Laying out the federal government’s stance on issues flagged by Indian origin startups over levy of hefty taxes for transferring their domicile again to India, commerce minister Piyush Goyal stated such entities must pay tax for onshoring themselves.

In an interplay with journalists from The Financial Instances on Friday, Goyal stated it could be troublesome to justify a “discrimination” on which corporations coming again to India ought to pay tax and which shouldn’t.

“These corporations went exterior for their very own selfishness…not due to any stress or different motive. They wished to do higher tax planning…they loved that profit. Why they wish to come again will not be an altruistic motive. They wish to record in India as a result of right here’s the place you get the valuations. India’s progress story is unparalleled on the planet and that’s why they wish to come right here,” he stated.

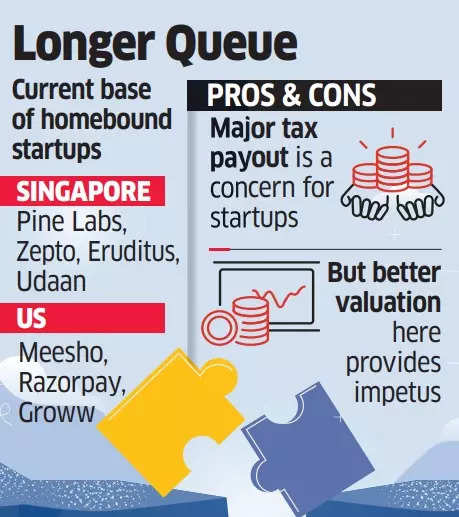

ET has reported earlier that a number of unicorn startups together with Pine Labs, Zepto, Meesho, Razorpay and Eruditus have been planning to maneuver their headquarters again to India from jurisdictions corresponding to Singapore and the US.

“So, in the event that they need to pay tax, it’s good. It’ll assist us give extra scholarships to poor youngsters or construct houses for the poor or substitute the slums with correct housing. We now have numerous plans for this nation and the tax they’re paying is from their earnings on which they initially saved tax,” the minister added.

When these corporations had been being included, entry to vital and well timed home funding was troublesome due to which many of those startups turned to abroad buyers requiring them to ascertain their holding corporations offshore.

“In hindsight, that is changing into a giant difficulty,” stated one founder.

Now, quite a lot of these corporations wish to transfer their base again to India trying to profit from the rising valuations being supplied by home public markets to know-how ventures.

In January final 12 months, US-based retail main Walmart paid almost USD 1 billion in taxes to the Indian authorities throughout separation of PhonePe from mum or dad Flipkart and the return of the fintech firm’s holding entity to India.

Shortly after that, the Financial Survey for 2022-23 laid down suggestions for the Union authorities for tax simplification to speed up the method of reverse-flipping, or shifting domicile from abroad places again to India.

Goyal additionally spoke in regards to the angel tax difficulty affecting startups that the norms round setting of valuations and the relevant tax had been introduced in contemplating “fly by night time corporations” arrange and used for “hawala transactions or creating capital”.

“That was the explanation that taxes had been introduced in…and valuation norms need to be there. There’s an oblique affect on startups…so we should steadiness the 2. If we completely open it up, then the startup difficulty will probably be resolved however the issue of the opposite type will begin once more,” he stated.

“The federal government has intelligently completed that in case you have such a difficulty, there’s a DPIIT committee, you may come earlier than that, register, and so they’ll hear your case…income officers are there (on the committee) and approve it. So, we’ve created that mechanism. It is working,” he added.