Additionally on this letter:

■ Instamart’s loss is Zepto’s achieve

■ Digiyatra transitioning to new app

■ Nazara consortium bids for Smaaash

Apple bonanza: iPhones drive India’s cell phone exports to report $15 billion

Apple iPhones powered an over 35% surge in India’s cell phone exports to a report $15 billion-plus in FY24, in line with authorities information seen solely by ET. Exports stood at $11.1 billion a yr in the past.

By the numbers: Apple contributed 65%, or about $10 billion, double the $5 billion of telephone exports from India in FY23 when the US main grew to become the primary smartphone model to attain this feat.

General, electronics exports jumped practically 24% to $29.12 billion in FY24, from $23.55 billion within the earlier yr, provisional information launched by the commerce ministry confirmed. Merchandise exports, nonetheless, noticed a 3.11% drop in FY24.

Native worth add: “We’ve had nice success in cell phone manufacturing,” electronics and IT minister Ashwini Vaishnaw advised us, including that “native worth addition has elevated, as parts are being manufactured in India.”

We reported on April 16 that Apple is in talks with Murugappa Group and Titan to assemble — and, presumably, manufacture — sub-components for iPhone digicam modules.

Employment enhance: India’s creating cell electronics manufacturing ecosystem has helped create greater than 1.2 million jobs, whereas producing items price $50 billion, in FY24, the info confirmed.

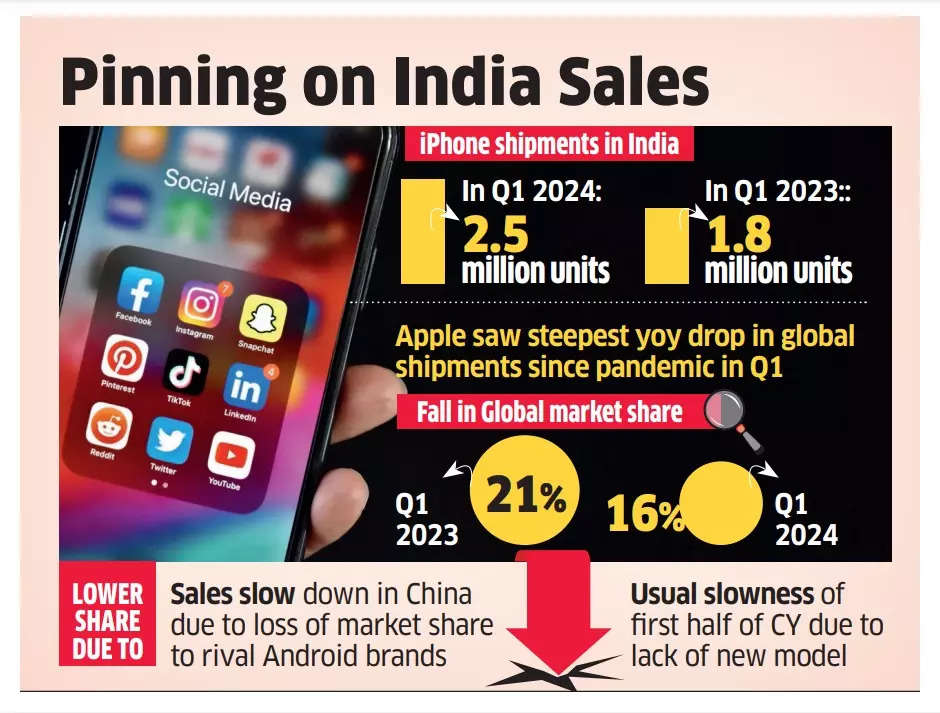

iPhone shipments up 40%: India proved to be a shiny spot for Apple within the March quarter with a virtually 40% surge in shipments, defying the worldwide development of a virtually 10% decline triggered by losses in China and different mature markets.

iPhone shipments in India, the world’s second-largest smartphone market, rose to 2.5 million models within the March quarter from 1.8 million models a yr earlier, in line with trade estimates.

International gross sales stoop: International iPhone shipments fell 9.6% in Q1 2024, an IDC report confirmed. This marked the steepest year-on-year drop because the pandemic, in line with market trackers, with Korea’s Samsung pipping the US model to the highest spot as soon as once more, after shedding it to Apple on the finish of 2023. Samsung shipped 60.1 million models within the quarter, whereas Apple got here in second with 50.1 million models.

International functionality centres unfold internet wider to catch expertise

As world functionality centres (GCCs) stand up the worth chain in India, they’ve stepped up hiring expertise from IT product corporations, Large 4 consultancies, startups and enormous conglomerates.

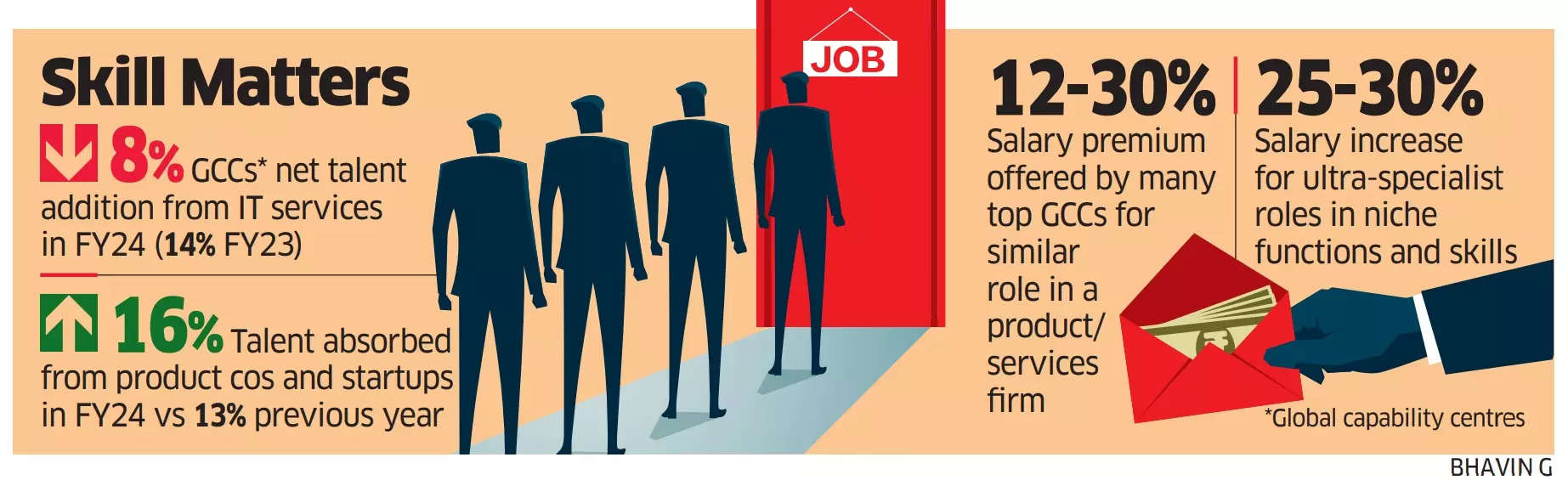

Inform me extra: In line with consultants, with the main target shifting from price arbitrage to expertise arbitrage, the demand is for platform and product engineers and leaders on the forefront of innovation. Historically, GCCs in India attracted a majority of staff from know-how providers corporations.

Most of the main GCCs are open to providing premiums within the vary of 12-30% over packages for related roles in a product or providers agency.

Additionally learn | GCCs in India seeking to strengthen digital capabilities: report

Information decoded: In FY24, GCCs crammed 18% of their positions by hiring from IT providers companies, down from 32% a yr in the past, in line with a examine carried out solely for ET by staffing firm Xpheno. Internet expertise addition from IT providers decreased to eight% from 14%. However, 16% (13% earlier yr) of latest staff had been employed from IT product corporations and startups.

A few of the corporations that captives have absorbed expertise from embody Zoho, Cisco, SAP, Adobe, VMWare, Microsoft, Oracle, Flipkart, Meta, Razorpay, Tally, Zerodha and Zomato, in line with information.

Knowledgeable take: “Many of the prime GCCs in India have began pondering and functioning like a product firm and therefore there’s a want for seasoned professionals who’ve product innovation expertise. In consequence, folks from product corporations, startups and enormous Indian conglomerates are a lot in demand,” mentioned Rajesh Ojha, companion and GIC/GCC market phase chief at PwC India.

Additionally learn | The rise of the GCC ecosystem in India

Zepto improves quick-commerce market share; Instamart loses floor: HSBC report

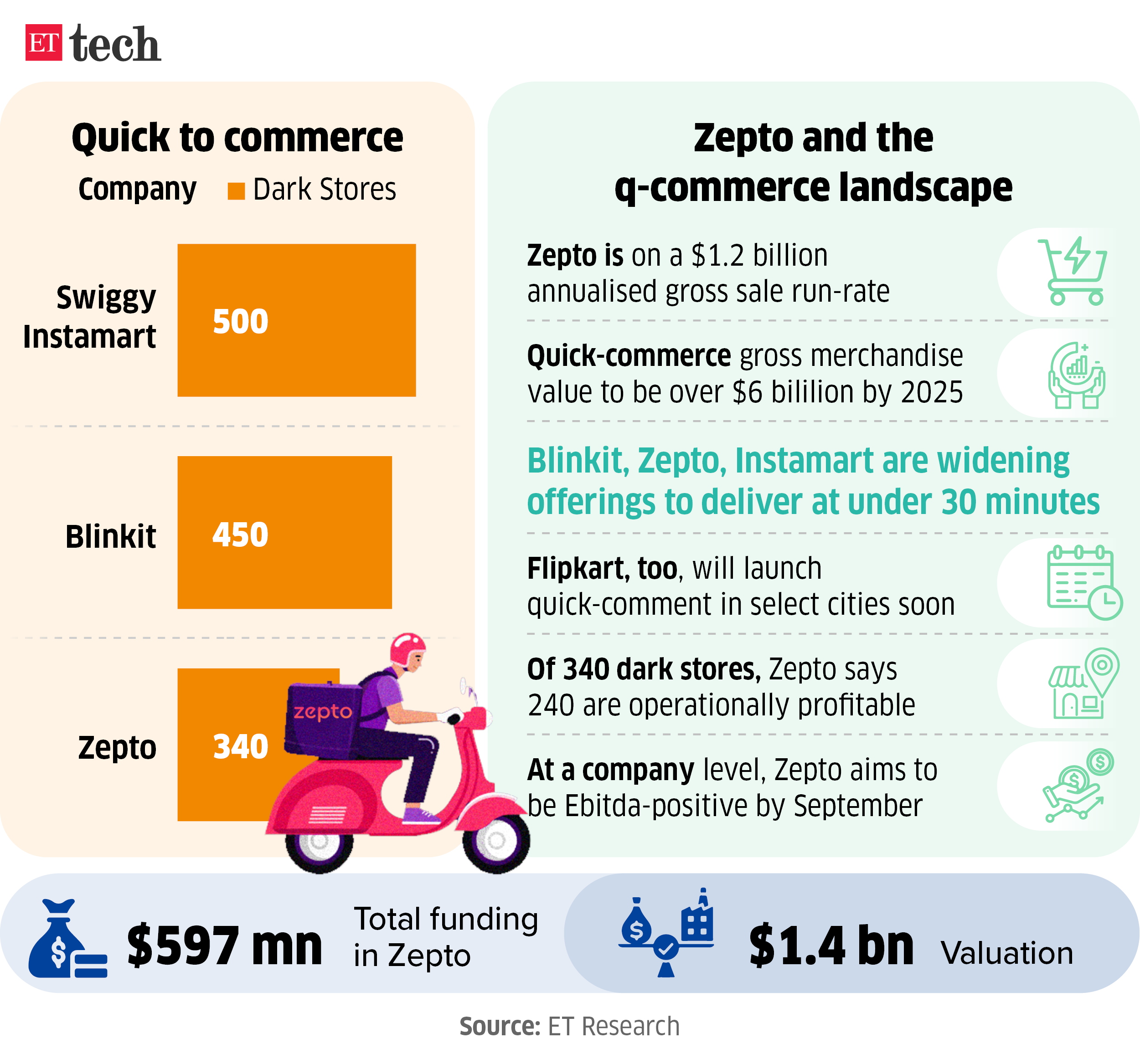

With the quick-commerce battle heating up, Zepto has elevated its market share at the price of Swiggy Instamart over the previous two years, as per a report from HSBC International Analysis.

The numbers recreation: The examine, undertaken in collaboration with Zepto, estimates that the agency’s market share rose from 15% in March 2022 to twenty-eight% in January 2024, whereas that of Instamart fell from 52% to 32% throughout that interval.

In the identical length, Zomato-owned Blinkit’s market share rose from 32% to 40%.

Blinkit in shiny spot: The report mentioned market chief Blinkit has clocked about $2 billion in gross merchandise worth (GMV) phrases, and is ready to double that in 2024. Its margin at an Ebitda degree is at -2% and is anticipated to enhance to 4-5% by FY27.

HSBC additionally raised the goal value of Zomato’s shares to Rs 215 and rated it a ‘purchase’ within the report dated April 9. The inventory closed at Rs 186.75 on Wednesday.

Additionally learn | On ‘fast’ path to profitability: Challenges for fast commerce corporations

Advert recreation: Promoting earnings can be essential to profitability for quick-commerce platforms, the report mentioned. “We predict promoting take charges (phrases of the commerce) are practically 6-8% within the case of grocery in contrast with 1-2% for electronics, which is a giant relative benefit for QC platforms vs different ecommerce platforms,” it added.

Additionally learn | Blinkit’s income from advertisements sees over threefold surge in Q3

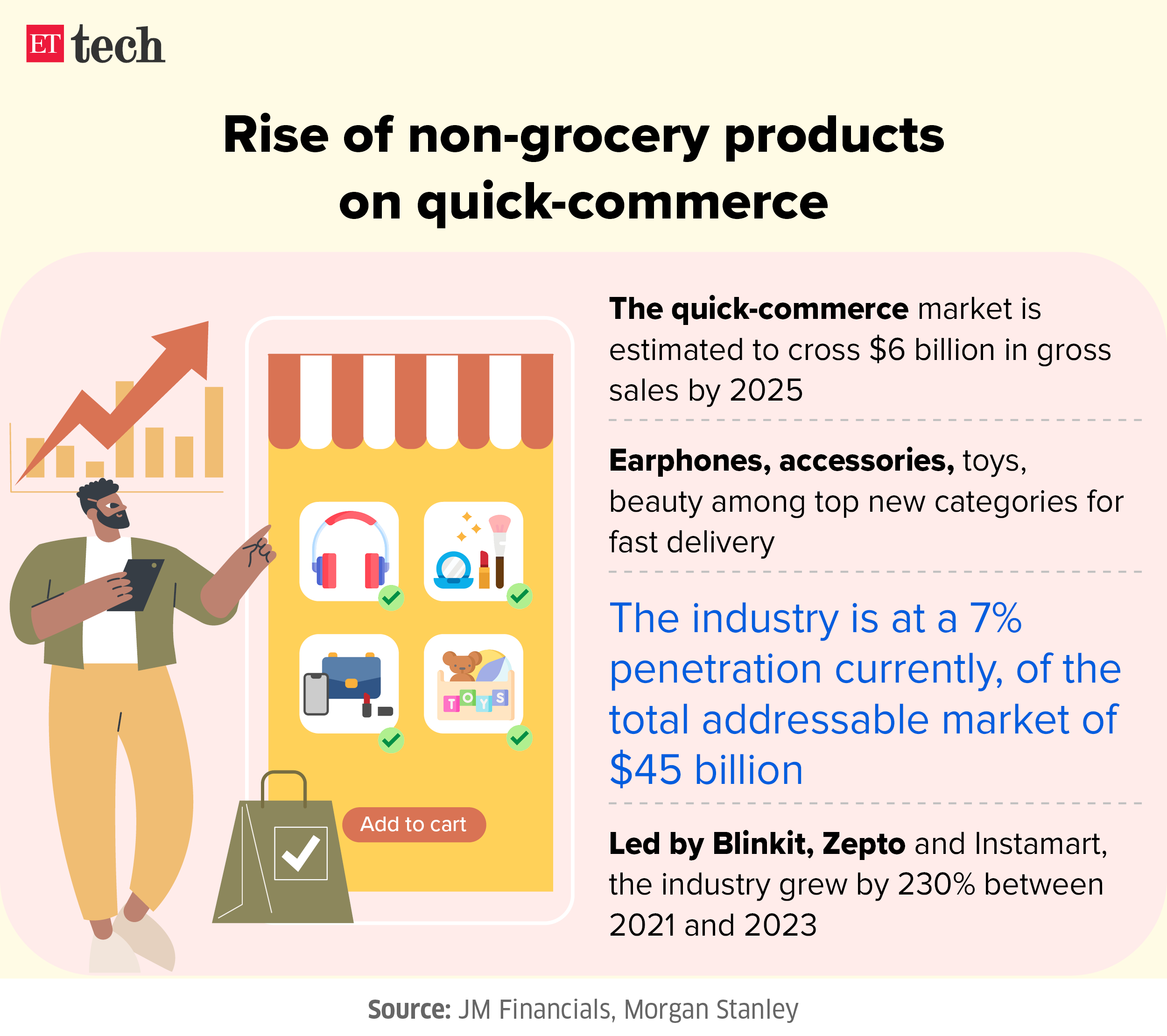

Fast recap: The report comes at a time when main quick-commerce platforms are increasing their choices and seeing strong gross sales development in non-grocery classes like magnificence, toys, well being and electronics.

Round 15% of Zepto’s $1.2-billion annualised product sales presently comes from non-grocery merchandise, mentioned a Goldman Sachs report.

Additionally learn | Fast-commerce turns into the villain for neighbourhood kirana shops

Digiyatra transitioning to new app to cater to growing consumer base

Digiyatra, the government-promoted app which goals to offer paperless check-in at airports via facial recognition, has been hit by an argument as one in every of its distributors, Dataevolve Options, has been accused by the Andhra Pradesh police of defrauding them of visitors e-challan funds.

Controversy strikes: Final yr, the Enforcement Directorate arrested Komireddi Avinash, CEO of the Hyderabad-based firm, for siphoning off funds by cloning cost gateways of visitors e-challan accounts. Dataevolve Options has constructed the Digiyatra Central EcoSystem – a platform that shares journey particulars with airports, which might then confirm them.

CEO speaks: Suresh Khadakbhavi, CEO of Digiyatra Basis, mentioned each infrastructure of the Digiyatra app is owned by Digiyatra Basis and there’s no likelihood that any information resides with Dataevolve.

Transition to a brand new app: Digiyatra is now transitioning to a brand new app, getting ready for worldwide journeys, and also will supply different providers like lodge check-in. Khadakbhavi mentioned that parting with Dataevolve will not be the rationale for the transition; quite, the growing consumer base of the app necessitated the transfer.

Nazara Tech, Resurgent consortium bidders for Smaaash

Gaming agency Nazara Applied sciences and a consortium led by monetary providers agency Resurgent India and Sanjay Lodha have positioned formal bids to purchase Sachin Tendulkar-backed sports activities leisure firm Smaaash Leisure Pvt. Ltd (SEPL). Each paid the Rs 5 crore earnest cash deposit (EMD) qualifying as bidders to amass the bankrupt agency.

Debt particulars: Smaaash owes collectors led by Edelweiss ARC about Rs 452 crore. Different lenders to the corporate are Sure Financial institution, Sidbi and Mabella Funding Advisors. It was admitted to chapter in Might 2022. Decision skilled (RP) Bhrugesh Amin has listed gaming machines, go-karts, bowling alleys and different leisure gadgets unfold throughout 13 centres as belongings.

Decision challenges: That is the third decision course of for SEPL after the earlier two rounds had been scrapped as a consequence of litigation and different problems. In a associated growth, earlier promoter Shripal Morakhia has withdrawn his plea within the appellate tribunal difficult an order by NCLT’s Mumbai bench final November, annulling the change in possession of the ‘SMAAASH’ model and terming it a “fraudulent” transaction by Morakhia.

Immediately’s ETtech Prime 5 e-newsletter was curated by Megha Mishra and Ajay Rag in Mumbai.