms are additionally utilizing the EV leasing choice as an worker retention instrument. “For the worker, it is tax environment friendly,” mentioned Suvajit Karmakar, nation MD India at Ayvens.

In India, Ayvens is the most important automotive leasing firm with a fleet of 45,000 automobiles, together with these operating on fossil fuels. Most of those are leased by corporates to their staff. It expects so as to add 1,500 EVs to the fleet this 12 months, which can be 8% of its annual fleet addition.

“We see worker transportation shifting very quickly to 100% EV fleets. Our enterprise in 2023 noticed 5 occasions progress and we count on an additional 5 occasions progress in 2024,” mentioned Nakao Hiroshi, managing director of Moto Enterprise Service India.

Working value for an EV is 15-20% decrease than a car operating on typical fuels, Hiroshi mentioned.

Quiklyz, the car leasing enterprise of Mahindra Finance, provides customised leasing options for electrical three- and four-wheelers. “We count on 20% of the leasing enterprise to come back from zero emission merchandise like EVs within the subsequent 2-3 years,” mentioned Raul Rebello, MD designate of Mahindra Finance.

The corporate goals to broaden its EV portfolio within the logistics and last-mile mobility house.

Regardless that the EV market in India continues to be in an early stage, the leasing business is seeking to capitalise on the potential progress.

For leasing firms, particular person shoppers current distinctive hurdles, like stringent car registration insurance policies, uncertainty round residual values and a scarcity of strong charging infrastructure, mentioned Ravi Bhatia, president of car consultancy agency Jato Dynamics. Moreover, the chance of buyer defaults is heightened, as missed funds don’t affect credit score scores in the identical manner as conventional loans, Bhatia added.

As the general Indian EV market continues to evolve, the leasing business is addressing points like residual worth, battery well being requirements and growth of charging networks, mentioned specialists.