Indian auto trade is ready to take a position as much as USD 7 billion, or about INR 58,000 crore, by FY28 to deepen localisation of superior elements from electrical motors to automated transmissions to cut back imports and capitalise on multinationals’ ‘China Plus One’ sourcing technique.

Automakers and their suppliers are more likely to make this funding between FY24 and FY28, trade physique Automotive Part Producers Affiliation (ACMA) stated.

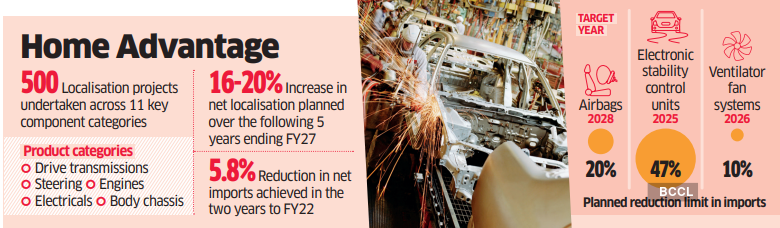

These companies have already undertaken greater than 500 localisation initiatives throughout 11 key part classes together with drive transmissions and steering, engines, electricals and physique chassis at an funding of over INR 3,000 crore to cut back web imports by 5.8% (double the goal of about 3%), or by INR 7,018 crore, within the two years to FY22, as per the most recent evaluation on localisation programmes collectively performed by ACMA and Society of Indian Vehicle Producers (SIAM).

Work is on to extend web localisation by one other 16-20%, or about INR 24,995 crore, over the next 5 years ending FY27, they stated.

Initiatives are underway to cut back imports of airbags to twenty% by 2028 from 26% in 2023 and 100% in 2012, these of digital stability management items to 47% by 2025 from 63% in 2023 and 100% in 2015, and imports of ventilator fan methods to 10% by 2026 from 85% in 2024 and 100% in 2021.

Plans to deepen localisation of automated transmissions, energy management items, excessive power metal, and mixed charging methods are additionally on playing cards mid-term.

These elements account for greater than 75% of auto components imported into the nation.

Apart from decreasing imports, the trade additionally appears to make India an export hub for superior auto elements.

“World over, the trade is constructing resilient provide chains by decreasing overdependence on any specific nation or geography,” stated Shradha Suri Marwah, president of ACMA.

“Worth-addition from the Indian auto elements trade has gone up considerably within the final couple of years and, with the Trade anticipated to take a position one other USD 6.5-7 billion in subsequent 5 years in design and growth and new age applied sciences together with electronics and EV elements, we’re assured that not solely will our imports come down (however) we can even turn into a big web international trade earner for the nation,” he stated.

Suri stated the tempo of discount of imports within the final two years has been practically double of that focused by the trade at about 6%.

To make sure, China dominates auto components provides to India. Nonetheless, its market share in automotive imports declined to 30% in FY22 from 32% in FY20. Indian automakers and suppliers imported elements value INR 1.36 lakh crore in FY22.

Trade stakeholders stated that along with decreasing dependence on China, localisation programmes will assist broaden India’s share within the world commerce of superior auto elements going forward.

Exports of auto components from the nation, in reality, elevated by practically one-third to INR 1.42 lakh crore within the two years to FY22, with suppliers delivery out elements even to mature markets in North America, Europe and Asia.

“Globally, there’s a large transition going down within the automotive trade with the arrival of electrical, linked and autonomous applied sciences,” stated a senior trade govt who didn’t want to be recognized. “It’s an opportune time as we transfer to new mobility to create extra value-addition in India, in order that we’re extra aggressive going ahead.”

Vinod Aggarwal, president of SIAM, stated the localisation programmes undertaken by the trade, together with the INR 25,000-crore production-linked incentive (PLI) scheme by the federal government to handle value disabilities, have began exhibiting outcomes.

“Regardless of the sharp rise in buyer demand for feature-rich automobiles throughout segments, the share of imports in whole revenues of the automotive trade has declined by about 4% between FY20 and FY22,” Aggarwal stated. “Trade turnover in these two years grew by 27.9%, whereas the expansion in imports was solely 8.7%, indicating that efforts in the direction of localisation have began yielding outcomes.”