Additionally on this letter:

■ Peak XV’s new fund

■ B2B, manufacturing tech drove IPOs for five years

■ CCI clears Slice-North East SFB merger

MSME fintechs steal present as client lending loses fizz

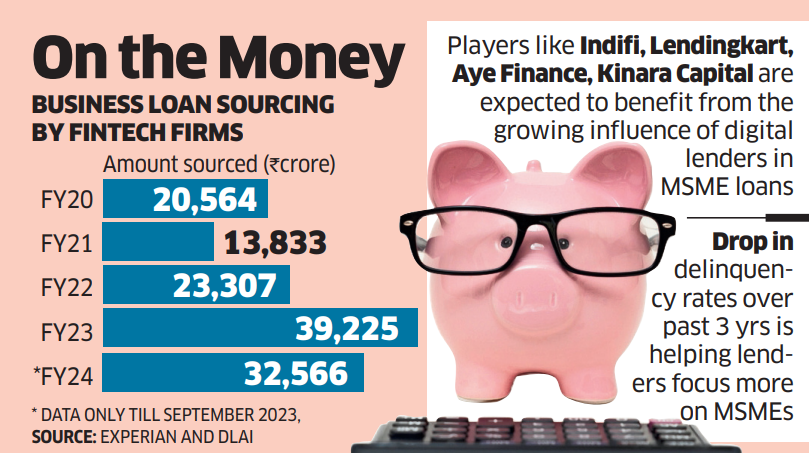

All these years, digital lending has been principally synonymous with unsecured client credit score. However that’s slowly altering. Enterprise-focused fintech lenders are more and more grabbing the limelight with extra conventional lenders opening as much as work with them.

New tendencies: Macroeconomic elements like a fast restoration for the MSME sector after Covid-19 and regulatory diktats to examine the unbridled progress of client lending are serving to funds move into MSME loans. Moreover, a fall in delinquency is making the sector extra engaging.

Numberspeak: Per business information, round 85% of the whole sub-Rs 1 lakh MSME loans sourced by fintechs final yr have been given out within the first half of the present fiscal. At Rs 32,566 crore, the speed of sourcing such loans in H1 2024 was a lot quicker than that of final yr. By way of market share, MSME loans are a lot smaller than the whole quantity of client loans given out by fintechs.

Driving progress: The federal government has made it simpler for small companies to register themselves by way of the Udyam portal. Additionally, the RBI has allowed banks to comply with the federal government’s classification of such companies for his or her precedence sector mortgage mandates.

Giant fintech NBFCs have began displaying stronger financials, which can also be prompting banks to begin working with them on higher phrases.

General, nationwide establishments like Sidbi (Small Industrial Growth Financial institution of India) and others are co-opting fintechs to take monetary companies to the small enterprises.

Additionally learn | RBI’s hardening cautionary stand on unsecured lending and its affect on the bigger market

Ola Electrical plans e-autorickshaw launch forward of IPO

IPO-bound Ola Electrical has finalised plans to launch an electrical autorickshaw, more likely to be known as Raahi, within the subsequent few weeks, folks within the know instructed ET.

The fundamentals: The product is in step with Ola’s wider plans to enter the business car enterprise. It should compete with the likes of Mahindra Treo, Piaggio Ape e-city and Bajaj RE within the electrical three-wheeler phase.

Market alternative: Mahindra, Piaggio and Bajaj worth their electrical autorickshaws from Rs 2 lakh to upwards of Rs 3.5 lakh. Based on authorities transport web site Vahan, greater than 580,000 electrical three-wheelers have been bought final yr, a 66% rise over 2022. Electrical three-wheelers comprised over 50% of whole three-wheeler gross sales in 2023.

IPO in sight: The launch is a part of a slew of bulletins main as much as its preliminary public providing (IPO), sources stated. The agency is seeking to elevate as much as Rs 5,500 crore by way of a contemporary subject, other than a suggestion on the market of 95.2 million shares by present traders.

Buzzing with exercise: Ola Electrical has been engaged on opening its gigafactory — to fabricate its personal battery cells — by the top of this quarter. In February, the corporate prolonged the battery guarantee for all its scooters. It additionally stated it might arrange 10,000 fast-charging factors and increase its service centre community.

Peak XV to arrange evergreen fund backed by agency’s companions

(From left) Peak XV Companions managing administrators Rajan Anandan, Shailendra Singh, Mohit Bhatnagar and GV Ravishankar

In a transfer that can allow the enterprise fund’s companions to take bets on a wider set of alternatives past its personal fund, Peak XV Companions is organising a brand new car backed by its inner pool of capital.

Go deeper: The everlasting capital car (PCV) will enable the agency to increase and make investments throughout totally different areas, methods and sectors. These embody public market corporations, enterprise funds in different areas and specialisations that don’t compete with Peak XV’s present strategy. It’s a manner for the fund’s companions and high management to diversify their publicity past the present portfolio.

Jargon buster: Evergreen funds, as PCVs are additionally identified, can exist in perpetuity because the income are ploughed again into the car itself. Typical enterprise capital and personal fairness funds have fastened tenures of seven to 10 years, after which they should return capital to LPs.

Verbatim: “The Peak XV Anchor Fund is a everlasting capital fund that can act like an inner stability sheet. It should drive immense alignment with our institutional restricted companions by enabling us to be a major investor in our personal funds,” Shailendra Singh, managing director, Peak XV Companions, instructed ET.

Catch up, fast: In 2022, Peak XV had introduced a $2.85 billion India and Southeast Asia fund. In June 2023, US-based Sequoia Capital cut up from its India and Southeast Asia, and China partnerships. The India and Southeast Asia partnership, which has backed high web startups together with Zomato, Razorpay, Pine Labs, Unacademy and Cred, was renamed Peak XV Companions. It presently has over $9 billion value of belongings beneath administration.

B2B, manufacturing tech drove IPO market in previous 5 years: report

Public listings on the bourses have been crowded by corporations from the business-to-business (B2B) and manufacturing know-how sectors previously 5 years, Boston Consulting Group and enterprise capital agency Matrix Companions stated in a joint report.

Particulars: Previously 5 years, there have been 11 preliminary public choices inside the B2B area, within the specialty chemical business, that includes corporations similar to Chemplast and Senmar.

Firms from sectors similar to digital manufacturing companies (EMS), digital gear, auto elements and associated industries, in addition to aerospace and defence additionally went public.

Promising sectors: The report expects a major improve in IPOs inside the electrical car (EV) sector, beginning with Ola Electrical. “However additionally, you will see a whole lot of (IPOs from) OEMs (authentic gear producers), motor corporations, charging infrastructure corporations and battery corporations. That shall be a giant pattern,” Sudipto Sannigrahi, managing director at Matrix Companions, instructed ET.

Additionally learn | SME board IPOs potential route for Indian startups, as enterprise funding declines: Blume report

Different Prime Tales By Our Reporters

CCI approves merger of Slice with North East Small Finance Financial institution: The antitrust regulator has cleared fintech Slice’s merger with North East Small Finance Financial institution. Garagepreneurs Web, which owns the model Slice, will merge with its in-house non-banking finance firm Quadrillion Finance and the mixed entity, together with the financial institution’s microfinance entity RGVN Microfinance, will merge with NESFB.

Workflow automation platform Nanonets raises $29 million led by Accel: AI-based doc workflow automation platform Nanonets has raised $29 million in a funding spherical led by Accel. The funds shall be used for analysis and growth to enhance its algorithms, in addition to for scaling its advertising and gross sales efforts.

Google ties up with Election Fee to sort out misinformation throughout polls: Google India in a weblog publish stated its product options are designed to raise authoritative info on varied election-related subjects. “We’re collaborating with ECI to allow folks to simply uncover crucial voting info on Google Search – similar to how one can register and how one can vote – in each English and Hindi,” Google stated.

First semicon chip from Dholera plant by 2026-end: PSMC’s Frank Huang | The primary semiconductor chip from the brand new plant being arrange by the Tata Group and Taiwan’s Powerchip Semiconductor Manufacturing Company in Gujarat’s Dholera, shall be able to roll out by the top of 2026, based on Frank Huang, chairman of PSMC.

New HP India MD sees ‘no finish’ in India units demand: Laptop computer and private laptop maker HP India will roll out its home growth plans over the subsequent 9-12 months to cater to the demand for the units within the nation which has “no finish”, HP India managing director Ipsita Dasgupta stated.

World Picks We Are Studying

■ Binance’s high crypto crime investigator is being detained in Nigeria (Wired)

■ How livestream realtors helped make Xishuangbanna a growth city (Remainder of World)

■ China’s obscure hopes for tech to reboot its economic system (Bloomberg)