New Delhi: Hero MotoCorp on Wednesday stated the monetary 12 months 2023-24 has been a exceptional interval for the corporate. This was pushed by its give attention to “product launches, community improve and buyer satisfaction”.

The 2 wheeler maker, which has seen its market share dip in the previous few years, is assured of driving market share positive factors within the present monetary 12 months 2024-25 “on the again of our launches within the premium and 125 cc phase completed in FY24”.

Throughout the 12 months, Hero MotoCorp launched six new merchandise within the premium phase– Xtreme 125R, Xtreme 200S, Xtreme 160R 4V, Harley-Davidson X440, Karizma XMR and the Mavrick 440.

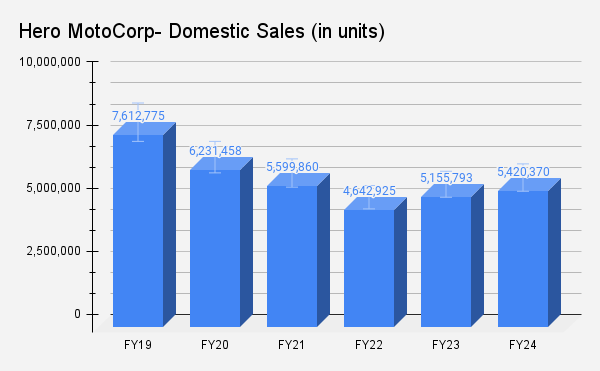

When it comes to gross sales volumes, the corporate stays a pacesetter within the two wheeler phase, nonetheless it has seen its share out there slid from 37% in FY 2020-21 to 30% within the 12 months ended March 2024. Trade consultants recommend this comes on the again of latest entrants within the EV market, altering preferences of the shoppers in direction of premium merchandise, and relatively gradual shifting mass market motorbike merchandise.

| Hero MotoCorp | Market Share |

| FY19 | 35.95% |

| FY20 | 35.78% |

| FY21 | 37.04% |

| FY22 | 34.47% |

| FY23 | 32% |

| FY24 | 30.1% |

Going ahead, the corporate is sort of optimistic in regards to the development of the general two wheeler trade. “We count on macro‐financial elements to assist the trade’s development. With commodity costs remaining secure, expectations of regular monsoons, and authorities spending anticipated to extend, we see a number of tailwinds for the sector over the upcoming quarters,” Niranjan Gupta, CEO, Hero MotoCorp stated.To reinforce its scooter portfolio, the corporate is trying to launch Xoom 125 cc and Xoom 160 cc within the coming months. “The approaching 12 months will see us taking large strides in EV by way of product launches within the mid and reasonably priced phase. General, we see a really constructive outlook for the approaching years.”

Presently, the corporate sells just one electrical scooter– Vida, which was launched in October 2022. Presently, Ola Electrical , TVS Motor, Bajaj Auto and Ather Vitality dominate the electrical scooter market in India.

Pushed by gross sales of its mid-range bikes, the 2 wheeler maker has reported a 17% development in its consolidated revenue after tax (PAT) at INR 943.46 crore in January-March 2024 quarter. The corporate reported a consolidated PAT of INR 810.8 crore in the course of the corresponding interval of final 12 months.

Consolidated income from operations in the course of the This fall FY24 stood at INR 9,616.68 crore when in comparison with INR 8,434.28 crore in This fall final 12 months.

Hero MotoCorp has declared a closing dividend of INR 40 per share. “This dividend along with interim and particular dividend, marking the centennial 12 months of Chairman Emeritus Dr Brijmohan Lall Munjal, of INR100 per fairness share, takes the mixture whole dividend for the 12 months 2023-24 to INR 140 per fairness share i.e. 7000%,” it stated.

The corporate can even arrange a brand new wholly owned subsidiary in Brazil, which can more than likely be named ‘Hero MotoCorp do Brasil Ltda.” It can put money into the brand new entity in phases, and cater to the manufacturing and distribution of two-wheelers together with elements and equipment.