The federal government introduced an additional 2p lower to Nationwide Insurance coverage (NI) within the Funds. Nonetheless, it’s not altering revenue tax charges.

Earlier modifications to tax guidelines imply the quantity of tax individuals pay general is rising.

How a lot will a 2p Nationwide Insurance coverage lower save me?

Chancellor Jeremy Hunt introduced the beginning fee for NI will change from 10% to eight%, for 27 million employees, from April 2024.

He says that is price £450 a 12 months to an worker on a mean wage of £35,000.

He’s additionally chopping NI for 2 million self-employed employees. Their fee will fall from 8% to six%.

The federal government says the lower is price £350 to a self-employed particular person incomes £28,200.

What Nationwide Insurance coverage modifications had already been introduced?

The federal government says that when mixed with the newest lower, a employee on £35,000 will save £900 a 12 months.

From the identical date, they may now not pay a separate class of NI referred to as Class 2 contributions.

When mixed with the lower to six% introduced within the Funds, the federal government says they may save £650.

NI on revenue and income above £50,270 stays at 2%.

NI charges apply throughout the UK. It isn’t paid by individuals over state pension age, even when they’re working.

Why are thousands and thousands paying extra tax?

Thousands and thousands of individuals pays a whole bunch of kilos extra in tax due to modifications to the tax thresholds. These are the revenue ranges at which individuals begin paying revenue tax, or should pay greater charges.

Freezing the thresholds signifies that extra individuals begin paying tax and NI as their wages enhance, and extra individuals pay greater charges.

What are the present income-tax charges?

Earnings tax is paid on earnings from employment and income from self-employment in the course of the tax 12 months, which runs from 6 April to five April the next 12 months.

The Primary fee is 20% and is paid on annual earnings between £12,571 and £50,270.

The Larger fee is 40%, and is paid on earnings between £50,271 and £125,140.

When you earn greater than £100,000, you additionally begin shedding your tax-free private allowance.

You lose £1 of your private allowance for each £2 that your revenue goes above £100,000.

Anybody incomes greater than £125,140 a 12 months now not has any tax-free private allowance.

The further fee of revenue tax is 45%, and is paid on all earnings above £125,140 a 12 months.

These apply in England, Wales and Northern Eire.

Who pays most in revenue tax?

For many households, revenue tax is the one largest tax they pay.

However for much less well-off households, a better share of household revenue goes on taxes on spending, often called oblique taxes.

For the poorest fifth of households, VAT is the largest single tax paid.

How do UK taxes examine with different international locations like France and Germany?

In 2022 – the newest 12 months for which worldwide comparisons might be made – that determine was 35.3%.

That places the UK proper in the midst of the G7 group of massive economies.

France, Italy and Germany tax extra; Canada, Japan and the US tax much less.

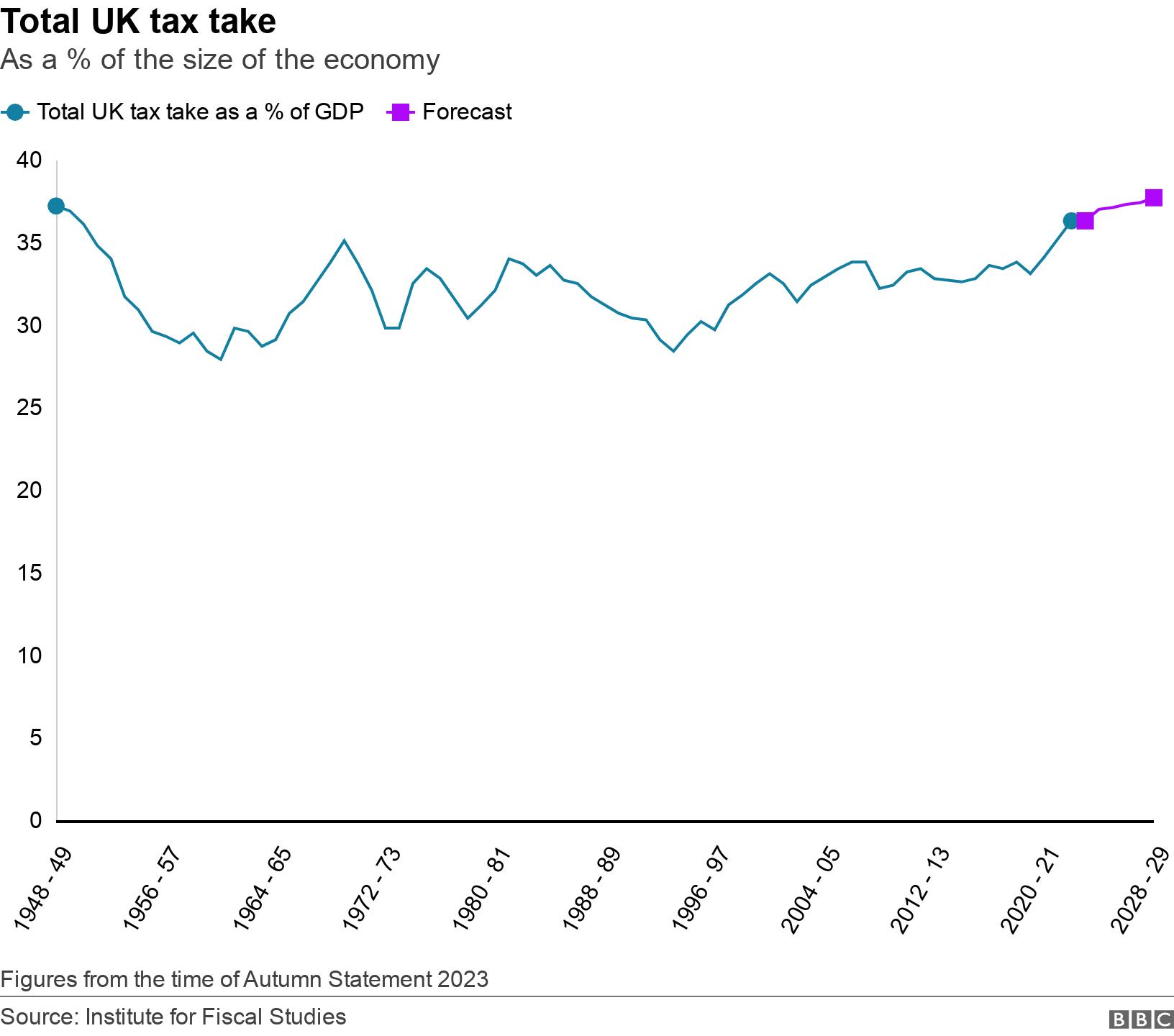

Nonetheless, general taxation within the UK is excessive in contrast with historic charges.

In its evaluation of the 2024 Funds, the OBR stated the federal government will accumulate 37.1p of each pound generated within the economic system in 2028/29.

That would be the highest degree in 80 years.

Please embrace a contact quantity in case you are keen to talk to a BBC journalist. You can even get in contact within the following methods:

If you’re studying this web page and may’t see the shape you’ll need to go to the cellular model of the BBC web site to submit your query or remark or you possibly can e mail us at [email protected]. Please embrace your title, age and site with any submission.