Additionally within the letter:

■ Cert-In flags vulnerabilities in Apple iOS

■ Centre Court docket Capital’s Rs 350 crore fund

■ Cell avid gamers trip nippy 5G

Sachin Bansal’s fintech Navi in talks to lift new funding at $2 billion valuation

Flipkart cofounder Sachin Bansal’s fintech enterprise, Navi Applied sciences, is in talks to lift an exterior spherical of funding at a valuation of about $2 billion, sources have advised ET.

Particulars: Bansal has mentioned elevating practically $200-300 million from non-public buyers, however this may increasingly enhance relying on how the talks progress. Folks within the know stated the $2-billion valuation is decrease than that sought in earlier funding discussions Navi had with buyers.

“That’s what he thinks is the proper valuation after the latest divestment of teams like Chaitanya India Fin Credit score,” one of many folks stated.

Background: This comes after Navi had filed for an preliminary public providing (IPO) and secured Sebi’s nod for a similar. Nevertheless, the corporate did not go forward with the deliberate itemizing.

In 2018, Bansal offered his total stake in Flipkart, on the time of its sale to US retail large Walmart. He went on to make use of most of those funds to launch Navi. He owns practically 98% stake within the firm and has by no means raised exterior capital. However this isn’t attributable to a scarcity of making an attempt.

Try to attempt once more: Bansal has beforehand tried to lift exterior capital. Sources stated the entrepreneur was in talks with Temasek and different buyers to lift a pre-IPO spherical, however it didn’t materialise – particularly because the Reserve Financial institution of India (RBI) rejected the corporate’s banking licence software.

Additionally learn | Residence mortgage, insurance coverage enterprise drag Sachin Bansal’s Navi into sluggish lane

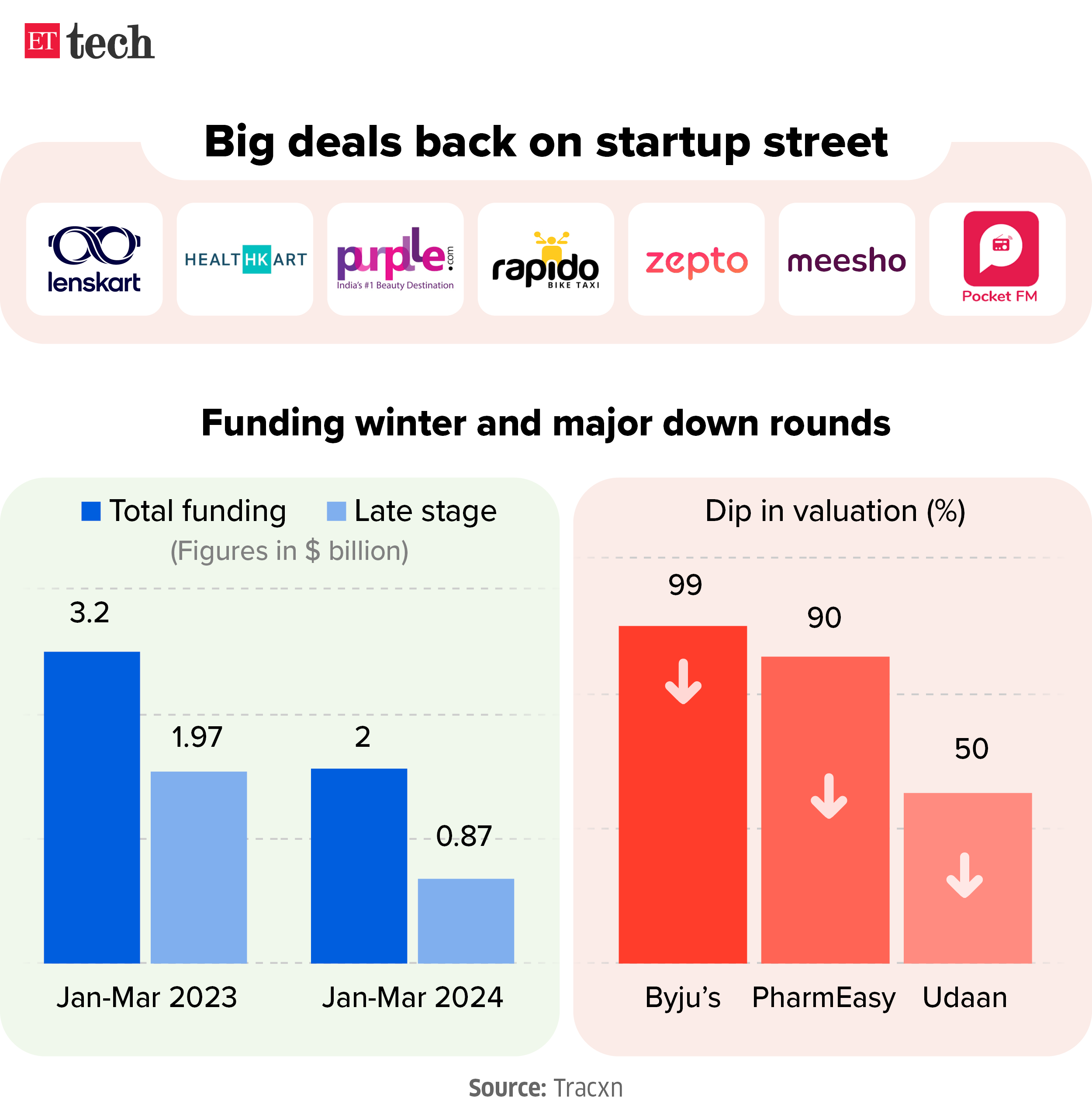

Funding alert: This growth comes on the identical day that ET reported on big-ticket offers in new-economy firms. A number of startups are in talks to lift capital through main and secondary share gross sales.

Byju’s seeks arbitration in dispute with buyers; NCLT adjourns listening to to April 23

Within the ongoing dispute between Byju’s and its buyers, the Nationwide Firm Legislation Tribunal (NCLT) in Bengaluru heard arguments on Thursday and adjourned the case to April 23.

Driving the information: Individually, Byju’s senior counsel on Wednesday filed a plea to switch the matter to arbitration, an settlement clause that will take the case away from the NCLT’s jurisdiction. On this case, a court-appointed arbitrator will take over proceedings on the matter.

Prosus, a number one investor in Byju’s, is spearheading a bunch of buyers searching for to dam the corporate’s $200-million rights concern and take away founder Byju Raveendran as CEO.

Insider particulars: The NCLT decide raised issues throughout Thursday’s proceedings that if Byju’s issued shares to buyers for the rights concern earlier than finalising the authorised share capital enhance, it will be a “blatant violation” of its interim order dated February 27. This stemmed from allegations by the buyers’ lawyer that Byju’s had already achieved so.

Byju’s had assured the NCLT it would not allot shares till the corporate’s share capital enhance was accomplished as per the Corporations Act of 2013.

What else? The tribunal directed the investor counsel to file a contemporary affidavit in writing to tell of the allegations, and in addition for Byju’s senior counsel to comply with it up with its objections on the identical.

Recap: On March 28, the NCLT had refused to grant a keep on investor pleas searching for to cease Byju’s extraordinary common assembly (EGM) to extend the authorised share capital. The ultimate results of the EGM decision is predicted to be filed on April 6.

Byju’s had advised shareholders on March 29 that it had secured over 50% votes to extend the share capital in an e mail, which was reviewed by ET.

Additionally learn | Byju’s lays off about 500 staffers, practically half from tuition centre enterprise

Cert-In flags vulnerabilities in Apple iOS, warns about units being compromised

Apple’s working system for iPhone and iPad, significantly its flagship choices such because the Safari internet browser, have been flagged by the Indian Laptop Emergency Response Staff (Cert-In) for a number of vulnerabilities that may even compromise units working remotely.

What is the information? In a vulnerability warning issued on Tuesday, Cert-In has stated the issues in Safari internet browser variations earlier than model 17.4.1, iOS and iPadOS variations earlier than model 17.4.1 may enable attackers to “execute arbitrary code” on focused units.

Warning indicators: “A distant attacker may exploit this vulnerability by persuading a sufferer to go to a specifically crafted request. Profitable exploitation of this vulnerability may enable an attacker to execute arbitrary code on the focused system,” Cert-In stated in its warning.

Android, too, in danger: On Wednesday, Cert-In additionally issued vulnerability warnings for cellular units utilizing the Android working system. In its warning, the federal government’s nodal company for cybersecurity stated that flaws within the framework, system, MediaTek parts, and Qualcomm parts may very well be exploited by attackers to acquire delicate data and trigger denial of service on the focused machine.

Not the primary time: In March, Cert-In stated working software program for iPhone 8, iPhone 8 plus, iPhone X, iPhone XS, iPad fifth era, and different units had been susceptible to assaults that might set off denial of service circumstances.

Sports activities-focussed Centre Court docket Capital launches maiden Rs 350-crore fund

Mustafa Ghouse, common accomplice at Centre Court docket Capital

Centre Court docket Capital, a gaming and sports-focussed enterprise agency, has launched its maiden Rs 350 crore fund. The agency stated it has obtained Rs 200 crore in commitments from its restricted companions (LPs), with the household belief of JSW Metal managing director Sajjan Jindal performing because the anchor investor.

Quote, unquote: “The Jindal household may be very bullish concerning the gaming and sports activities sectors in India, and anchoring this fund is an extension of that perception… nevertheless these investments gained’t have any direct relation to JSW Sports activities (sic),” stated Mustafa Ghouse, common accomplice at Centre Court docket Capital.

Inform me extra: Different LPs embrace the Small Industries Improvement Financial institution of India (SIDBI), PremjiInvest, USK Capital, GMR Sports activities, and SG Sports activities.

The fund has a ten-year maturity interval and can spend money on gaming and sports-adjacent corporations, seeking to take up shareholding within the mid-teens alongside different rights and board seats. Centre Court docket Capital goals to lift your complete fund by the top of 2024.

Funding mantra: The fund will spend money on pre-series A and collection A corporations in ticket sizes of $1-3 million, making a complete of 15 to 18 investments. Half of those funds can be reserved for follow-on investments. “This sector remains to be nascent, so we would require extra fluidity in the case of investments… we may even contemplate pre-revenue corporations,” Ghouse added.

Additionally learn | VCs in reset mode amid exit stress

No noobs right here! Cell avid gamers trip nippy 5G

India’s fast-paced rollout of high-speed cellular broadband providers by way of 5G has introduced in a surge of cellular avid gamers, in what’s already the world’s second-largest gaming market. Excessive-end AAA titles like BGMI, Name of Responsibility: Cell, and others are seeing enormous demand.

Knowledge decoded: As per a report from Ookla, sport latency that impacts a gamer’s response time, improved from 109 ms (millisecond) on 4G to 77 ms on 5G for Reliance Jio customers in 2023, whereas Airtel customers reported a 15% enchancment, from 108 ms to 92 ms.

In line with knowledge.ai, an app analytics platform, Singapore-based Garena’s Free Hearth and Korea-based Krafton’s Battlegrounds Cell India (BGMI) had been the highest video games by way of whole time spent on them in India.

Jargon buster: Recreation latency, or the time taken for knowledge to journey from the machine to the sport’s servers, is a vital metric to measure responsiveness in on-line gaming, particularly in high-octane motion video games the place each second counts.

Additionally learn | Small-town edge: How 5G is driving demand for knowledge centres past huge cities

Right now’s ETtech High 5 publication was curated by Gaurab Dasgupta in New Delhi and Vaibhavi Khanwalkar in Bengaluru.