Additionally on this letter:

■ India’s new EV coverage

■ ETtech Offers Digest

■ All in regards to the OTT apps’ ban

Paytm strikes its level of sale terminals to RBL Financial institution

After shifting its nodal accounts to Axis Financial institution and turning into a third-party app on Unified Funds Interface, Paytm has moved its level of sale terminals to RBL Financial institution.

What’s the information? Paytm had deployed greater than 5 lakh PoS terminals throughout service provider retailers competing with the likes of Pine Labs and others. A bulk of those retailers had been utilizing the settlement companies of Paytm Funds Financial institution (PPBL). Now, One 97 Communications, which runs Paytm, has moved the backend banking companies to RBL Financial institution. The private-sector lender will finally switch the funds to the nodal account which Paytm has with Axis Financial institution.

Additionally learn | NPCI permits Paytm to turn out to be third-party software on UPI with 4 banks

What subsequent? This helps RBL Financial institution push its PoS depend considerably. In keeping with newest RBI knowledge, RBL Financial institution had round 8.4 lakh PoS terminals. Now, that would go up by round 50%. Finally, transactions made by means of these terminals can even enhance RBL Financial institution’s whole cost quantity by 50 to 60%, in accordance with folks within the know.

Paytm will retain the branding of those terminals and the service provider relationships, however will now not have the ability to settle transactions by means of PPBL.

Additionally learn | Paytm discontinues inter-company agreements with Paytm Funds Financial institution

Standing test: The deadline for PPBL to cease providing primary banking companies ends as we speak. Paytm turns into a third-party cost app on UPI from tomorrow. The present @paytm deal with might be processed by Sure Financial institution. New handles might be created going ahead by means of Sure Financial institution, HDFC Financial institution, Axis Financial institution and State Financial institution of India. Whereas Sure Financial institution and Axis Financial institution are being examined in a closed person group, the opposite two are but to get into the testing stage.

Additionally learn | Paytm Funds Financial institution to chop about 20% of employees as enterprise halt looms

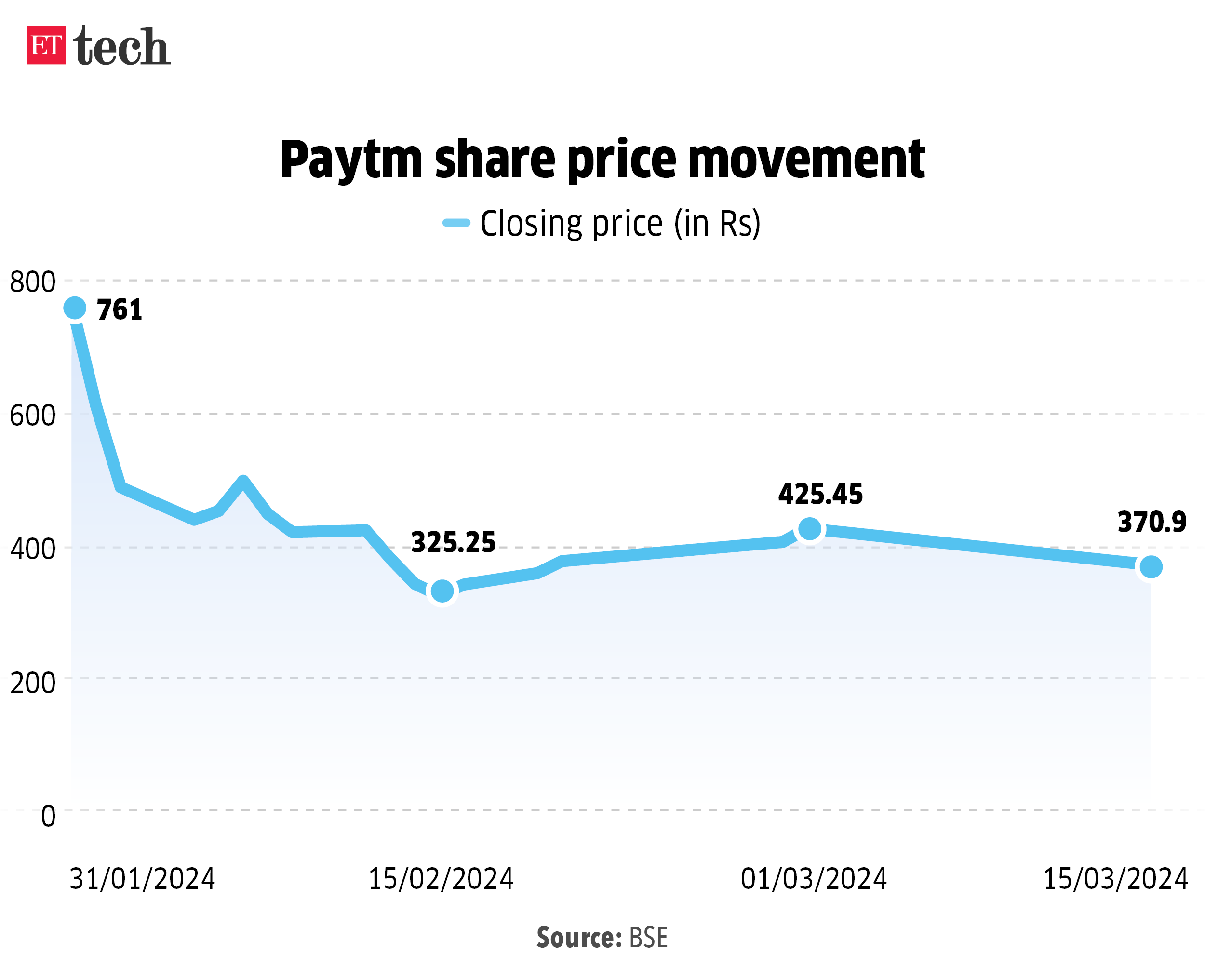

Paytm shares soar 5%: Shares of One 97 Communications on Friday jumped 5% to Rs 370.90 on the BSE after the Nationwide Funds Company of India (NPCI) granted approval to Paytm to take part in UPI as a third-party software supplier (TPAP) underneath multi-bank mannequin.

CCI orders probe into Google’s Play Retailer billing insurance policies

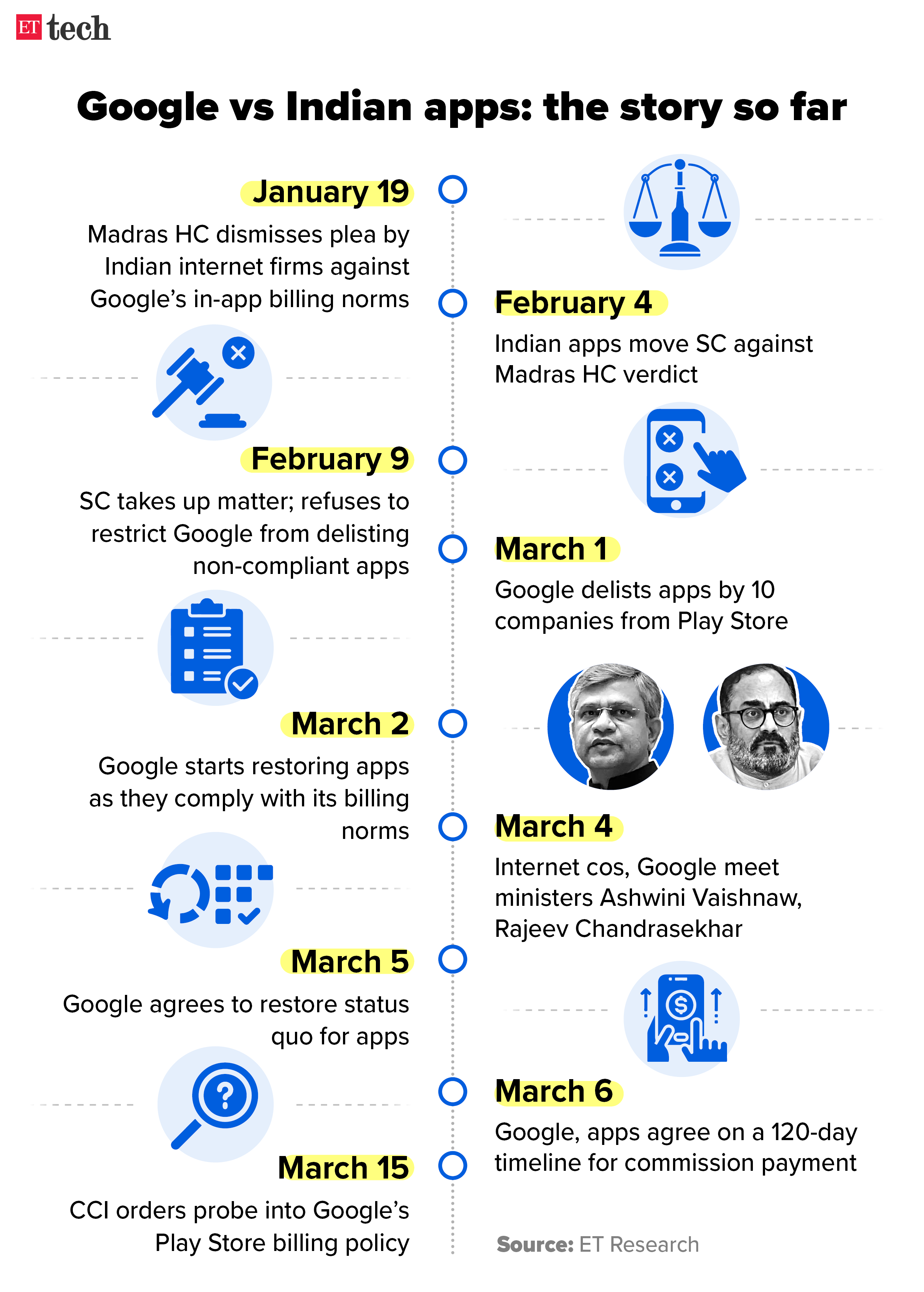

The Competitors Fee of India (CCI) on Friday ordered an investigation into Google’s Play Retailer billing insurance policies, in opposition to which Indian web corporations have raised considerations.

In a 21-page order, the antitrust regulator mentioned it’s of the view that, prima facie, Google has violated provisions of the Competitors Act, which warrants an in depth probe into the matter.

Particulars: The problem pertains to Google’s billing insurance policies underneath which it fees web corporations offering digital companies 11-30% fee on in-app purchases made by their customers. Web corporations have opposed this fee.

Additionally learn | ETtech Full Stack | No level Googling ‘swadeshi’

On March 1, Google delisted a whole bunch of apps by ten corporations together with Data Edge, Folks Interactive and Matrimony from its app market for violating its billing insurance policies. Later, following intervention from the Indian authorities, Google reinstated these apps on the Play Retailer.

Abuse of dominance: Among the many key observations made by the CCI in its order, it has identified that the charge charged by Google to app builders “seems to be disproportionate to the financial worth of companies being rendered” and “seems to be an abuse of dominant place by Google”.

Discriminative practices: Furthermore, the antitrust regulator additionally underscored that prima facie, Google is implementing its insurance policies in a “discriminating method”, thus violating the provisions of the Competitors Act.

Truce: On March 5, Google mentioned it was restoring the established order for the apps by these builders, which allowed them to supply in-app purchases to their customers. Google additionally mentioned it would bill its full relevant service charge within the interim, with an prolonged cost timeline for these ten corporations.

Additionally learn | ETtech Explainer: Why are Indian startups up in arms in opposition to Google Billing?

India okays EV coverage with tax aid to rev up manufacturing

A brand new electrical car scheme, with a tax aid aimed toward positioning India as a premier manufacturing hub, was green-lighted by the federal government on Friday. The announcement comes amid the nation’s makes an attempt to woo overseas gamers resembling Tesla.

The brand new coverage: India plans to decrease import taxes on choose EVs for corporations committing to investments of over $500 million. Corporations should obtain a home worth addition (DVA) of not less than 50% inside 5 years. Furthermore, a localisation stage of 25% by the third 12 months is remitted.

Inform me extra: Listed here are just a few particulars of the brand new scheme:

- For autos with a minimal CIF (value, insurance coverage, and freight) worth of $35,000, a 15% customs responsibility (as relevant to utterly knocked down models) might be levied for 5 years, topic to the establishing of producing amenities in India inside three years.

- The responsibility foregone on the whole variety of EVs permitted for import might be capped on the funding made or Rs 6,484 crore (equal to incentive underneath PLI scheme).

- A most of 40,000 EVs, at a fee not exceeding 8,000 per 12 months, might be allowed if the funding surpasses $800 million.

Tesla to profit? Main Indian gamers had voiced considerations about decreased EV taxes, worrying about elevated competitors from globally favoured high-end EVs. Tesla’s request for an preliminary tariff concession, aiming to offset customs duties by 70% for automobiles priced underneath $40,000 and 100% for higher-priced automobiles, has been a focus of dialogue.

Nevertheless, the federal government has affirmed that India will uphold its insurance policies, with out tailoring them particularly to accommodate requests from Tesla.

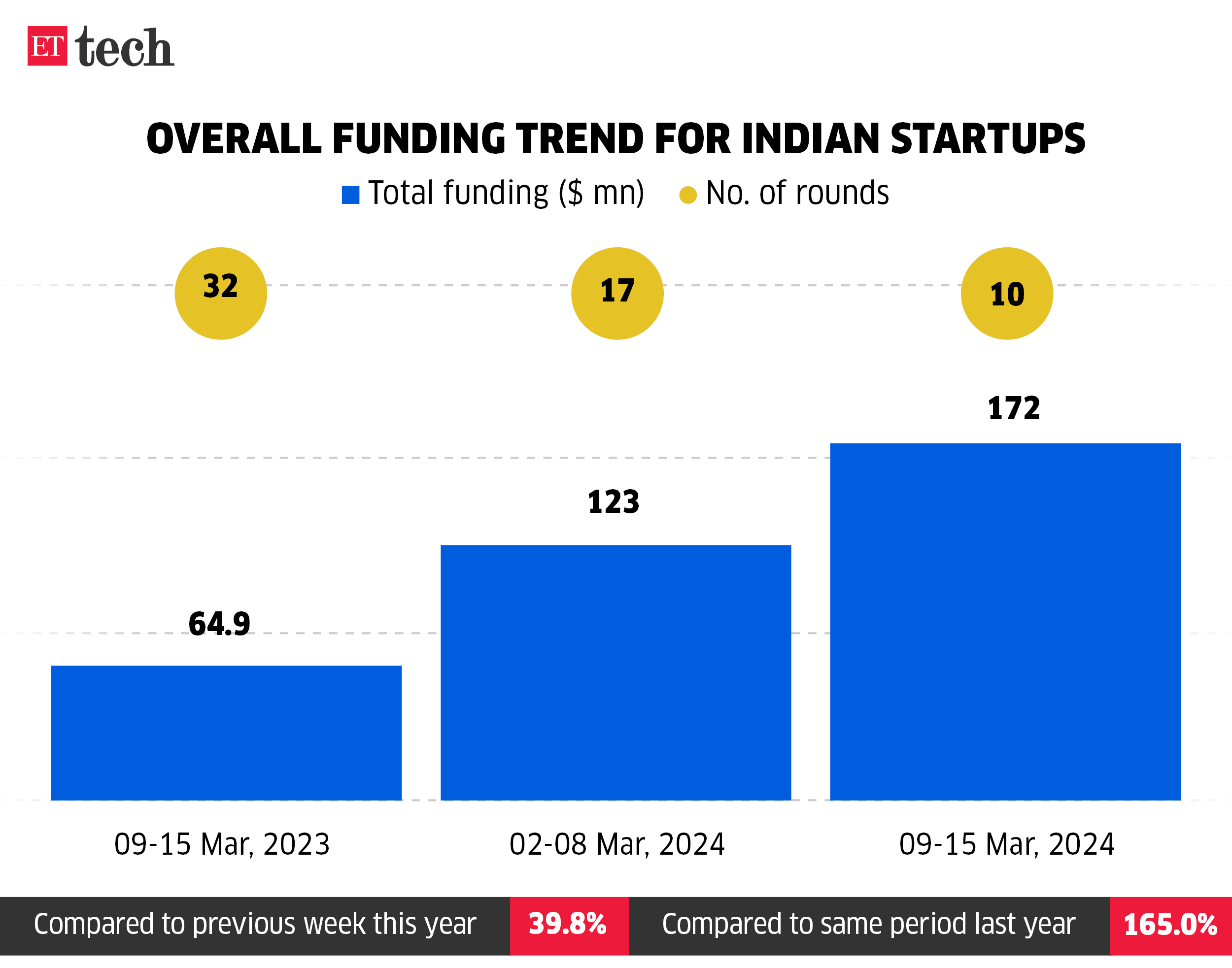

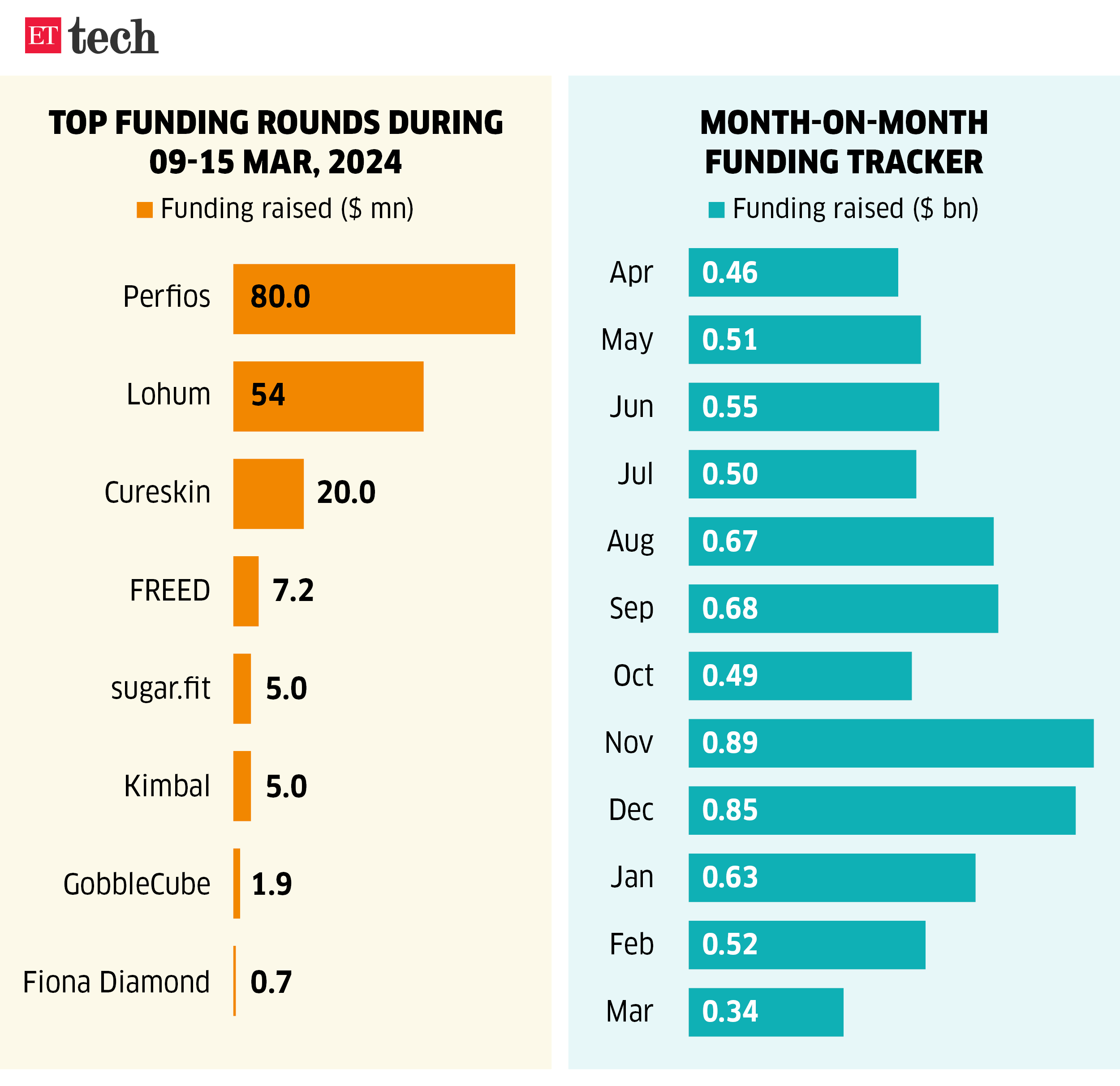

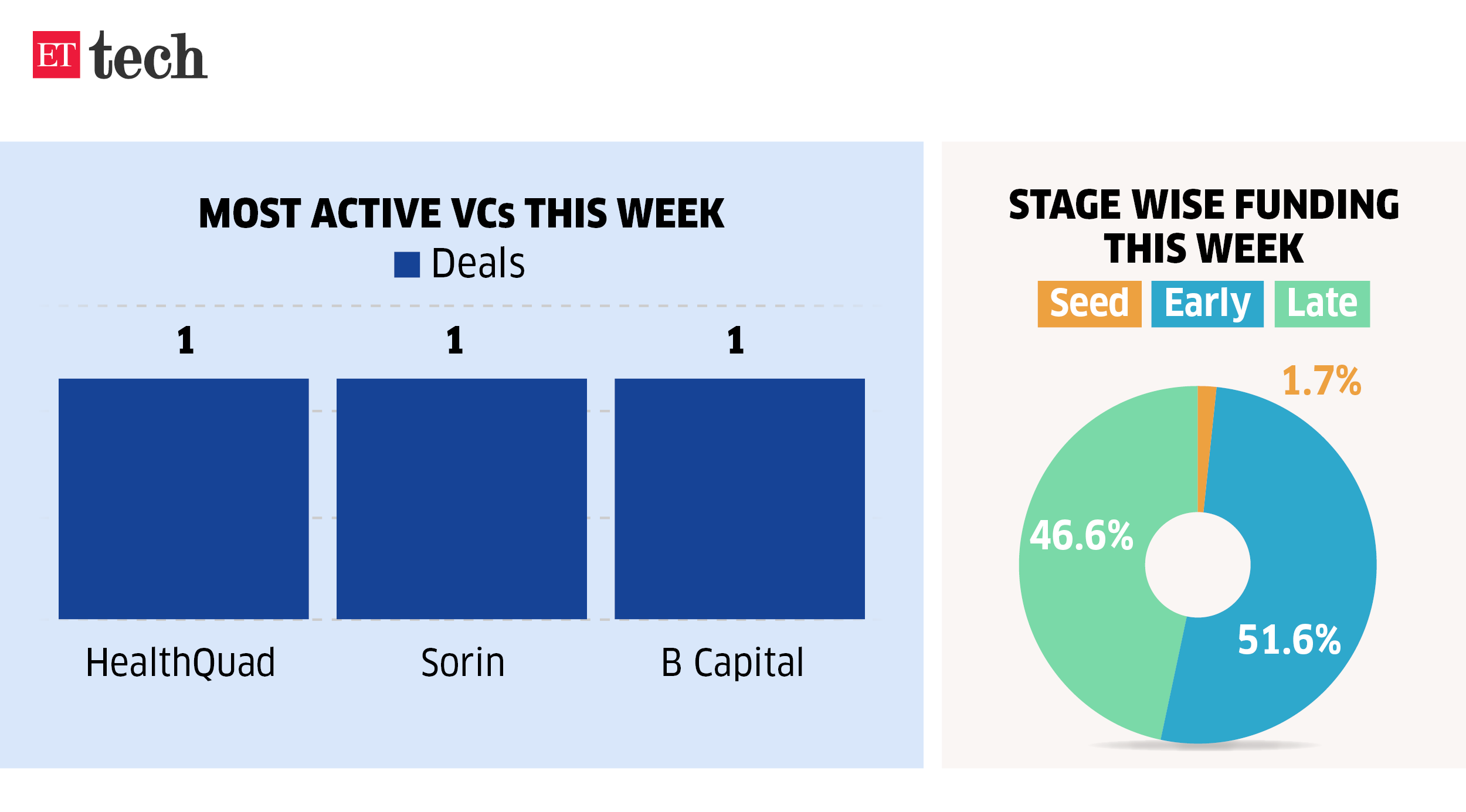

Perfios, Lohum offers enhance startup funding practically 3X to $187 million this week

Progress-stage startups Perfios and Lohum raised equity-based funding of over $50 million every this week – a uncommon feat for corporations within the stage, given the sluggish state of deal-making.

The 2 offers helped push up general funding numbers by practically 3X to $186.6 million, deployed throughout 10 offers. This was up 188% from $64.9 million throughout 32 offers in the identical week a 12 months in the past – March 9 to March 15, 2023.

Accordingly, deal density through the week additionally rose to about $19 million per deal, as in opposition to $2 million in the identical interval final 12 months, and $7 million within the earlier week.

Sequentially, funding within the newest week noticed a rise of about 52% in worth phrases, and was down about 41% by quantity.

ETtech Explainer: The government’s ban on OTT platforms

The ministry of knowledge & broadcasting (I&B) has banned 18 OTT platforms for publishing obscene, vulgar, and in some instances, pornographic content material. The transfer follows mounting concern relating to the accessibility of express materials on digital platforms. ETtech tries to clarify the explanations behind this transfer.

Obscene Content material: A good portion of the content material hosted on these platforms was discovered to be obscene and vulgar and portrayed girls in a demeaning means. “It depicted nudity and sexual acts in numerous inappropriate contexts, resembling relationships between academics and college students, incestuous household relationships, and many others.,” the federal government mentioned in a launch.

What does the regulation say? OTT is regulated by the Data Expertise (IT) Act of 2000. Part 67 of the Act prohibits the sharing or publishing of any materials in digital type that’s obscene or sexually express. The regulation additionally prohibits the sharing of supplies depicting youngsters in sexually express acts and punishes these concerned in such actions.

Different banned apps: In February this 12 months, the federal government ordered the blocking of 138 betting and playing apps and 94 quick-loan-providing apps over considerations of improper knowledge storage and switch to different international locations and suspected cash laundering. In February 2022, the federal government had issued new orders to ban greater than 54 Chinese language apps, terming them as threats to the privateness and safety of Indian customers.

At present’s ETtech Prime 5 e-newsletter was curated by Gaurab Dasgupta in New Delhi.