Additionally on this letter:

■ Scaler fires 150 staff

■ Paytm shares get well losses

■ Variety of unicorns in India declines

Cultfit elevates Naresh Krishnaswamy as CEO, Mukesh Bansal takes on govt chairman position

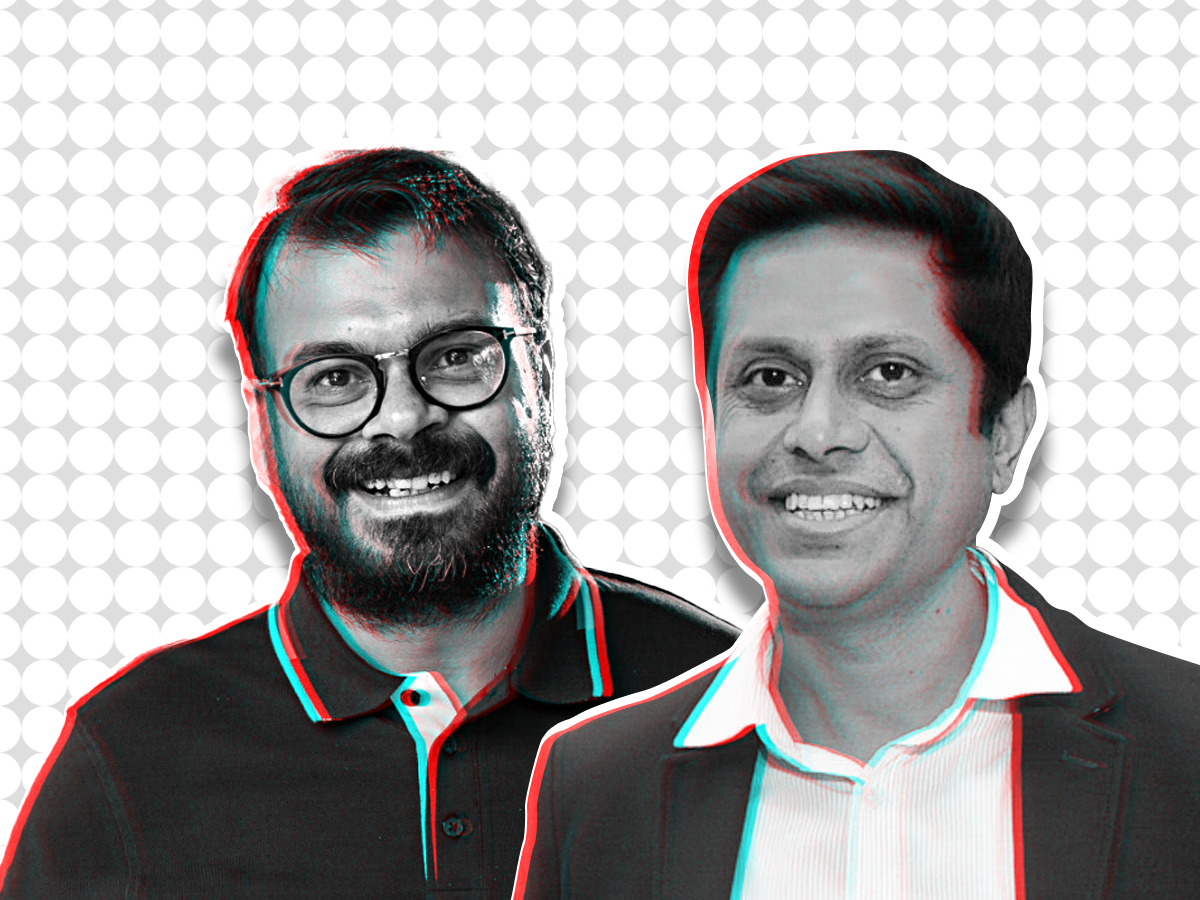

(L-R) Cultfit CEO Naresh Krishnaswamy and chairman Mukesh Bansal

Zomato and Tata Digital-backed health startup Cultfit has formally elevated Naresh Krishnaswamy because the chief govt with cofounder and former CEO Mukesh Bansal shifting to the chairman place.

Journey to the highest: Krishnaswamy, who was beforehand the top of health companies at Cultfit, has been operating all key operations since cofounder and former chief govt Mukesh Bansal moved to Tata Digital as its president, folks within the know mentioned.

An organization spokesperson confirmed the event.

Internally, Krishnaswamy was made the CEO in October nevertheless it was not formally introduced. He was beforehand the chief income officer at Flipkart-owned on-line vogue retailer Myntra, which was additionally cofounded by Bansal.

What’s subsequent for Bansal? After a brief stint at Tata Digital, Bansal is finalising his new enterprise within the vogue house with Zomato cofounder Mohit Gupta. The enterprise has been in talks with a number of traders to lift new capital.

Latest job cuts: In January, Cultfit laid off between 100-120 staff as a part of a cost-cutting train. It’s trying to go public over the subsequent two years and is aiming to show worthwhile.

The corporate final raised Rs 84.5 crore (round $10.2 million) in a spherical led by current backer Valecha Investments, which contributed over Rs 36 crore.

In FY23, Cultfit’s working income greater than tripled to Rs 694 crore, whereas its loss for the 12 months narrowed to Rs 551 crore from Rs 688 crore the 12 months earlier than.

Google unveils Arm-based chip to tackle rivals

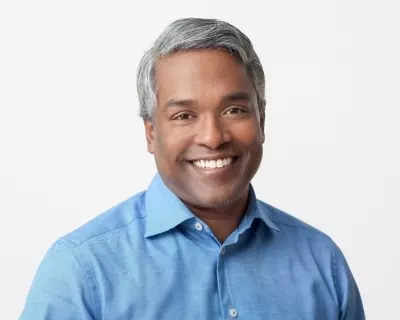

Google Cloud CEO Thomas Kurian

Google unveiled its newest weapon within the ongoing chip struggle to counter rivals similar to Microsoft and Amazon. At its annual Google Cloud Subsequent 2024 occasion in Las Vegas, the corporate introduced the Axion Processor — its first customized Arm-based chip or central processing unit (CPU) designed for knowledge centres.

Driving the information: The brand new silicon chip processor will turn out to be accessible for purchasers later in 2024. It’s already powering YouTube advertisements, the Google Earth Engine and different Google companies.

“Our first customized Arm-based CPU designed for the information centre delivers as much as 50% higher efficiency and as much as 60% higher power effectivity than comparable current-generation x86-based (processor) cases,” mentioned Google Cloud CEO Thomas Kurian.

Rivals within the recreation: Amongst international rivals, Amazon Net Providers (AWS) revealed its Graviton Arm-based chip and Inferentia AI processor in 2018. It introduced Trainium for coaching fashions in 2020. Chinese language competitor Alibaba launched arm processors in 2021 and Microsoft launched one in November 2023.

Quote, unquote: “Google Cloud is the one main cloud supplier providing each first-party AI fashions and third-party AI fashions on equal footing, which is an unimaginable differentiator when our companions communicate with prospects,” Kurian mentioned.

Different key launches:

- The monetisation of Google Workspace productiveness suites providing aggressive charges of $10 per person per thirty days with add-on packages

- AI massive language mannequin (LLM) Gemini 1.5 Professional

- Gemini Code Help for builders

- Expanded cybersecurity capabilities with Gemini in Menace Intelligence

- New enhancements for Gemini in Google Workspace

Edtech startup Scaler lays off 150 staffers

Abhimanyu Saxena, cofounder, Scaler Academy

Edtech startup Scaler has sacked 150 staffers throughout its advertising and marketing and gross sales features in a bid to chop prices.

Discount in measurement: Scaler, which helps school college students and tech professionals improve abilities, has laid off about 17% of its 900 full-time staff, one of many sources advised us. The edtech agency employs about 1,400 workers together with part-time staff, contractual staff and interns.

Scaler has attributed the job cuts to its want for long-term progress and sustainability.

Companyspeak: “We now have designed a brand new manner of working to have the ability to obtain sustainable progress whereas delivering the very best studying expertise and outcomes for our learners – one thing that we have at all times been dedicated to. As a part of this restructuring, we recognized some features and roles, primarily in advertising and marketing and gross sales, within the firm that we needed to half methods with,” cofounder Abhimanyu Saxena advised us.

Firm’s financials: Complete bills at Scaler shot up by 2.7 occasions to Rs 654.6 crore, considerably pushed by worker bills of Rs 322 crore within the monetary 12 months ended March 2023. Nevertheless, Scaler additionally reported a 4.8 occasions enhance in yearly operational income to Rs 316.7 crore throughout the interval, by which it raised no exterior capital.

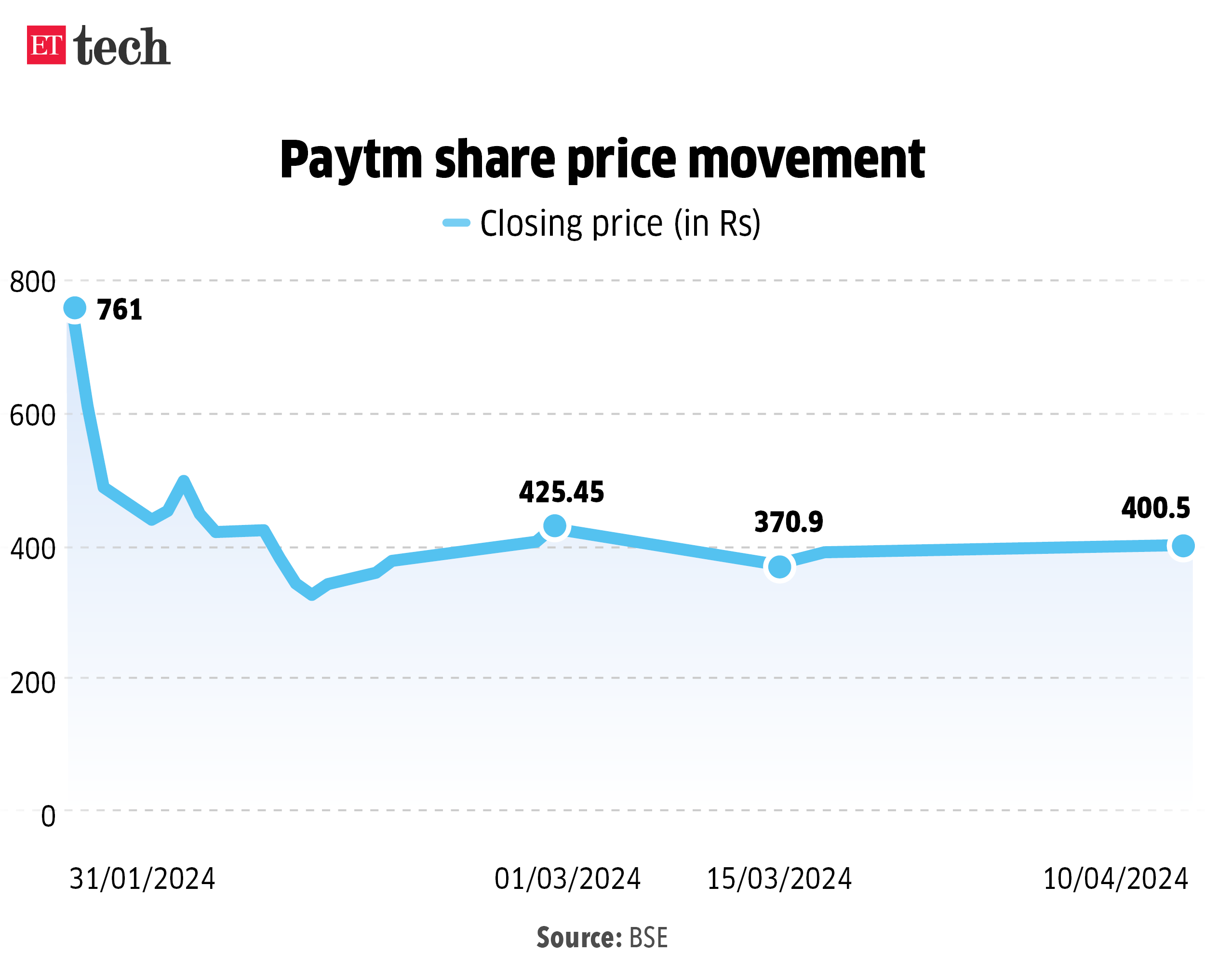

Paytm shares get well losses, PB Fintech shares hit 52-week excessive

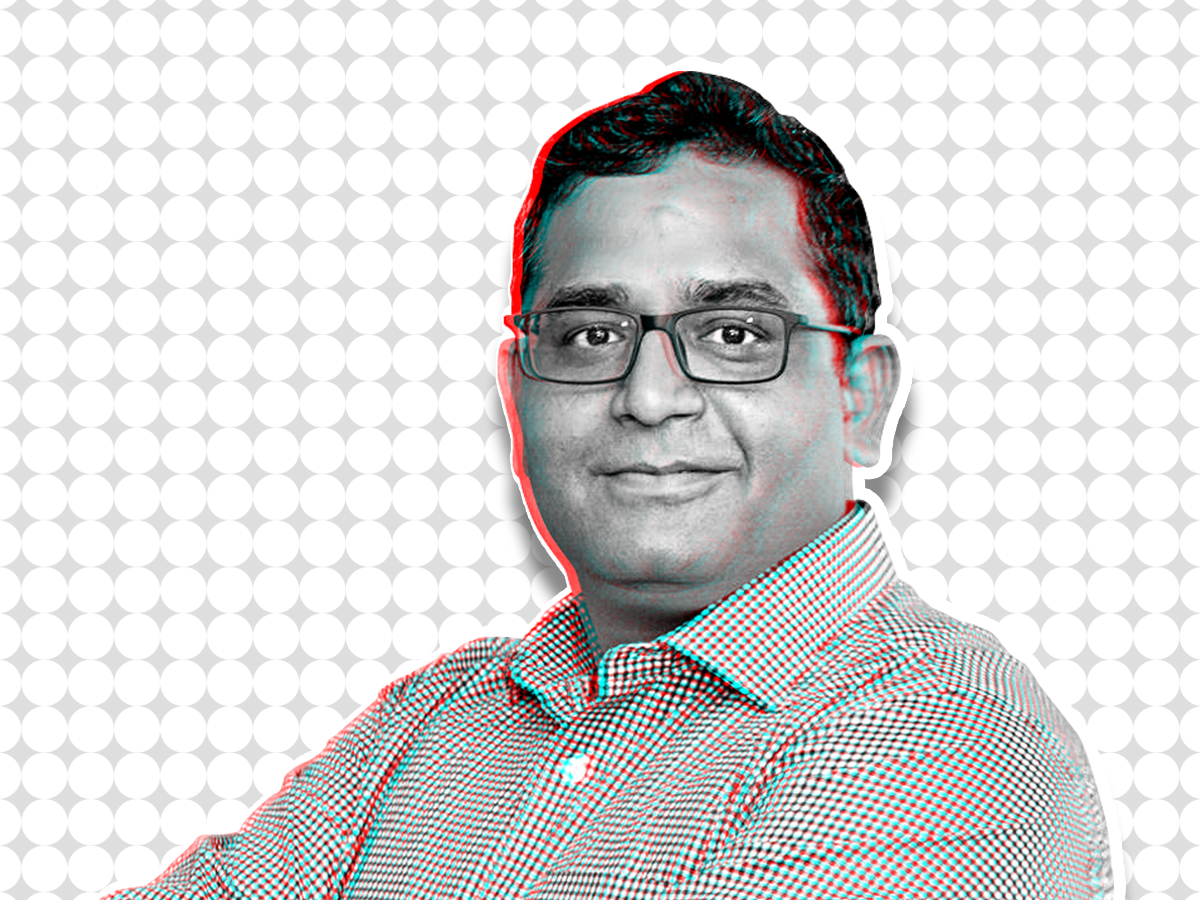

Vijay Shekhar Sharma, founder, One 97 Communications

Shares of two new-age firms — Paytm and PB Fintech — noticed important motion on the bourses on Wednesday. Whereas shares of Paytm tanked earlier than recovering, Policybazaar mother or father PB Fintech rallied to hit a 52-week excessive.

Paytm tumbles: Shares of Paytm fell 4% to Rs 388 in intraday commerce on the BSE a day after Surinder Chawla, managing director and CEO of Paytm Funds Financial institution Restricted (PPBL), tendered his resignation. The inventory, nonetheless, recovered its losses to shut at Rs 400.

Driving the information: Chawla’s resignation may very well be a potential trigger. He resigned on Monday, citing private causes and to pursue “higher profession prospects.” Whereas PPBL has misplaced its high govt, Paytm has misplaced additional market share on Unified Funds Interface (UPI), the most well-liked cost mechanism within the nation.

PB Fintech rallies: Shares of PB Fintech jumped over 7% on Wednesday to hit a contemporary 52-week excessive at Rs 1,400 on the BSE after the corporate introduced a partnership with ICICI Lombard to supply insurance coverage options to 1 crore prospects. The shares closed at Rs 1,333, up 2.20%.

Subsidiary unit: The rise in PB Fintech’s share worth additionally comes after the corporate included a subsidiary unit by the title of PB Pay Personal Restricted.

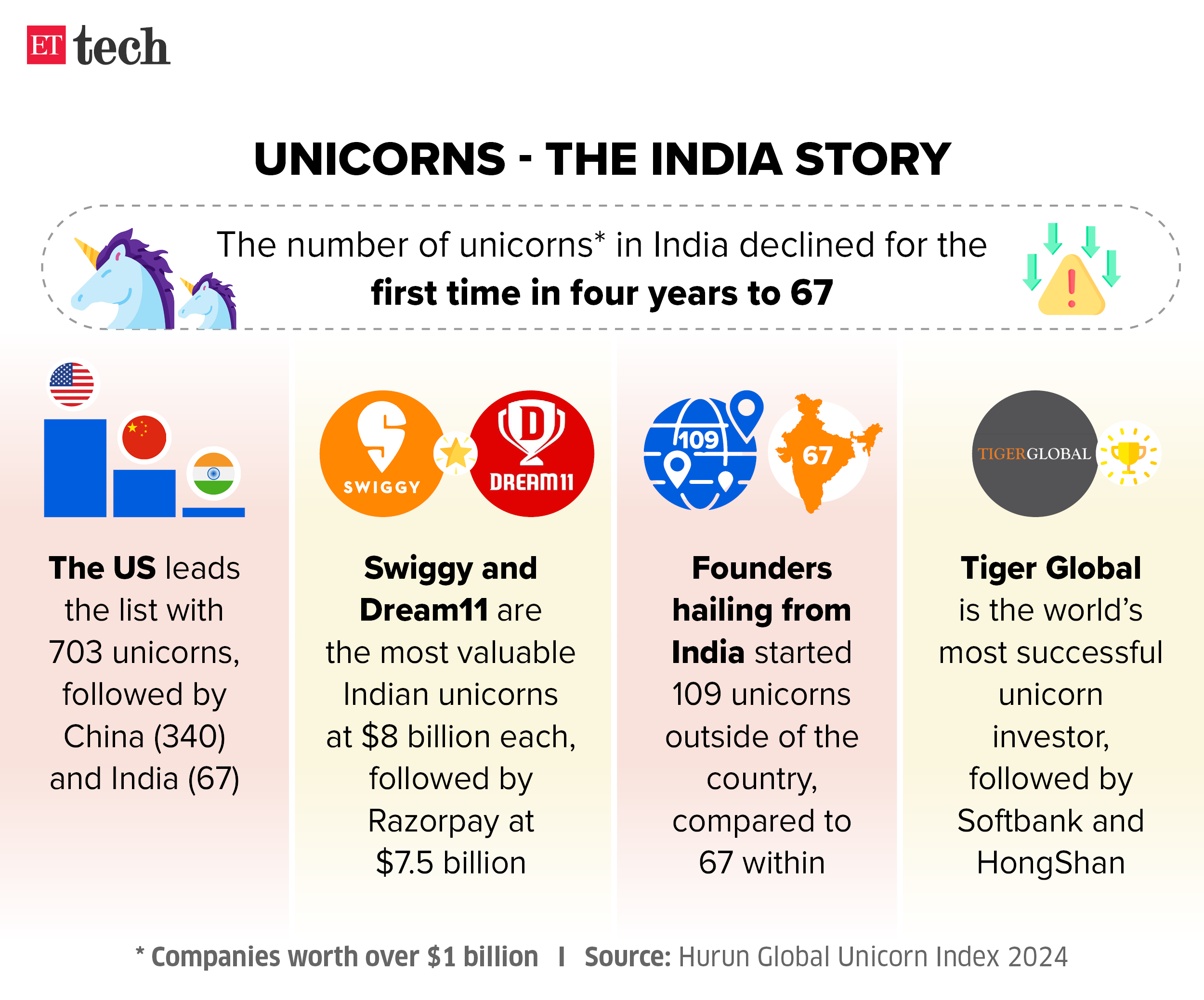

Infographic Perception: Variety of unicorns in India declines for first time in 4 years

The overall variety of unicorns – firms value over $1 billion – within the nation has declined for the primary time in 4 years to 67, in line with the Hurun World Unicorn Index 2024. India, nonetheless, retained the tag of being the third largest hub for unicorns the world over.

On investments in startups, the report mentioned the 12 months 2024 has seen a slowdown in new unicorn investments, particularly in contrast with the heyday of 2021 as investor exits show more durable to come back by.

Immediately’s ETtech High 5 e-newsletter was curated by Megha Mishra in Mumbai and Gaurab Dasgupta in New Delhi.