Additionally on this letter:

■ ET Explainer: What’s VASA-1?

■ Razorpay’s foray in UPI infrastructure

■ Mamaearth shares rally 8%

Workplace-sharing startup Awfis will get Sebi nod for IPO

Workplace-sharing startup Awfis House Options has acquired Securities and Trade Board of India’s clearance for an preliminary public providing (IPO).

IPO particulars: The Delhi-based firm had filed its draft IPO papers in December, proposing to boost Rs 160 crore by way of a problem of recent shares, together with a sale of 10 million shares by its present shareholders.

The corporate plans to utilise the online proceeds from the recent problem of shares for growth and establishing new centres, working capital necessities and common company functions.

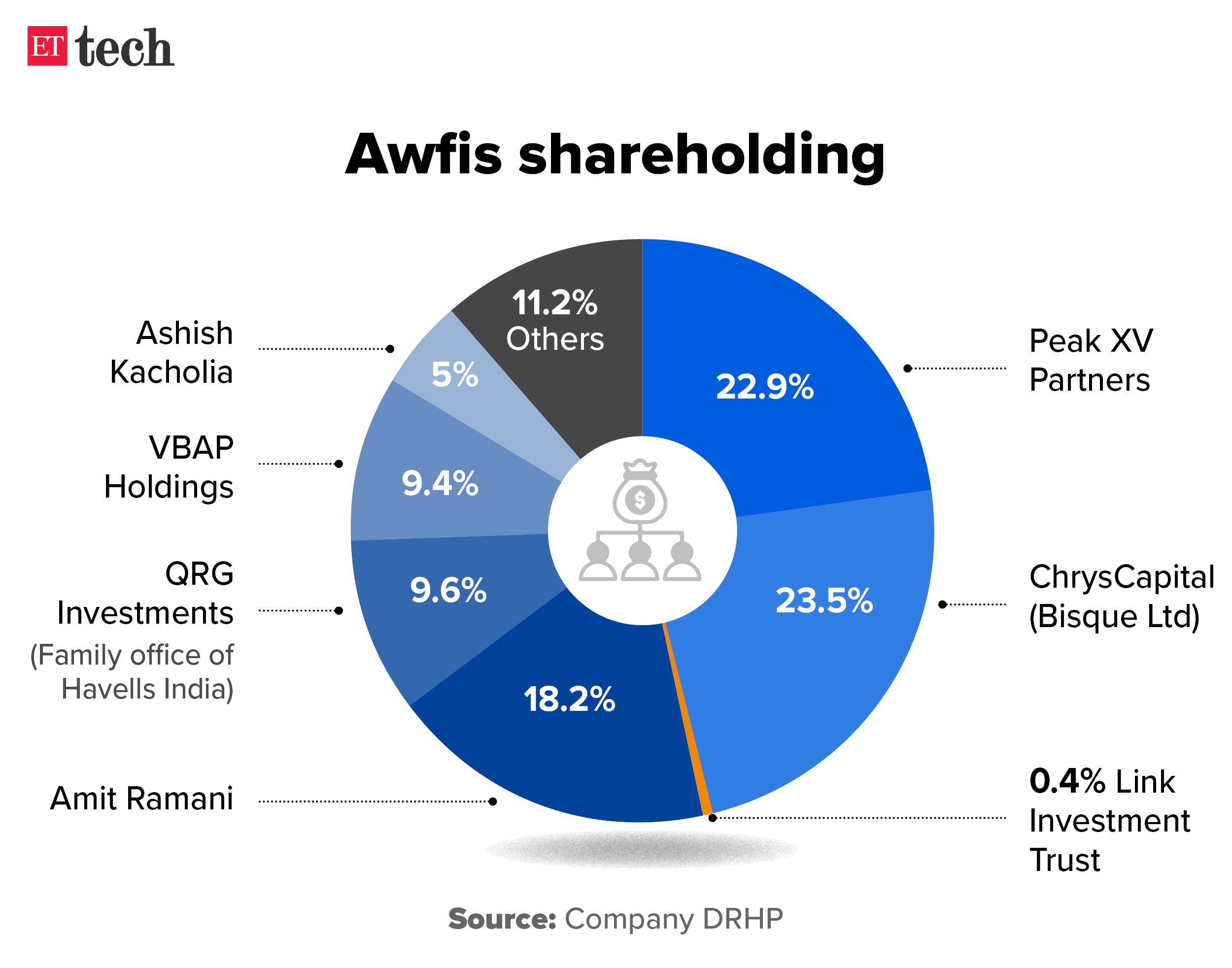

Who’s promoting: Peak XV Companions plans to promote about 5 million shares in Awfis by way of the proposed IPO. Bisque Ltd, a unit of personal fairness agency ChrysCapital, can also be seeking to promote practically as many shares, whereas actual property funding belief Hyperlink Funding Belief is in search of to promote over 75,000 shares.

In its final fundraising spherical in 2022, Awfis was valued at round $110 million (Rs 917 crore at present change charges).

FY23 numbers: Within the fiscal yr ended March 31, 2023, Awfis’ working income greater than doubled to Rs 545 crore from Rs 257 crore in FY22, as per its draft crimson herring prospectus. For the primary quarter of fiscal 2024, Awfis reported working income of Rs 188 crore.

Upcoming IPOs: A number of new-age corporations, together with SoftBank-backed Unicommerce, electrical automobile maker Ola Electrical, omnichannel retailer FirstCry, and fintech agency Mobikwik have filed draft IPO papers with Sebi. Bengaluru-based meals and grocery-delivery agency Swiggy can also be planning to file quickly for a $1 billion IPO.

Additionally learn | WeWork to promote 27% stake in India unit through Rs 1,200 crore secondary deal

Investor group accuses Byju’s of violating NCLT order

Byju Raveendran, founder, Byju’s

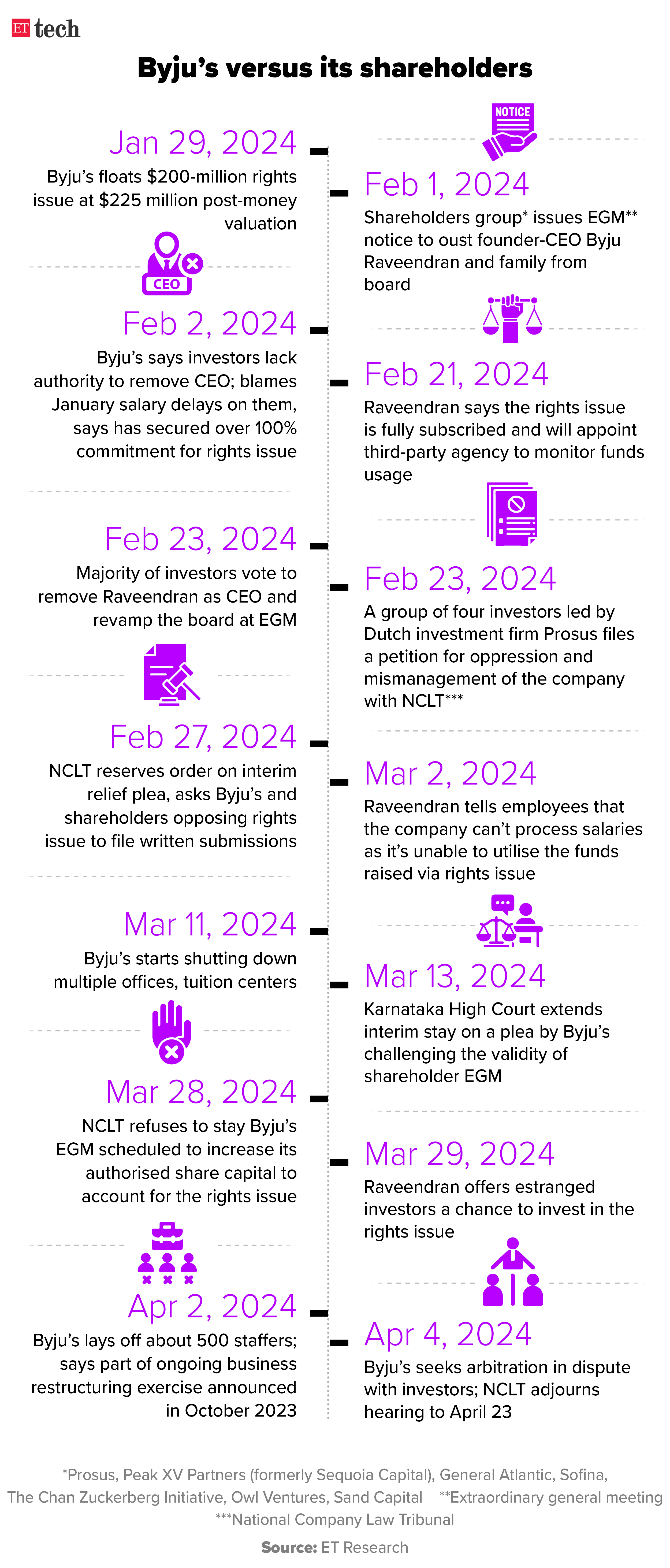

The Nationwide Firm Legislation Tribunal (NCLT), Bengaluru, on Tuesday heard the most recent arguments within the Byju’s versus traders saga and adjourned the matter for listening to on June 6.

What occurred at this time? The arguments started with a senior counsel on the traders’ aspect alleging a violation on the a part of Byju’s with respect to an NCLT order dated February 27, which prevented the Bengaluru-based agency from allotting shares to traders as a part of the disputed rights problem with out procedurally rising authorised share capital.

The tribunal had additionally directed Byju’s to maintain the proceeds from the $200 million rights problem in a separate escrow account. However Byju’s didn’t do that, and as an alternative used the funds, the traders’ counsel alleged.

Byju’s stance: Byju’s counsel contended that its actions had been carried out in accordance with the legislation and didn’t violate the order as per its interpretation of the identical.

A gaggle of Byju’s traders led by Dutch investor Prosus is in search of to dam a $200 million rights problem and the removing of founder Byju Raveendran as CEO of the edtech agency.

Zoom out: Byju’s, going through a extreme money crunch, paid solely part of March salaries to its workers, as of April 20, in one more delay of those payouts. Earlier within the month, the startup laid off about 500 staffers, largely throughout gross sales and advertising features.

Additionally learn | Byju’s seeks arbitration in dispute with traders; NCLT adjourns listening to to April 23

ET Explainer: What’s VASA-1, Microsoft’s new ‘speaking face’ generator?

Know-how main Microsoft final week launched a brand new image-to-video mannequin known as VASA-1 that it developed as a analysis undertaking. Right here’s a breakdown on what it’s all about:

What does the VASA-1 do? Microsoft described VASA-1 as an AI mannequin that produces ‘lifelike audio-driven speaking faces in actual time’. ‘VAS’ stands for visible affective ability.

The AI mannequin solely wants a portrait picture and a speech audio observe. The output is ‘hyper-realistic’ and might seize a wide range of expressive facial nuances, it stated, with exact lip sync and pure head motions.

For example, Microsoft offered a clip of Da Vinci’s Mona Lisa portrait singing a rap track.

Comparability with friends: Comparable lip sync and head motion expertise is offered from AI firm Runway, Nvidia’s Audio2Face AI utility, Google’s Vlogger AI launched in March, and Emo AI by China’s Alibaba. “It (VASA-1) actually beats the whole lot else palms down,” stated Pawan Prabhat, cofounder, Shorthills AI.

Deepfake issues: As with all video-generating AI mannequin, observers flagged that VASA-1 makes it simpler to create deepfakes and that there’s potential for misuse. “The factor we are able to hope for is that corporations, particularly Huge Tech, put in the best guardrails and security mechanisms earlier than common availability,” stated Jaspreet Bindra, founder, Tech Whisperer UK, a digital transformation and AI consulting agency.

Razorpay forays into constructing UPI infrastructure, unveils ‘UPI Swap’

Razorpay cofounders Harshil Mathur (left) and Shashank Kumar

Digital funds platform Razorpay on Tuesday launched its personal Unified Funds Interface (UPI) infrastructure, or UPI Swap, in partnership with Airtel Funds Financial institution.

What does it do? The UPI Swap is designed to deal with as much as 10,000 transactions per second, at any given time, and allow 5 instances quicker entry to UPI improvements for companies. The corporate claimed that it resolves disputes seven instances quicker — inside 24 hours towards the business common of seven days — in addition to processes refunds immediately in contrast with the usual of as much as three days.

Inform me extra: The efficacy of UPI transactions depends closely on the UPI infrastructure deployed by banks. These banks join with the prevailing UPI infrastructure to facilitate seamless communication between the core banking techniques and UPI expertise throughout UPI transactions.

Razorpay stated it had recognized shortcomings within the present infrastructure, akin to an absence of customisation options for companies, leading to scalability points, technical declines and downtimes that damage buyer expertise.

UPI momentum: In March, UPI transactions in India witnessed substantial progress, surging 55% in quantity to 13.44 billion and over 40% in worth to Rs 19.78 lakh crore in contrast with a yr earlier.

Additionally learn | Razorpay sees surge in credit score card-linked UPI funds: report

Honasa shares rally as The Derma Co hits Rs 500-crore income run fee

Honasa Client’s cofounder and CEO Varun Alagh

Shares of Mamaearth guardian Honasa Client rallied as much as 7.6% to Rs 435 after the corporate introduced that its skincare model, The Derma Co, has achieved an annual income run fee of Rs 500 crore.

Buyers cheer: Shares of Honasa have given 15.68% returns to traders within the final month, whereas the inventory rallied 14% final week. The inventory ended at Rs 338 on the BSE, up 8.51% from the day past’s shut.

Energetic ingredients-backed skincare model The Derma Co achieved an annual income run fee of Rs 500 crore, pushed by the creation of manufacturers providing specialised merchandise tailor-made for Indian pores and skin and climate situations, Honasa stated on Monday. The corporate stated it offered greater than 10 million models underneath the model within the final fiscal yr.

Q3 recap: The corporate reported 265% progress in its consolidated internet revenue to Rs 26 crore for the quarter ended December, from Rs 7.1 crore a yr earlier. Income from operations within the third quarter rose 28% year-on-year to Rs 488 crore.

At the moment’s ETtech High 5 publication was curated by Megha Mishra and Ajay Rag in Mumbai.