Additionally on this letter:

■ NCLT refuses to remain Byju’s Friday EGM

■ Honasa Client launches Gen Z model ‘Staze’

■ Inside Karnataka’s GCC coverage

Unique: I-T points discover to new-age corporations over current VC funding

Over the previous few weeks, plenty of startups have been served revenue tax notices over funding that they raised. These notices and subsequent tax calls for have principally been despatched to fintech corporations, a number of folks aware of the matter stated.

Driving the information: Earlier this week, the founding father of a fintech startup obtained a discover requiring him to furnish the steadiness sheet of buyers who invested capital into his firm within the monetary yr 2023. “We submitted all of those paperwork together with the Everlasting Account Quantity playing cards (of the buyers) however have nonetheless been served with a tax demand,” he stated.

The fintech startup, registered with the Division for Promotion of Business and Inner Commerce (DPIIT), has been requested to pay Rs 37 crore in direction of tax, and a penalty on the Rs 40 crore raised from enterprise capital buyers.

Underneath scanner:

- Plenty of startups underneath scrutiny

- Queries raised on fund infusion

- Sec 68 of I-T Act mandates searching for clarification on funding supply

- Startups say that is resulting in pointless harassment

- I-T dept says instances closed if clarification discovered passable

- Startups registered with DPIIT additionally served tax notices. Usually, these don’t face such scrutiny

Know the foundations: Underneath Part 68 of the Earnings Tax Act, if an organization is unable to satisfactorily clarify the character and supply of its funding, authorities are permitted to tax the capital raised together with revenue earned by the startup within the related yr.

Equally, such tax calls for are closed if the corporate gives a passable clarification and furnishes the requisite documentation.

Zoom in: Some corporations dealing with tax calls for declare they’ve furnished related shareholder agreements for evaluation. Furthermore, if an affected startup decides to enchantment in opposition to the tax calls for, it has to first deposit 20% of the general tax demand with the federal government.

“It will eat into our money reserves and can harm our working capital necessities,” stated a startup founder, talking on the situation of anonymity.

Processing costs a drag on fast-growing Indian funds startups

Lack of direct income era and the excessive price of operations have gotten a drag on the steadiness sheets of digital funds startups, regardless of rising enterprise volumes as a result of wide-scale adoption of digital funds.

Driving the information: The difficulty has solely grow to be worse as a consequence of zero MDR (service provider low cost price) paid to fee service suppliers on Unified Funds Interface (UPI). “This can be a main price for funds corporations, so irrespective of how a lot you develop by way of whole fee quantity, your bills shoot up accordingly, which impacts profitability,” stated a high govt at a funds firm.

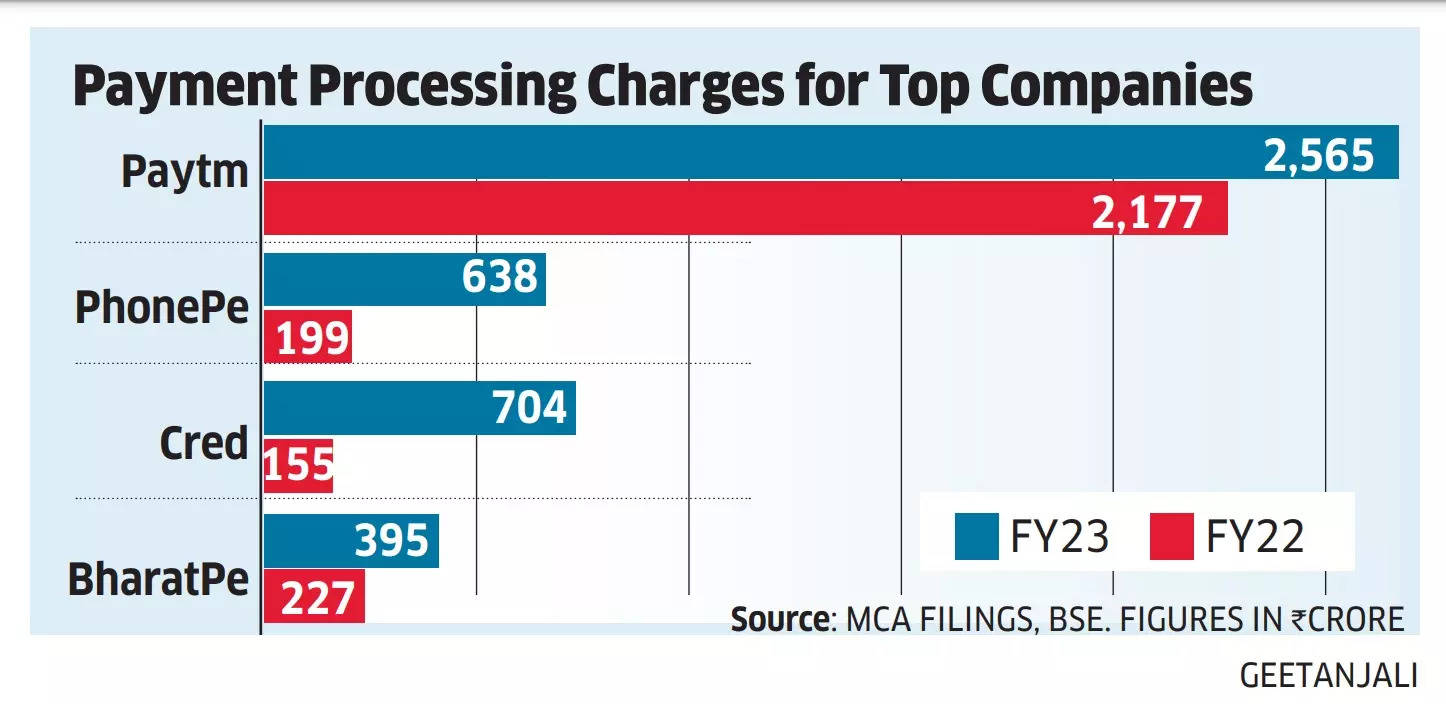

Inform me extra: Whereas PhonePe’s general transaction volumes skyrocketed in recent times, its fee processing costs spiked too. In FY23, PhonePe spent Rs 638 crore in processing expenditure, up thrice from Rs 199 crore a yr in the past.

For BharatPe, the transaction processing costs for FY23 stood at Rs 395 crore, up 74% from Rs 227 crore a yr earlier, financials sourced from Tofler present.

Paytm reported processing costs of Rs 2,565 crore until December of fiscal 2024, up nearly 18% from Rs 2,177 crore a yr in the past.

Additionally learn | Fintech is making world funds its enterprise

NCLT refuses to remain Byju’s Friday EGM for $200-million rights subject

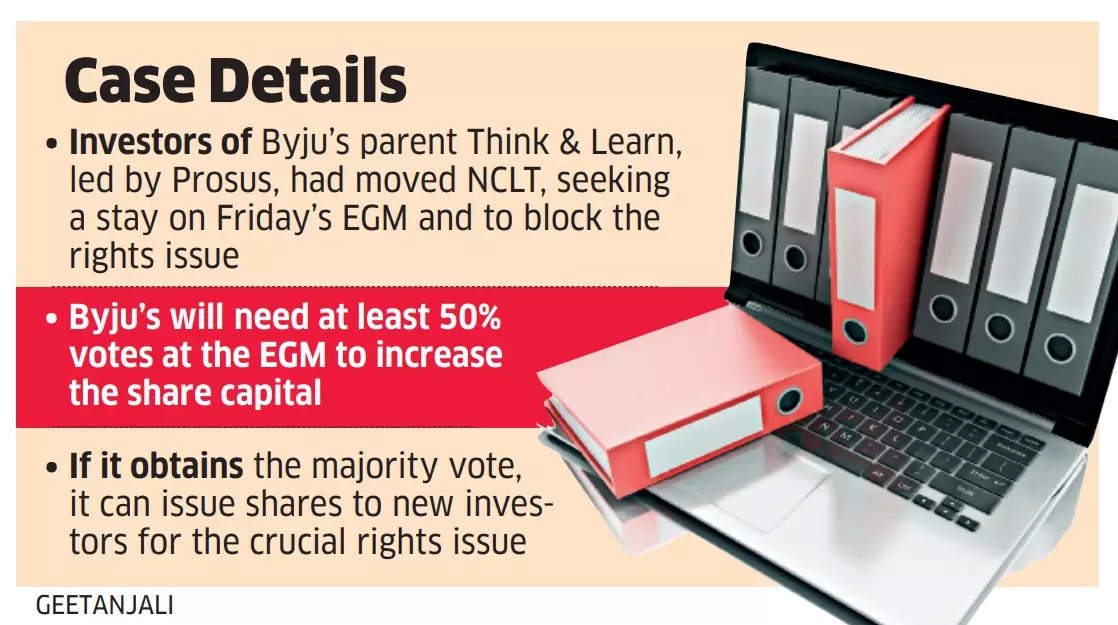

The Nationwide Firm Regulation Tribunal (NCLT), Bengaluru, on Thursday refused to remain the extraordinary normal assembly (EGM) known as by Byju’s on Friday to extend the authorised share capital to account for its $200-million rights subject. The corporate wants new capital desperately to handle each day operations and clear pending dues.

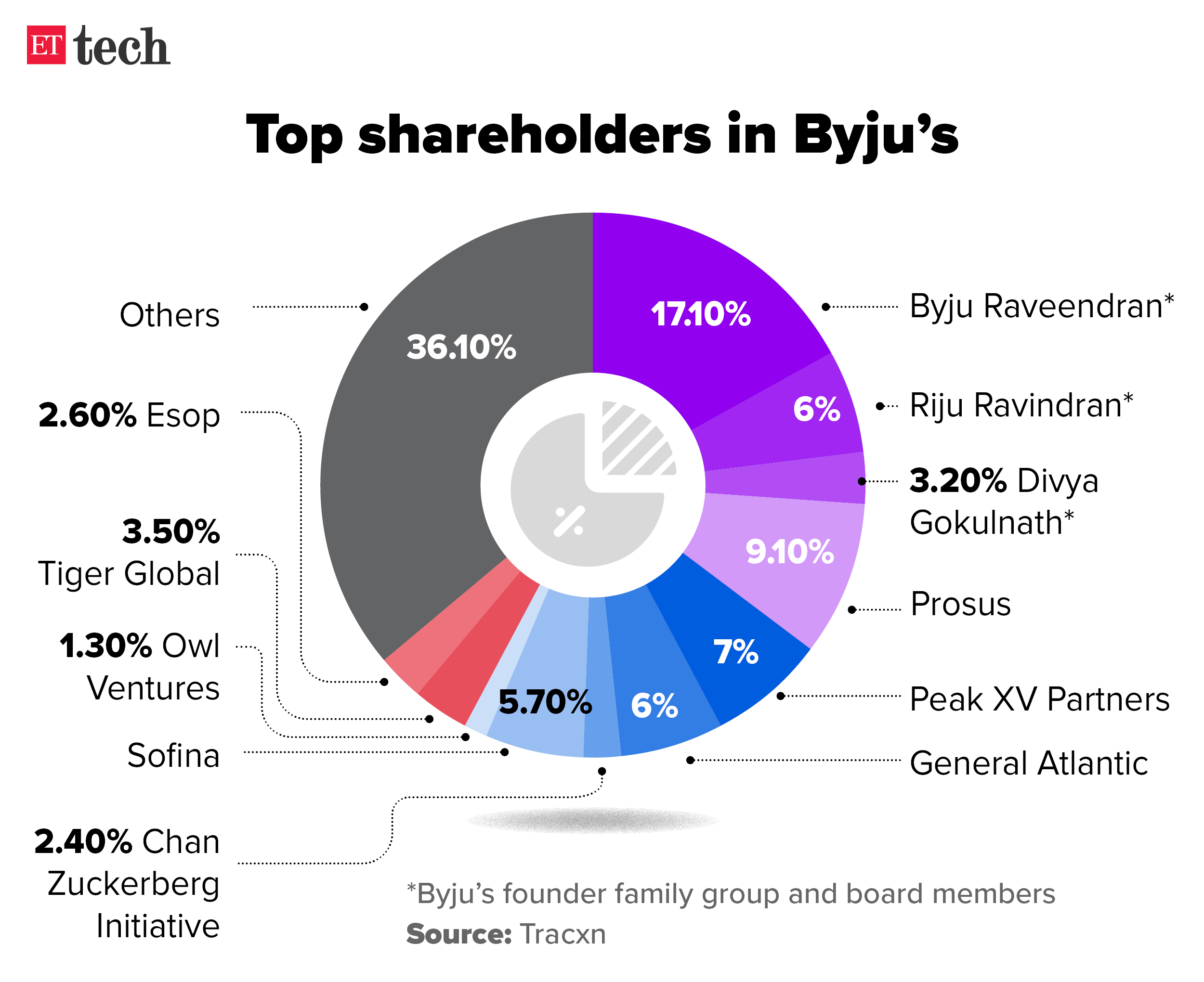

Decoding the difficulty: 4 buyers — led by Prosus — moved the NCLT, searching for a keep on the deliberate EGM to successfully block the rights subject. The matter will now be heard on April 4.

The tribunal additionally directed Byju’s to share its captable registry sought by buyers, which the corporate stated can be made out there instantly.

What occurs now? Byju’s will want no less than 50% votes on the EGM to extend its share capital. If it obtains the bulk vote, it might subject shares to new buyers for the essential rights subject.

That is of significance as legal professionals showing for the buyers stated that when new shares are issued, it can’t be reversed and thus pleaded for a keep on the EGM.

Excessive courtroom replace: In the meantime, the Karnataka Excessive Court docket prolonged the interim keep on the outcomes of a February EGM known as by buyers who demanded the ouster of CEO Byju Raveendran and a change of board at guardian agency Suppose & Be taught. The courtroom will now hear this matter after two months. Raveendran had advised workers in February that he stays the CEO and there are not any adjustments within the composition of the board.

Additionally Learn | Unique: Chaudhry unlikely to return to steer Byju’s-owned Aakash Institute

Honasa Client targets Gen Z with color cosmetics model Staze

Honasa Client’s cofounder and CEO Varun AlaghHonasa Client, the guardian firm of magnificence and private care (BPC) model Mamaearth, has entered the color cosmetics house with a brand new model ‘Staze’, focused at 18 to 24-year-olds.

Particulars: Staze is the seventh model in Honasa Client’s portfolio after Mamaearth (its largest), The Derma Co, Aqualogica, Ayuga, Dr Sheth’s and Bblunt.

The corporate will promote merchandise equivalent to lipsticks, kajal pens, foundations, compacts and eyeliners underneath the brand new model. Staze has eight classes with 40 stock-keeping items (SKUs).

Founder converse: Honasa Client cofounder and CEO Varun Alagh advised ET that the brand new model will compete with the likes of L’oreal-owned cosmetics model Maybelline and Hindustan Unilever’s Lakme on worth factors. Staze may have a mean unit worth of Rs 300-350, much like Maybelline and Lakme, he stated.

Different Prime Tales By Our Reporters

Karnataka GCC coverage: business suggests funding in tier-II cities: As Karnataka readies a coverage to spice up International Functionality Centres (GCC), the primary draft of which is anticipated in June, high executives advised us that the coverage ought to embody funding within the progress of infrastructure in tier 2 cities by initiatives like Past Bengaluru.

SAP sees 10-15% income progress from GenAI: SAP, Europe’s largest expertise firm by market capitalisation, goals to quadruple generative synthetic intelligence (AI) use instances by yr finish, its chief AI officer Philipp Herzig advised us. He added that the potential income enhance is probably going “within the ballpark of 10-15% due to our code era capabilities. I feel that is a quantity that we see.”

BillDesk reviews slight progress in income, fall in revenue in FY23: Funds main BillDesk has reported a slight enhance in operational income to Rs 2,678 crore for FY23, from Rs 2,442 crore a yr earlier. Nonetheless, the corporate’s internet revenue dropped to Rs 141.9 crore for the second consecutive yr from Rs 149.6 crore a yr in the past and Rs 245 crore in FY21.

International Picks We Are Studying

■ Meet the designer behind Neuralink’s surgical robotic (Wired)

■ OpenAI’s app retailer attracts buyers and college students searching for synthetic aids (FT)

■ AI is transferring sooner than makes an attempt to control it. Right here’s how corporations are coping (WSJ)