Additionally on this letter:

■ Byju’s India CEO Arjun Mohan quits

■ US funds mark up Pine Labs valuation

■ Information centre companies search regulatory readability

Security web within the works to spice up native fund flows to startups

In what may doubtlessly transfer the needle on enhancing home swimming pools of capital within the startup ecosystem, the Indian authorities is making ready a framework to assist minimise the danger for native pension funds and insurance coverage firms to straight again Indian startups.

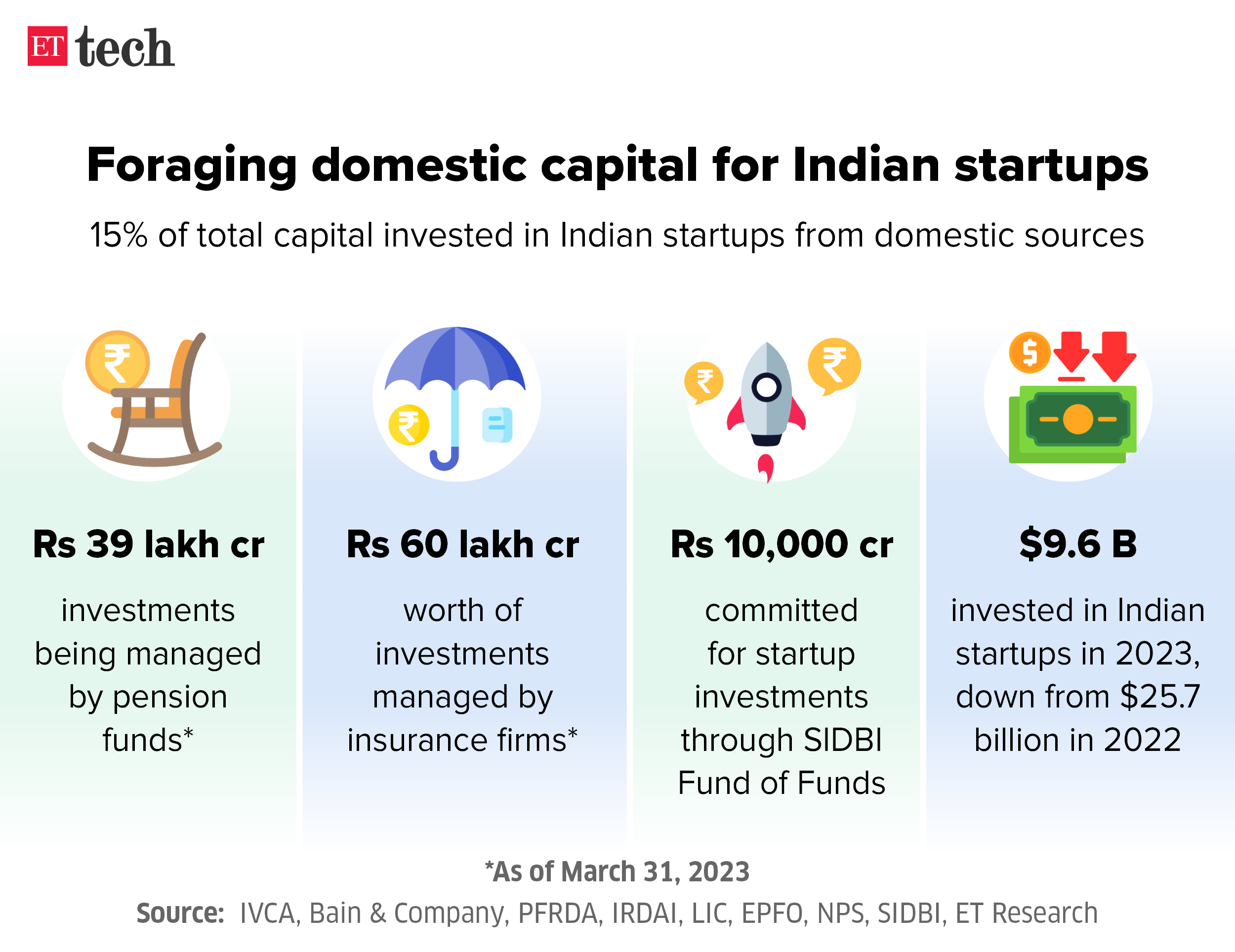

Driving the information: The Centre is working to place a security web in place, which can enable for alleviating rules and allow direct funding into startups by pension funds and insurers, which managed near Rs 100 lakh crore of public cash on the finish of fiscal 2023.

Background: Round 15% of the capital invested in Indian startups is from home sources. Whereas this has grown through the years, investments within the know-how ecosystem prior to now few years have fallen considerably.

Quote, unquote: “There are international monetary establishments who’re taking completely different dangers akin to foreign money dangers and credit score dangers to speculate into Indian startups, however Indian monetary establishments are unable to take action primarily as a consequence of rules,” stated Siddarth Pai, founding associate, 3one4 Capital.

What’s the context: In an interplay with ET reporters final month, commerce and trade minister Piyush Goyal stated one of many largest considerations of the federal government within the context of India’s startup ecosystem was the necessity for greater home capital. “I want to see extra personal sector investments from home funds and home trade…that’s my largest space of concern within the startup ecosystem,” he stated.

Apple in talks with Murugappa, Titan for meeting of digicam modules

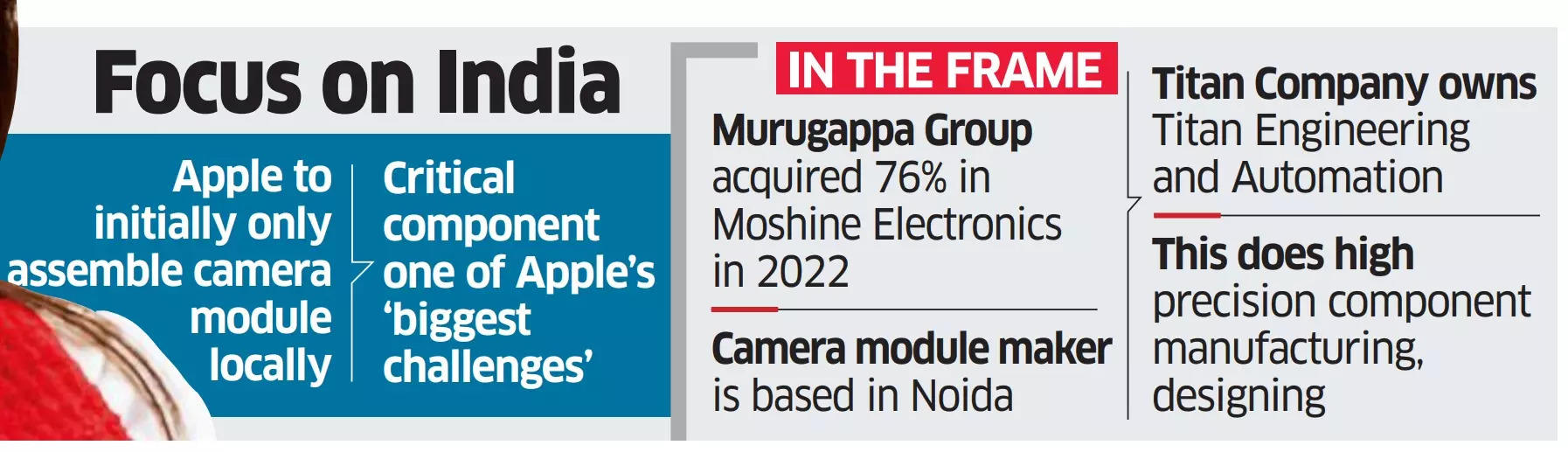

Apple is in superior discussions with Chennai-headquartered Murugappa Group and Tata Group’s Titan Firm to assemble and probably manufacture sub-components for the digicam modules utilized in iPhones.

Driving the information: If the talks are fruitful, it should mark a deepening of the Indian provider ecosystem for the Cupertino- headquartered firm because it shifts extra of its operations away from China. Apple at the moment doesn’t have Indian suppliers for the digicam module embedded in its flagship telephones, a number of fashions of which at the moment are assembled in India.

“Partnering both with Titan or with the Murugappa group may deal with this difficulty,” an individual conscious of the matter stated.

Why’s it essential? Sometimes, picture sensor chips inside a digicam module kind the biggest and costliest element of a smartphone in addition to of its show. “The digicam module is a vital element and at the moment one of many largest challenges for Apple in India,” the particular person added.

Diversifying provide networks: ET reported on April 11 that Apple is seeking to transfer at the least half of its present provide chain to India and in addition improve native worth addition from native suppliers by virtually 50% over the following three years.

Additionally learn | Apple’s India iPhone output hits $14 billion: report

Byju’s India CEO Arjun Mohan resigns, founder Raveendran to move every day ops

Byju’s founder Byju Raveendran (left) and former India CEO Arjun Mohan

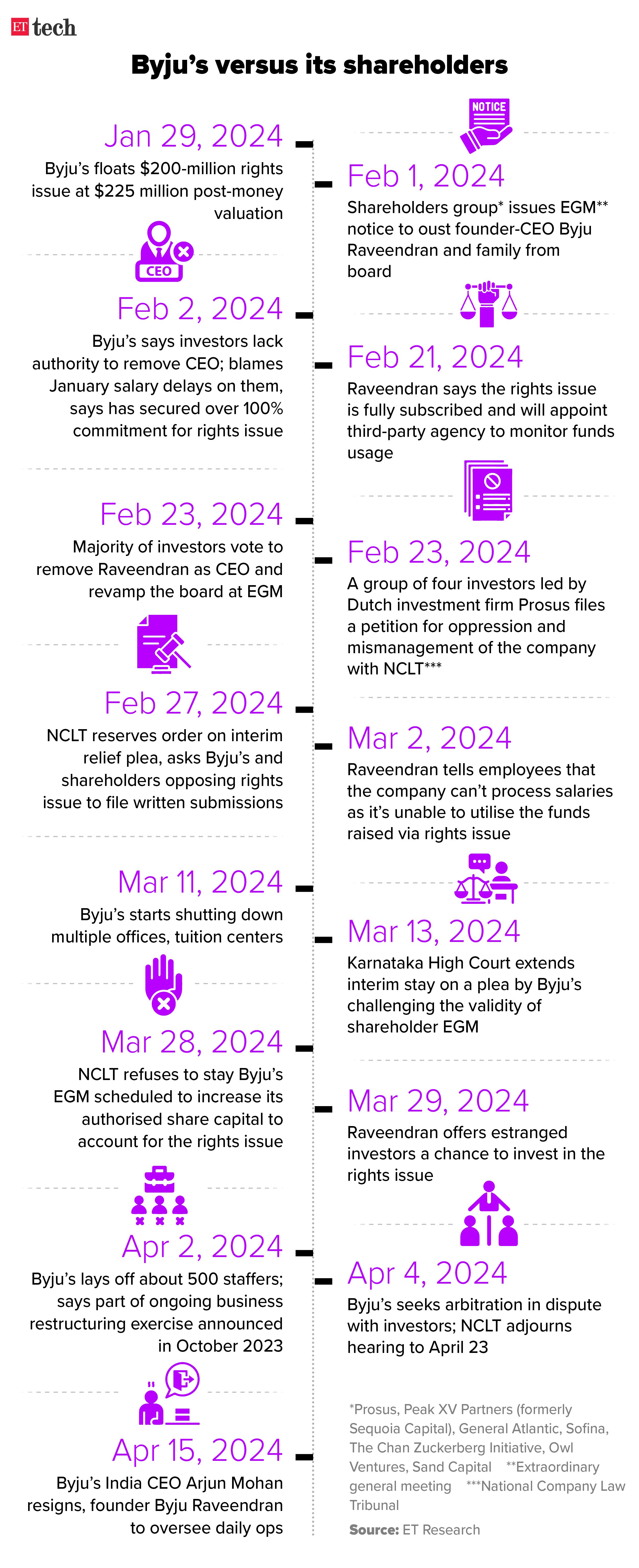

In a significant top-level rejig at troubled edtech agency Byju’s, its India CEO Arjun Mohan has resigned, after just a bit over six months within the job. Founder Byju Raveendran can be returning to the helm of affairs to supervise day-to-day operations. ETtech first broke the information on Monday morning, citing sources.

Driving the information: “By specializing in our core strengths with three specialised enterprise models, we are going to unlock new progress alternatives whereas persevering with to give attention to profitability,” Raveendran, group CEO at Byju’s, stated, including that the restructuring will pave the way in which for ‘Byju’s 3.0’.

What’s the importance? Raveendran’s plan to return as operational CEO on the agency assumes significance as a gaggle of the corporate’s buyers voted in February, at a rare normal assembly (EGM), to oust him because the chief govt. The end result of this EGM is being challenged within the Karnataka Excessive Courtroom and the matter is underneath an interim keep. Subsequently, the resolutions can’t be enforced.

Byju’s troubles: The event, signalling a deepening of the disaster on the agency, comes at a time when Raveendran is grappling with a number of points which have hit the corporate over the previous 12 months.

Byju’s, in a separate assertion, stated it acquired the unbiased scrutiniser’s report on the EGM to extend the share capital. The report stated shareholders have accepted the decision with a majority 55% of the whole votes polled being in favour of accelerating the share capital for the rights difficulty.

A majority of its staff are but to be paid salaries for the previous two months, and a number of other senior executives have left amid a extreme money crunch on the agency.

Baron hikes Pine Labs valuation to $5.8 billion, Invesco marks it as much as $4.8 billion

Amrish Rau, CEO, Pine Labs

Two US-based funds have marked up their funding in merchant-focused digital funds firm Pine Labs.

What’s occurring: Whereas Baron Funds hiked its valuation to $5.8 billion, Invesco has raised it to $4.8 billion as of December 2023, regulatory filings with the US Securities and Change Fee confirmed.

Baron Funds had valued Pine Labs at $5.3 billion in September final 12 months. On January 4, ET reported that Invesco had reduce the valuation of Pine Labs to $3.9 billion as of October 31.

At the moment, Invesco owns round 2.8% of Pine Labs and Baron Funds has round 1.3%. Peak XV Companions, the unique investor within the firm, now owns about 20.6%, knowledge from Tracxn reveals.

Background: Crossover funds, which make investments each in publicly traded and privately held firms, periodically evaluation the valuation of their portfolio firms. Amongst varied components, revisions in valuations by buyers in privately held companies typically replicate the modifications of their public market counterparts.

Additionally learn | Baron Capital marks Swiggy valuation at $12.1 billion, up 13% from final fundraise

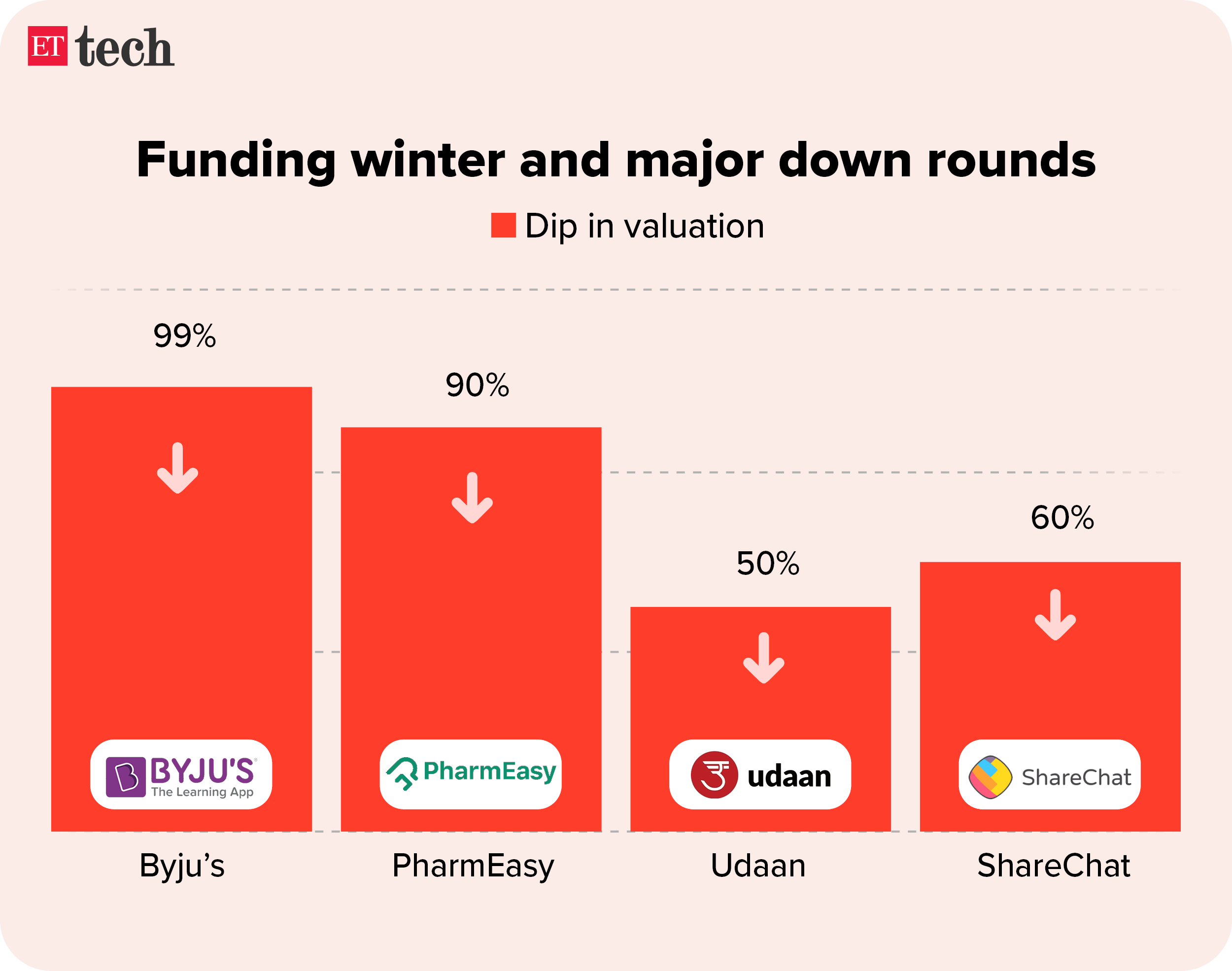

ShareChat valuation nosedives: Vernacular social media agency ShareChat’s valuation has plunged greater than 60% to under $2 billion from its peak of $5 billion in 2022, stated individuals conscious of the matter.

This comes because the Twitter and Google-backed firm closed a $49-million debt financing by convertible debentures from present buyers together with Lightspeed, Temasek, Alkeon Capital, Moore Strategic Ventures and HarbourVest.

This is among the steepest valuation cuts for a venture-funded startup, which has raised round $1.3 billion up to now. Byju’s, PharmEasy and Udaan are among the many massive startups which have seen steep valuation cuts in current months.

Different High Tales By Our Reporters

Information centre companies search readability on darkish fibre for captive networks: The information centre trade is asking for regulatory clarification from the federal government to allow using darkish fibre for captive networks to enhance the convenience of doing enterprise (EoDB) at a time when India’s knowledge centre trade is poised for progress with growing cloud and synthetic intelligence (AI) adoption.

ETtech Carried out Offers

Srinivas Pallia bought all his Wipro shares earlier than taking up as CEO: A month and a half earlier than being appointed as the brand new chief govt at Wipro, Srinivas Pallia, who has been with the corporate for over three many years, bought all his shares price Rs 5 crore within the public market. Pallia disposed of his one lakh Wipro shares by “market sale” on February 14 this 12 months and the transaction was reported to the trade on February 15.

World Picks We Are Studying

■ The Subsequent Frontier for Mind Implants Is Synthetic Imaginative and prescient (Wired)

■ AI retains going mistaken. What if it could actually’t be fastened? (FT)

■ Generative AI Is Altering the Hiring Calculus at These Firms (WSJ)