Additionally on this letter:

■ SoftBank could double down on Icertis

■ Advert-film makers await launch of OpenAI’s Sora

■ PB Fintech stories Rs 60 crore revenue in This autumn

NBFCs pull the plug on Paytm’s lending biz, invoke mortgage ensures

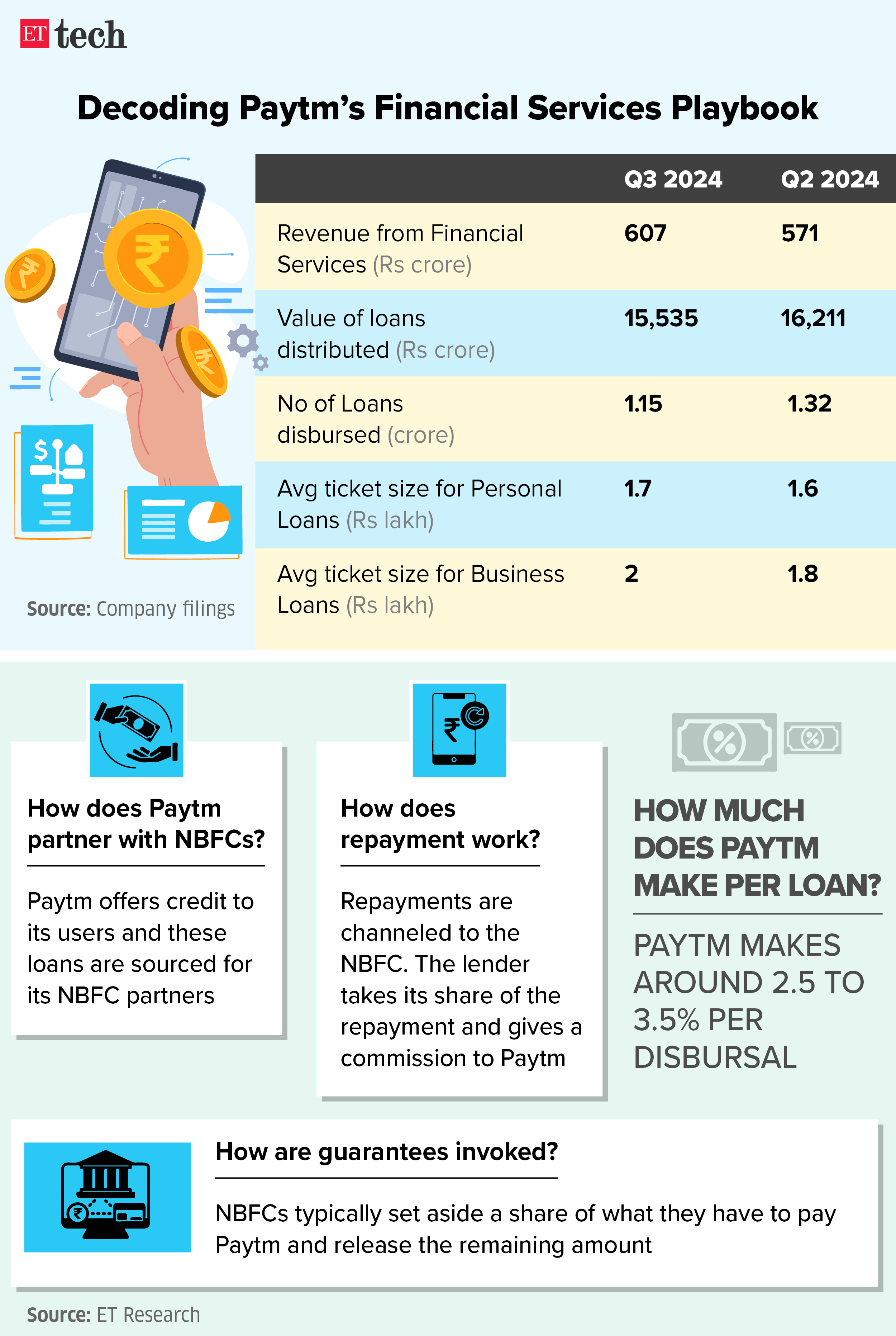

The challenges confronted by Paytm Funds Financial institution, an affiliate entity of One 97 Communications, are impacting the fintech main’s lending enterprise.

Driving the information: A bunch of non-banking finance corporations (NBFCs) that labored with Paytm for client loans have now pulled the plug, sources instructed us.

The likes of Aditya Birla Finance (ABFL), Piramal Finance, Clix Capital, amongst others are leant to have paused disbursement of recent loans sourced by Paytm, individuals within the know mentioned. Additionally, ABFL is learnt to have invoked a few of the ensures which Paytm had supplied the NBFC towards unsecured loans facilitated by the fintech platform.

The large image: For Paytm, which made almost 21% of its total quarterly income from monetary companies, a success on its lending enterprise may very well be damaging. ABFL invoking the ensures would even have a direct affect on its high line.

New partnerships: Whereas a bunch of older partnerships have slowed down for Paytm, the corporate is seeking to sew some new alliances, sources mentioned. Muthoot Fincorp is about to strike a cope with Paytm, individuals within the know mentioned.

Additionally learn | Paytm COO & president Bhavesh Gupta resigns; to tackle advisory position

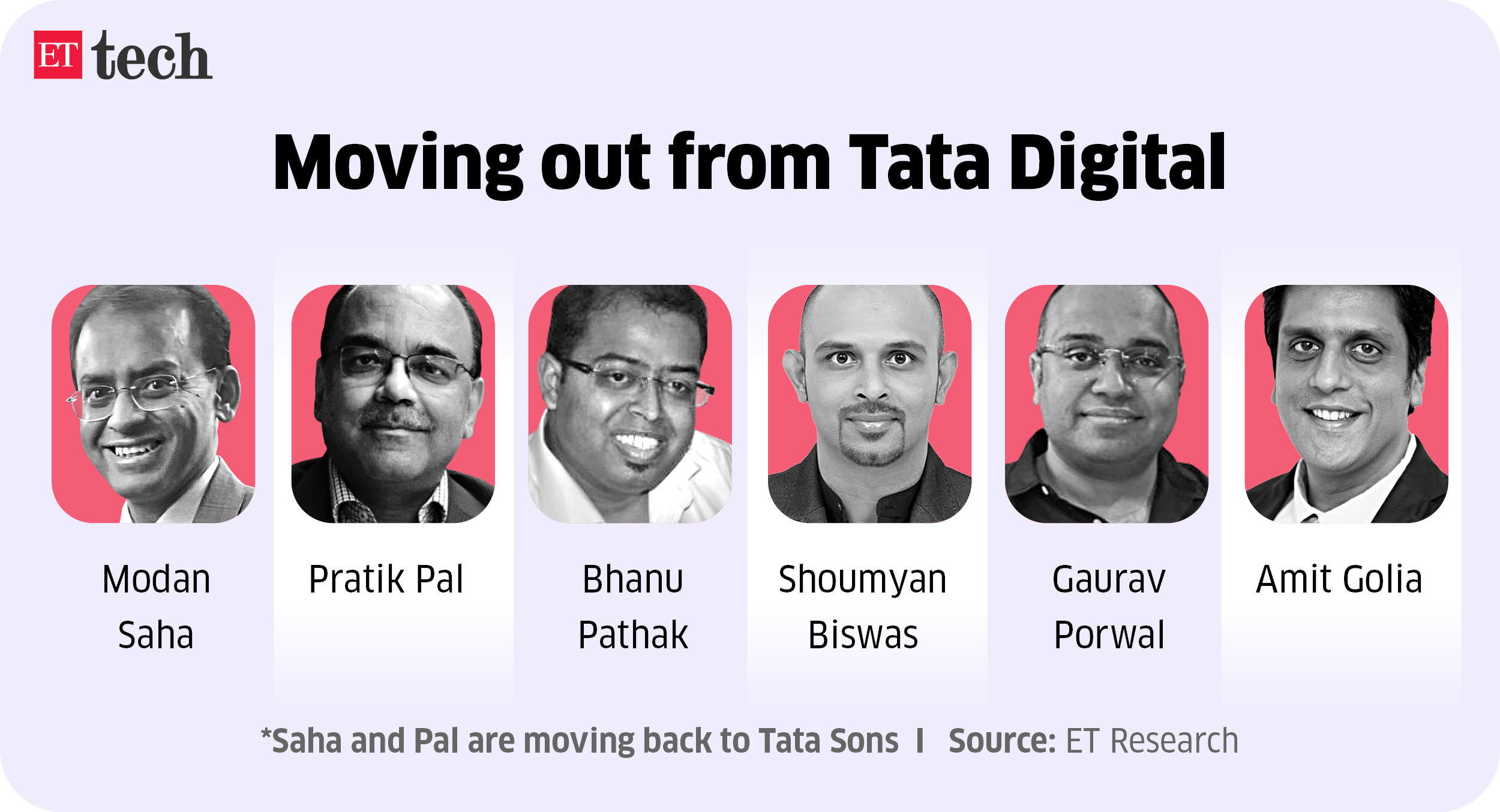

Tata Digital sees huge reorganisation publish new CEO’s arrival

In February, Tata Digital, which runs superapp Neu, appointed Naveen Tahilyani as the brand new CEO, changing Pratik Pal. Minimize to Could, and the previous guard on the group’s ecommerce unit is out. Listed here are the small print:

Exit record: Modan Saha, chief govt of the fintech enterprise, is shifting again to guardian Tata Sons, after steering the vertical for two-and-a-half years. Bhanu Pathak, Shoumyan Biswas and Gaurav Porwal — all senior executives employed by former president and Myntra founder Mukesh Bansal — have resigned and can go away after serving their discover interval, which coincides with the tip of the Indian Premier League cricket match. The Tata group is the title sponsor for IPL. Amit Golia is one other govt quitting Neu.

Pal has additionally moved again to Tata Sons, sources mentioned.

Inform me extra: At the same time as most members from the unique staff of Tata Neu are out, the corporate has shelved plans to onboard non-Tata manufacturers on the superapp, sources mentioned. The brand new CEO’s focus is on utilising the prevailing Tata manufacturers on Neu and elevating the buyer expertise.

Additionally learn | Tata Neu gained’t simply provide in-house manufacturers

Zoom in: Tata Neu stays a channel for large digital property like BigBasket and 1mg, a supply mentioned. “The main focus is that they (Tatas) ought to first get the shopper expertise improved with group manufacturers after which consider exterior manufacturers. Inside the group, integration has not been simple.”

Tata Digital didn’t have a perfect begin with Neu, launched on April 7, 2022. There was a constant churn in its senior ranks, together with Bansal’s exit inside a yr of coming in as president in June 2021. Neu’s contribution, in the meantime, stays lower than 10% of the product sales of egrocer BigBasket and epharmacy 1mg.

Additionally learn | Tata Digital CEO steps up give attention to reducing prices

SoftBank again at deal counter with Icertis deal talks

We now have another scoop on one other SaaS cope with a SoftBank hyperlink.

Deal particulars: SoftBank, one of many world’s largest expertise buyers, is in early talks to double down on Icertis by a secondary share sale, sources instructed us. The spherical may very well be round $150 million in dimension, however the valuation, as but undecided, will maintain the important thing to the deal closing.

Sure, however: Icertis was final valued at $5 billion. The ‘worth discovery’ for the brand new funding – the place others could also be concerned together with SoftBank – remains to be underway.

“The talks are in early phases and the important thing to the deal could be within the valuation and the worth discovery is but to be finalised,” one of many sources instructed us.

Additionally learn | Kaiser could steer $250 million funding in SaaS agency Innovaccer at flat valuation

SoftBank again? The Japanese investor, which has largely stayed away from new investments and took exits from a number of of its listed bets in India, holds round 3% in Icertis and desires to double down. Concurrently, it’s investing in Meesho in a brand new funding spherical.

Whereas these are current portfolio corporations, SoftBank’s plan to step up its funding in Icertis is kind of important.

Quantity recreation: Icertis, which gives contract administration companies to enterprise purchasers, in February mentioned it had hit annual recurring income of $250 million. The corporate mentioned on the time that 30% of its purchasers have been Fortune 100 corporations and 70% of its prospects had greater than $1 billion in income.

Additionally learn | SoftBank took dwelling $1.8-1.9 billion from 4 listed portfolio corporations

Different Prime Tales By Our Reporters

Advert-film makers await launch of text-to-video AI fashions | Advertising companies and ad-film makers are eagerly awaiting the discharge of text-to-video fashions similar to OpenAI’s Sora and China’s Vidu AI, which might convey down the price of capturing movie star ad-films from Rs 1 crore to maybe just some lakhs.

Policybazaar guardian stories PAT of Rs 60 crore vs lack of Rs 9.34 crore YoY | On-line insurance coverage aggregator PB Fintech, which operates Policybazaar, on Tuesday reported a web revenue of Rs 60.19 crore for the quarter ended March 31, 2024, as towards a lack of Rs 9.34 crore within the year-ago interval.

Shiprocket eyes extra income streams | Ecommerce logistics startup Shiprocket, which hit $3 billion in gross merchandise worth in 2023-24, is focusing on income from extra companies for on-line sellers similar to advertising, sourcing, funds and lending, mentioned its chief product officer Praful Poddar.

One month of Wipro’s Srinivas Pallia as CEO | Srinivas Pallia, who accomplished one month as CEO of fourth largest software program companies agency Wipro, has been globe-trotting to satisfy workers and stakeholders. Final week, he did a city corridor in London, the place he has been focussed until not too long ago as CEO of Americas 1.

LTIMindtree aspires to develop income to $10 billion: CEO Debashis Chatterjee | LTIMindtree, India’s sixth largest IT companies agency, aspires to greater than double its income from $4.3 billion in 2023-24 by natural development in addition to acquisitions over the following six years, chief govt Debashis Chatterjee mentioned.

International Picks We Are Studying

■ How Google misplaced floor within the AI race (FT)

■ Apple is growing AI chips for knowledge facilities, in search of edge in arms race (WSJ)

■ Amazon’s supply drones gained’t fly in Arizona’s summer time warmth (Wired)