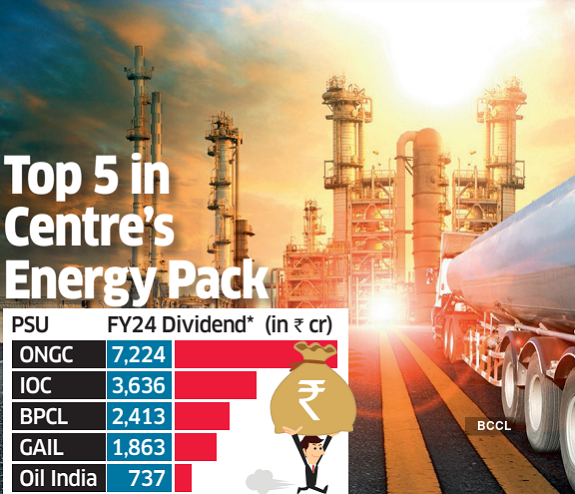

New Delhi: Oil and Pure Gasoline Company (ONGC) has paid a dividend of INR 7,224 crore to the Centre for the fiscal 2023-24, main the pack of oil and gasoline firms, which kind the most important block of dividend payers to the Central authorities.

ONGC’s dividend contribution to the state was virtually double the INR 3,636 crore dividend by Indian Oil Company (IOC), almost 3 times Bharat Petroleum Company’s INR 2,413 crore, near 4 occasions GAIL’s INR 1,863 crore and about ten occasions Oil India’s INR 737 crore.

These are interim dividends and a last instalment normally comes after the businesses declare annual earnings.

Heavy payouts have been pushed by sturdy income in the course of the monetary 12 months. Excessive oil and gasoline costs aided producers’ income, whereas a home pump value freeze lifted refiners’ earnings. Pure gasoline entrepreneurs additionally gained from elevated consumption of gas.

“ONGC maintains a wholesome mixture of dividend launch and inside useful resource era to get stability of current and future,” ONGC chairman Arun Singh advised ET, referring to the corporate’s capability to fulfill present shareholder expectations and fund future capital expenditure, which is able to rise on account of the transition.

ONGC spent INR 30,000 crore within the first 11 months of FY24, marginally exceeding its annual capex goal. The oil and gasoline producer expects its capex to virtually double in the direction of the top of the last decade.

Investor sentiment shifts

International oil and gasoline companies have used their terribly excessive income previously two years to reward shareholders by paying heavy dividends or shopping for again shares. This has contributed to a shift in investor sentiment in the direction of these firms which, earlier than Covid-19, struggled within the inventory market.

For the 9 months until December 2023, ONGC posted a consolidated revenue of INR 43,466 crore and paid a dividend of INR 12,266 crore. The Centre holds 59% in ONGC.

IOC has paid a complete dividend of INR 7,061 crore to sharholders after clocking a revenue of INR 36,364 crore for the 9 months. Coal India’s dividend of INR 12,634 crore, together with INR 7,976 crore to the federal government, exceeds ONGC’s this 12 months.

Payouts from different sectors

India’s prime energy producer, NTPC, declared a dividend of INR 4,363 crore, together with INR 2,230 crore to the federal government.

Energy Grid Company has paid a dividend of INR 7,906 crore, together with INR 4,059 crore to the federal government, whereas Hindustan Aeronautics Ltd has paid a dividend of INR 1,471 crore, with INR 1,054 crore going to the state. NMDC paid INR 1,685 crore in dividends, with INR 1,024 crore to the federal government.