Additionally within the letter:

■ Telcos’ enterprise play

■ FirstCry CEO’s pay drops

■ Amazon triples quarterly revenue

IT firms log sturdy income development outdoors key North America market

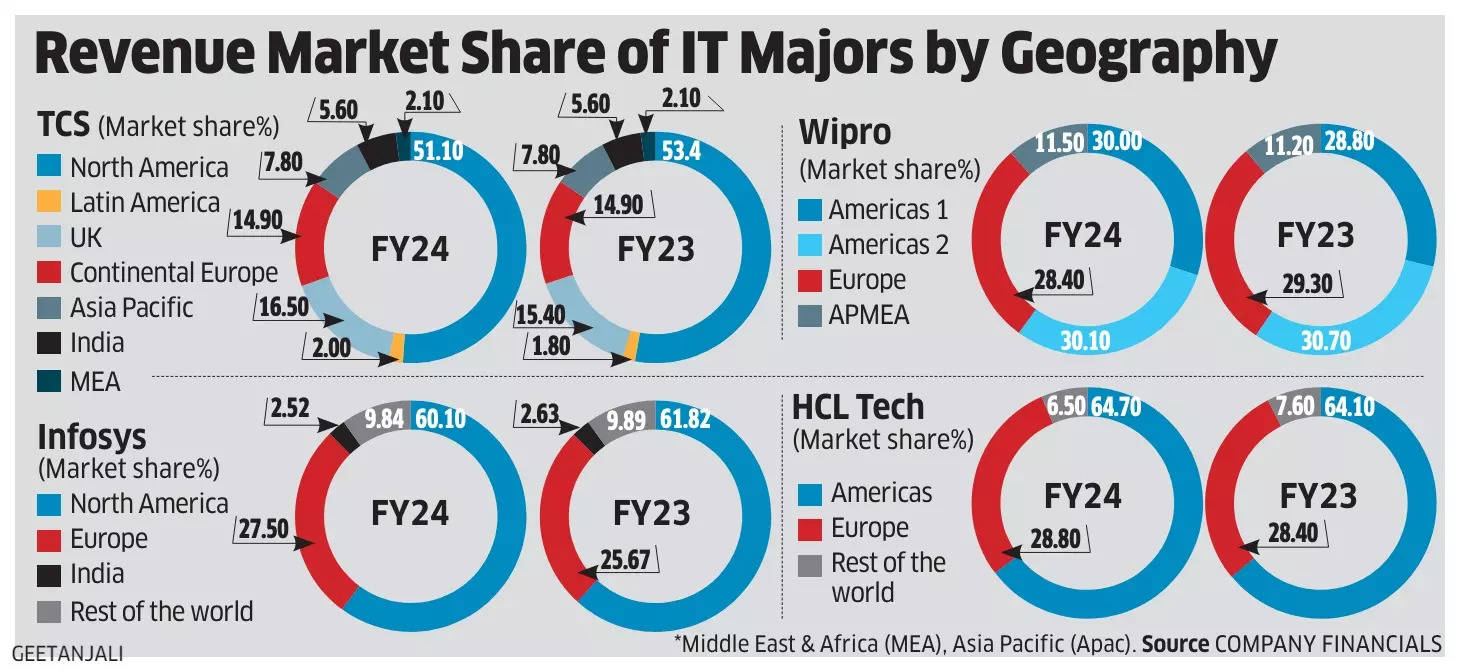

Indian IT majors are discovering sooner income development in new markets like Europe, the Center East & Africa (MEA), and Asia Pacific (APAC) in comparison with the slowdown of their established North American market.

Why it issues? For many IT companies companies, North America at present contributes 50-60% to complete income, adopted by Europe at round 30%. The regional markets nonetheless represent a small portion of the overall income pie.

Sure, however: “For the final two quarters, the Center East and Japan have grown sooner than Europe. However earlier than the final two quarters, Europe has grown sooner than North America for 10 straight quarters,” Peter Bendor-Samuel, founder and CEO of analysis agency Everest Group, informed ET.

Progress path: On a quarterly foundation, TCS’ income development through the January-March interval was led by regional markets. For Infosys, whereas India income shrank over 15%, its Europe and Remainder of the World (APAC and MEA) markets reported development. HCLTech, the nation’s third largest IT participant, is seeing rising demand in Europe and Japan.

US market woes: Analysts stated that US shoppers, particularly in BFSI and retail, are sceptical about making discretionary spending because of excessive inflation and rates of interest. India, the Center East and the UK, however, are persevering with to see investments in know-how, making it enticing to IT firms.

Stride Ventures closes third fund at $165 million

(L-R) Stride Ventures managing companions Ishpreet Singh Gandhi and Apoorva Sharma

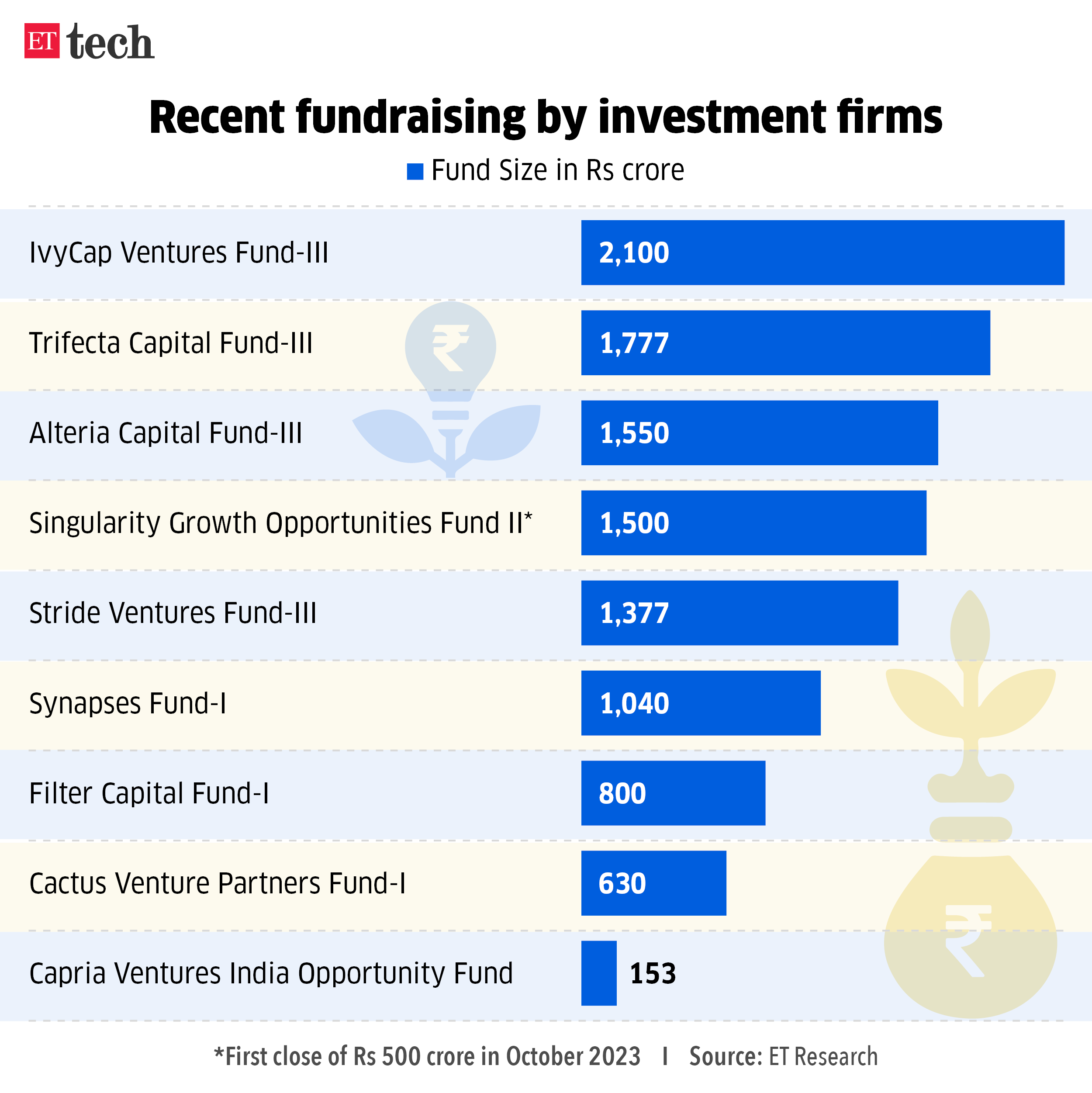

Enterprise debt agency Stride Ventures, which has backed startups reminiscent of Zepto, Insurgent Meals, Sugar Cosmetics and Mensa Manufacturers, has introduced the ultimate shut of its third fund at $165 million.

Capital deployed: Stride Ventures stated it has already supplied capital to startups reminiscent of BlueStone, Moneyview, Foxtale, NewMe, Nat Behavior and Agrostar from its third fund, by way of which it’s going to primarily deal with client, monetary companies and cleantech sectors.

Missed goal: The third fund had made its first shut at $100 million in Could 2023. Nevertheless, the agency’s ultimate shut for its Fund-III has fallen wanting its preliminary goal of $200 million.

“We thought in regards to the fund in late 2022 after which the speed of development of enterprise capital additionally defines the speed and development of enterprise debt…during the last 18 months, the enterprise capital hasn’t actually picked up momentum and the deployments are nonetheless lower than what it was in 2021 and 2020,” stated Apoorva Sharma, managing companion at Stride Ventures.

Earlier funds: Stride Ventures stated it has returned its first fund, which was $50 million in measurement, and was raised in 2019, in its entirety. The agency’s second fund, raised in 2021, had a $200-million corpus.

The enterprise debt agency had additionally backed on-line car service platform GoMechanic, which was offloaded in a misery sale in Could 2023.

Recap: In latest months, a number of funds, together with these disbursing enterprise debt, have raised capital. On April 30, early-stage investor IvyCap Ventures closed its third fund at Rs 2,100 crore ($250 million). Capria Ventures, too, concluded the fundraising for its India Alternative Fund at Rs 153 crore ($19 million) earlier within the month.

GCCs emerge as key cog in telcos’ enterprise play

India’s main telecom firms are rising deal with serving the enterprise wants of offshore models of multinational companies (MNCs) by investing in leased traces, fiber optic networks, safe information connections and high-speed web entry for them.

Driving the information: Over 47 new models, popularly often called international functionality centres (GCCs), have emerged in India in 2023 alone. Telcos are searching for tailor-made options and strategic partnerships with them, anticipating enterprise income to the touch Rs 30,000 crore in FY24, rising 16% on yr, in line with analysts.

At the moment, GCC contribution is simply 4-5% of a telco’s enterprise enterprise, however that’s anticipated to rise sharply.

Rising numbers: GCCs have been mushrooming in India over the previous few years, with over 1,580 now in operation with an put in expertise base of over 1.66 million, in line with a joint research by know-how trade physique Nasscom and Zinnov, particularly in tier-II and tier-III cities.

This has translated into high-speed connectivity and densification of networks in lesser populated cities and cities.

Inform me extra: The expansion of GCCs can also be fuelling the info storage and processing wants of enterprises which require sturdy fibre networks for top capability and low latency information switch between the cloud and on-premise.

FirstCry CEO Supam Maheshwari’s month-to-month pay drops 49% in Apr-Dec 2023

Supam Maheshwari, CEO, FirstCry

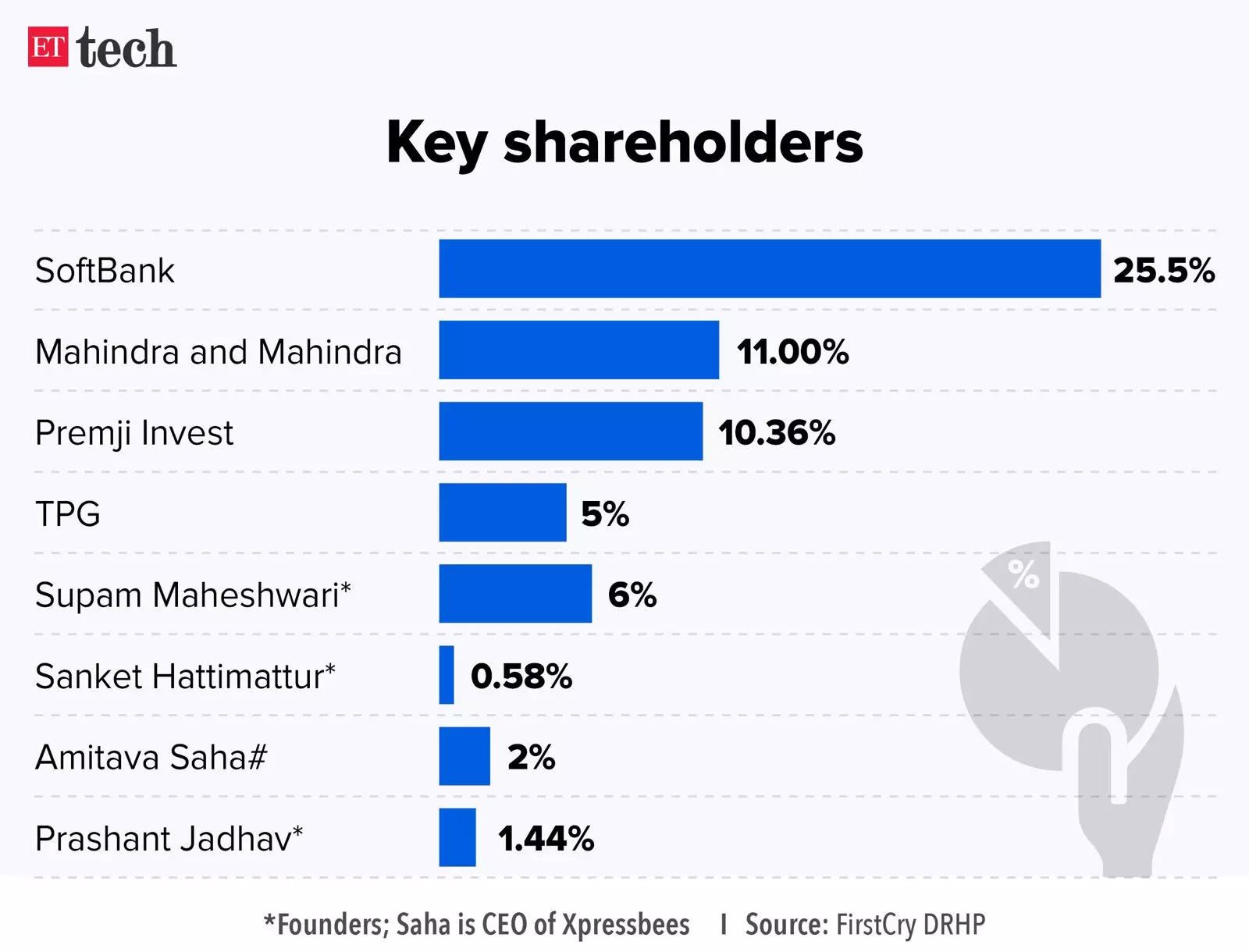

IPO-bound FirstCry’s cofounder and CEO Supam Maheshwari noticed a 49% drop in month-to-month remuneration to Rs 8.61 crore for the primary 9 months of FY24, in line with the corporate’s draft purple herring prospectus (DRHP).

Inform me extra: Maheshwari’s complete remuneration for the 9 months till December 31, 2023, was Rs 77.5 crore, down from Rs 200.7 crore for the entire of FY23. Sanket Hattimattur, additionally a cofounder, noticed a drop in pay to Rs 8.33 crore in the identical interval, from Rs 18.57 crore in FY23.

Share transaction: Earlier than submitting for the IPO, Maheshwari offered 6.2 million shares of the corporate, and at present holds 28,893,347 fairness shares (5.94% stake) in FirstCry.

IPO objectives: FirstCry goals to lift $218 million (Rs 1,815 crore) by way of a contemporary challenge of shares, with current traders planning to promote 54 million shares. The IPO, anticipated in July, is projected to be valued at round $500 million (Rs 4,163 crore), combining major and secondary share gross sales.

Sebi’s intervention: Backed by SoftBank, FirstCry was directed by the Securities and Change Board of India (Sebi) to refile its DRHP because of inadequate disclosure in key efficiency indicators (KPIs).

Amazon triples quarterly revenue as cloud biz surges

Ecommerce main Amazon on Tuesday reported sturdy numbers for the January-March quarter, using on the expansion in its cloud computing unit and new promoting cash from its Prime Video streaming service.

Numbers: “It was an excellent begin to the yr throughout the enterprise, and you may see that in each our buyer expertise enhancements and monetary outcomes,” Amazon CEO Andy Jassy stated in an announcement.

- Amazon introduced in $143.31 billion in income, up 13%

- Internet earnings got here out to $10.43 billion, or 98 cents per share

- Gross sales within the firm’s internet marketing enterprise additionally rose 24%

On cloud 9: Amazon stated first-quarter gross sales in its cloud computing unit, Amazon Net Providers, amounted to $25.04 billion, up 17% from the identical interval final yr. Jassy stated AI capabilities have reaccelerated AWS’ development price and it’s now on tempo for $100 billion in annual income.

Hurdles alongside the best way: Underneath Jassy, Amazon has lower prices in numerous elements of its enterprise to stay worthwhile. This yr, the corporate lower lots of of positions throughout AWS, Prime Video and MGM Studios. Its subsidiaries, the favored social media platform Twitch and the audiobook service Audible, have additionally laid off staff.

Additionally learn | Large Tech stories sturdy Q1 numbers amid AI push

At present’s ETtech Prime 5 e-newsletter was curated by Vaibhavi Khanwalkar in Bengaluru.