Additionally within the letter:

■ WhatsApp vs govt on end-to-end encryption

■ IvyCap Ventures’ Rs 2,100-crore fund

■ Wipro’s new CEO to earn as much as $7 million

FirstCry refiles IPO papers, stories December income at Rs 4,841 crore

Supam Maheshwari, CEO, FirstCry

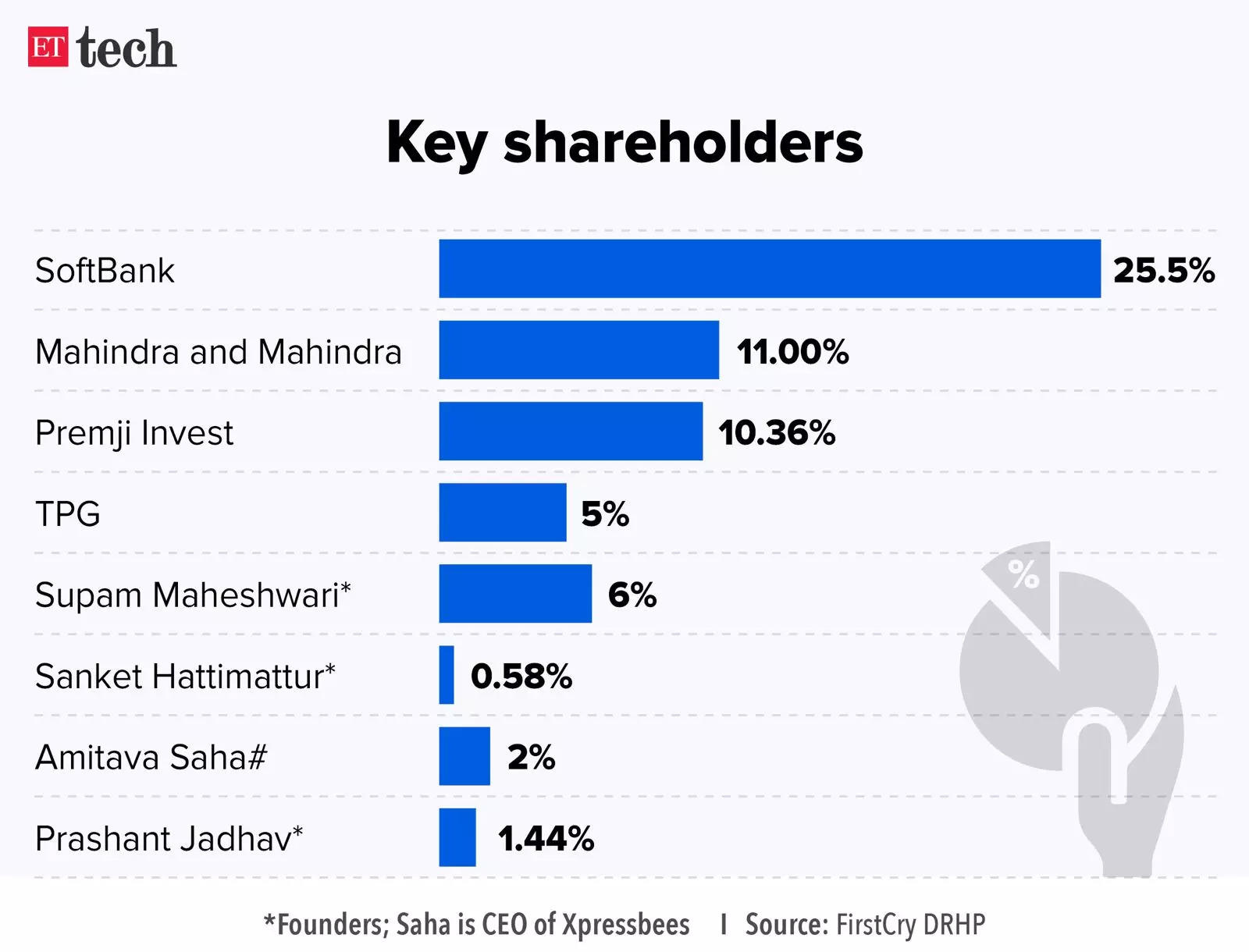

FirstCry, the omnichannel retailer for child and mom care merchandise, has refiled its draft preliminary public providing (IPO) papers, days after the capital markets regulator flagged an absence of sufficient disclosure in key efficiency indicators (KPI) in its preliminary submitting.

Driving the information: The Pune-based firm’s newest draft crimson herring prospectus (DRHP) reveals its monetary efficiency for the 9 months ended December 2023. Throughout this era, it recorded working income of Rs 4,814 crore, however incurred a web lack of Rs 278 crore. The corporate’s product sales stood at Rs 5,650 crore. Almost 77% of its whole gross sales comes from on-line, and the remainder by means of offline retail shops.

Extra from the DRHP: The refiled draft prospectus is unchanged as regards subject particulars. The agency intends to boost $218 million (about Rs 1,815 crore) in main funding by means of issuance of latest shares and divestment of 54 million shares from current traders. The IPO is more likely to be launched in July.

The IPO measurement is predicted to be $500 million (about Rs 4,163 crore), however would rely on the valuation it units for itself throughout the public providing.

A glance again: FirstCry had filed its IPO papers in December final yr. FirstCry had then stated it could use the brand new capital from the sale of contemporary shares for organising new shops and warehouses together with worldwide growth in Saudi Arabia.

Newest numbers: The corporate has a community of 1,018 FirstCry and BabyHug shops in 508 cities. Pine Children, Cutewalk and Babyoye are amongst its different manufacturers. FirstCry operates shops by means of two fashions – personal shops and franchise-owned shops. Globalbees–the model aggregator subsidiary–reported income of Rs 910 crore on a lack of near Rs 70 crore.

Friends on the block: This comes at a time when new-age firms equivalent to Ola Electrical and Awfis have filed draft IPO papers with Sebi. SoftBank-backed Swiggy too filed for its $1.25 billion IPO confidentially.

Groww, Worldline ePayments safe cost aggregator licences

Wealthtech unicorn Groww and digital cost processing firm Worldline ePayments have secured an internet cost aggregator (PA) licences from the Reserve Financial institution of India on April 29. Groww obtained the licence for its subsidiary cost enterprise Groww Pay.

Driving the information: With this licence, Groww will be capable to course of on-line funds by itself. The corporate’s funds providing is targeted on invoice cost companies, permitting customers to handle mortgage and bank card repayments, settle electrical energy and water payments, and recharge DTH companies, amongst different functionalities.

French cost main Worldline deploys point-of-sales (PoS) terminals on behalf of banks in India. Now, with the PA licence it could actually begin working within the on-line funds area too.

Constructing a full stack: Groww has been increasing its monetary companies choices. In July final yr, it launched its UPI-based companies by means of Groww Pay, enabling peer-to-peer funds in addition to transactions with retailers by way of QR codes scanning. The corporate has expanded into monetary companies by means of a non-banking finance license and the Groww Asset Administration (AMC) enterprise.

Different gamers: ET reported earlier this month that PayU and Cred obtained the RBI’s in-principle nod to grow to be cost aggregators. Others who’ve obtained the PA approval lately embrace Razorpay, Cashfree, MSwipe, Amazon Pay, Juspay, Zoho, Google Pay, and Tata Pay, amongst others.

Additionally learn | Neobanking startup Fi secures NBFC licence from RBI

ETtech Explainer: WhatsApp’s standoff with Centre over end-to-end encryption

Throughout latest proceedings within the Delhi Excessive Court docket, Meta-owned WhatsApp threatened to close down its Indian operations if the federal government enforces a rule requiring them to interrupt their encryption protocols. Let’s take a deeper look.

What’s end-to-end encryption? In an end-to-end encryption app like WhatsApp, Telegram or Sign, any message despatched is encrypted on the system earlier than flowing by means of the web to the receiver, on whose system it’s decrypted. This fashion solely the sender and the receiver can learn the messages.

The federal government’s IT guidelines mandate ‘important’ social media intermediaries equivalent to WhatsApp, to allow traceability for legislation enforcement functions.

WhatsApp’s stance: WhatsApp argued that the requirement to reveal person information violates privateness rights and claimed that this rule was launched with out prior session. Breaking encryption on its platform, the corporate argued, would infringe upon customers’ basic proper to privateness.

The federal government, for its half, advised the courtroom that WhatsApp and its dad or mum firm Meta, which monetises person info for enterprise functions, can’t legitimately declare to guard privateness.

IvyCap Ventures broadcasts ultimate shut of third fund at Rs 2,100 crore

Vikram Gupta, founder and managing companion, IvyCap

Early-stage enterprise capital agency IvyCap Ventures, which backed startups equivalent to BlueStone, Purplle and Biryani By Kilo, has introduced the ultimate shut of its third fund at Rs 2,100 crore.

Funding plans: By way of this fund, the agency plans to put money into about 25 early-stage startups, with common beginning funding quantity starting from Rs 30-50 crore. It has already deployed 40% of the capital from the third fund to startups equivalent to Dhruva House, Snitch, Celcius Logistics, GradRight, Eggoz and Flexifyme.

IvyCap stated 20% of the fund is earmarked for investing in its current portfolio firms, with the agency stepping in as a co-investor throughout their future fundraising rounds.

Booming sectors: It’s prioritising sectors like shopper tech, well being tech, fintech, B2B, SaaS and enterprise fashions as these are extremely disruptive areas.

“Local weather tech is an space which we’re fairly intently wanting into as a result of globally that is changing into the theme and we’re fairly actively that,” stated Vikram Gupta, founder and managing companion, IvyCap Ventures.

Earlier funds: In 2014, IvyCap launched its maiden fund with a corpus of Rs 240 crore, and invested in 10 firms, whereas Fund II was more-than-double the dimensions at Rs 530 crore. In its first fund, IvyCap clocked a virtually 3x distribution of money to paid-in capital (DPI), whereas the second fund has seen a 0.4x DPI, primarily pushed by exits by means of mergers and acquisitions of firms like Clovia, acquired by Reliance, and Sokrati, acquired by Dentsu Worldwide, amongst others.

Wipro’s new CEO Srinivas Pallia to get max pay of $7 million

Srinivas Pallia, CEO, Wipro

Wipro’s new CEO and MD, Srinivas Pallia, will obtain a most compensation of $7 million each year for the primary two years, together with a money compensation that will vary from a minimal of $1.75 million and a most of $3 million each year.

Cash within the financial institution: Wipro disclosed in its submitting that Pallia’s primary pay would vary between $1,750,000 each year to $3,000,000 each year. He may also obtain goal variable pay in an analogous vary.

Pallia’s contract with Wipro as CEO and MD is for a interval of 5 years with impact from April 7, 2024 to April 6, 2029.

Extra incentives: The brand new CEO may also obtain long-term incentives i.e. “inventory compensation by means of grant of American Depository Shares (ADS) Restricted Inventory Items (ADS RSUs) and ADS Efficiency Inventory Items (ADS PSUs) aggregating to $4 million.

Promoting of shares: Former CEO Thierry Delaporte may also be paid $4.33 million within the type of money compensation and relevant social safety contributions, topic to applicable deductions, the IT main stated in a BSE submitting. In the meantime, one other alternate submitting additionally reveals that Delaporte bought all his shares (about 4,72,292 Wipro shares) price Rs 21.4 crore this month.

Right now’s ETtech Prime 5 e-newsletter was curated by Vaibhavi Khanwalkar in Bengaluru and Jessica Rajan in New Delhi.