Additionally on this letter:

■ Interoperability spurs cellular funds revolution

■ Infosys to get Rs 6,300-crore tax refund acquire

■ Zomato will get tax demand of Rs 23 crore

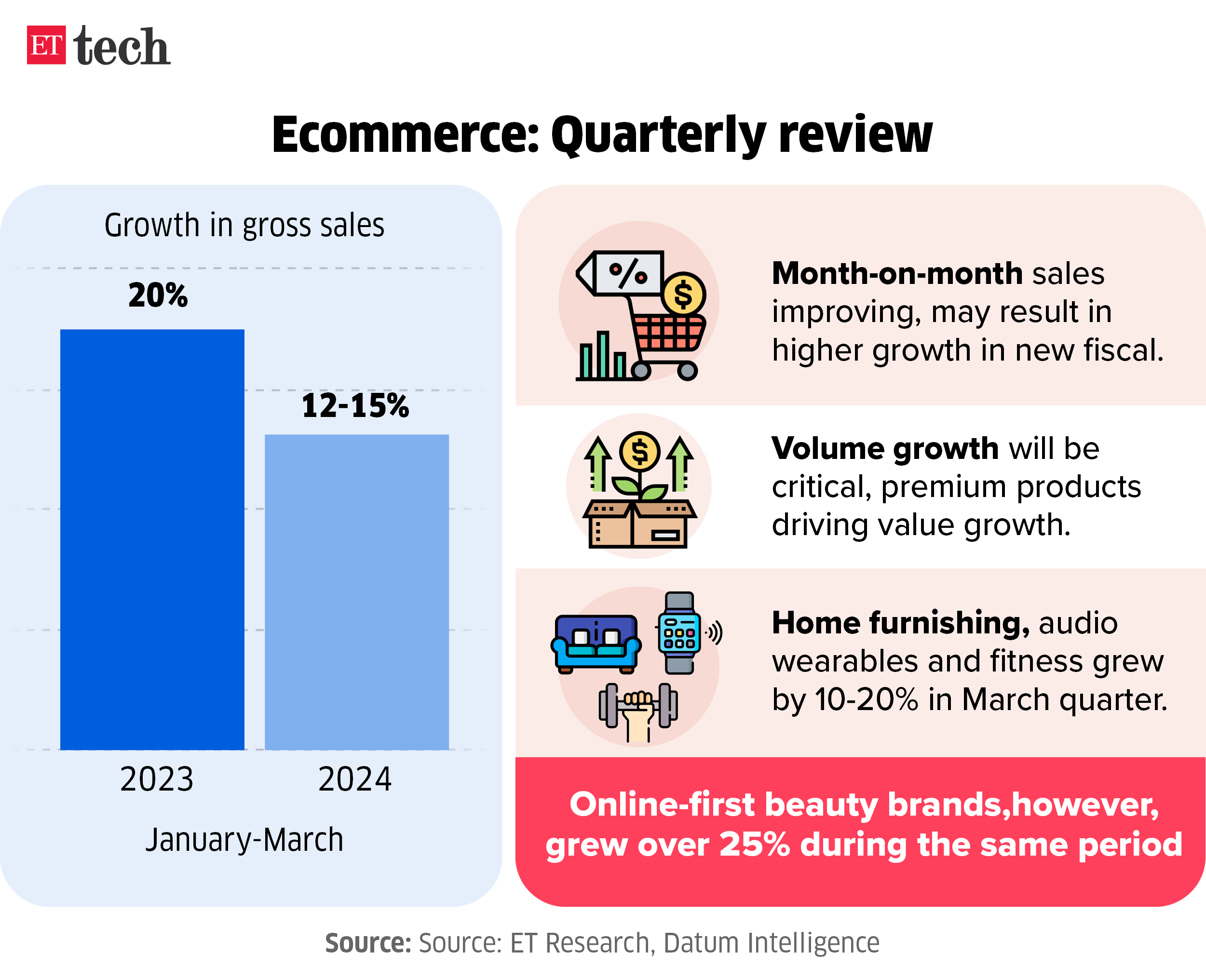

Ecommerce gross sales development in sluggish lane this yr

Ecommerce corporations noticed product sales rising 12% to fifteen% by worth within the first three months of 2024 in comparison with a yr in the past, market analysis information confirmed. This was slower than the 20% year-on-year development seen within the first quarter of 2023.

Quantity development vital: The decline was indicative of softer demand as order volumes shrunk, even because the uptake of pricy objects helped sustain total gross sales. Nevertheless, month-on-month gross sales are bettering, fueling hope that with the onset of summer season, elevated demand for sure classes may bolster full-year gross sales figures.

“Although this January was dangerous, we have now seen development return over the past three weeks, and we are going to doubtless see an about 20% development fee return by April,” Satish Meena, advisor at Datum Intelligence, mentioned.

Magnificence bucks slowdown: Magnificence and Private care, as an example, noticed sturdy gross sales throughout January and February, helped partly by winter gross sales and elevated gifting round Valentine’s day. Well being and health, which often doesn’t see an enormous bounce in gross sales through the festive interval, noticed a rise in gross sales pushed by a post-festive drive in direction of health-focused exercise.

“We see one other spike in April to June, as a youthful, health-conscious base will get their summer season breaks,” mentioned Pallav Bihani, founding father of health-focused dietary supplements and tools maker Boldfit.

Manufacturers proceed to develop: Sure segments like magnificence and private care bucked the broader slowdown to develop significantly within the first quarter. New-age magnificence and private care manufacturers doubtless grew over 25%, whereas the well being and health class doubtless grew between 15- 20%. House furnishing merchandise additionally carried out higher than anticipated with between 15-18% development.

Submit festive stoop: A wide selection of sellers and types executives instructed ET that the market was recovering from a stoop after bumper festive season gross sales within the remaining quarter of 2023. The clearance of trend and peripheral stock and the shortage of main smartphone launches additionally weighed on gross sales. The spike in inflation additionally performed a key function within the dipping curve for on-line retail.

Additionally learn | Ecommerce clicks dip in December, triggering development issues

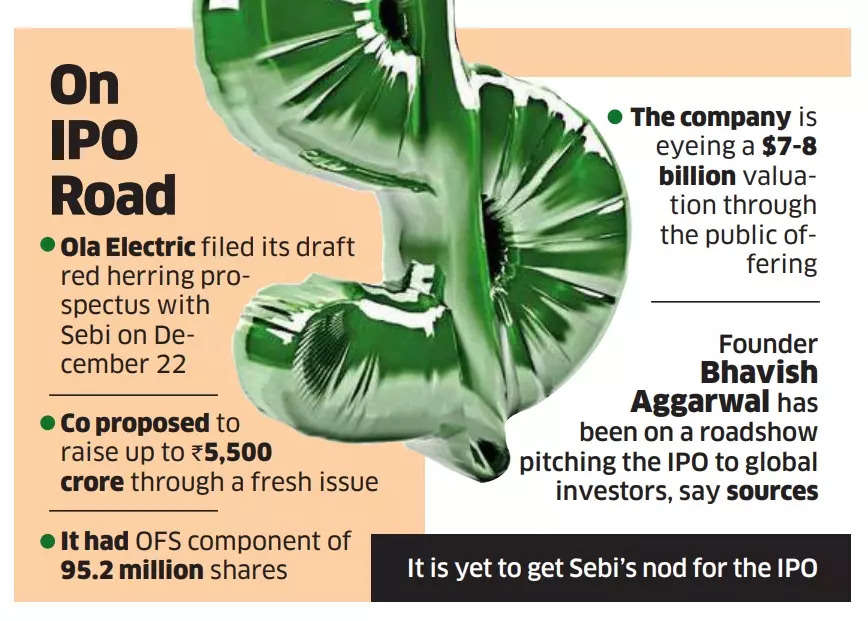

Ola Electrical raises Rs 410 crore in debt

Ola Electrical, the preliminary public providing (IPO)-bound electrical two-wheeler maker, has raised Rs 410 crore (round $50 million) from debt financing platform EvolutionX Debt Capital.

Driving the information: Regulatory filings with the Registrar of Firms (RoC) present that Ola Electrical Mobility Ltd, the mum or dad firm of Ola’s EV enterprise, has raised the quantity by issuing non-convertible debentures to EvolutionX, which was arrange by DBS and Temasek, and has backed Indian startups similar to Udaan, PharmEasy, Mensa Manufacturers and LendingKart.

The backdrop: Previous to the most recent debt fundraise, the corporate had closed one other $240 million debt financing from State Financial institution of India in October – a part of its total $384 million financing spherical, together with an fairness increase from Singapore’s sovereign wealth fund Temasek. On the time, Ola Electrical was valued at $5.4 billion. In response to Tracxn, the corporate has raised a complete of over $1 billion in fairness and debt funding thus far.

IPO plans: On December 22, Ola Electrical filed its draft pink herring prospectus (DRHP) with the Securities and Change Board of India (Sebi), proposing to boost as much as Rs 5,500 crore by means of a contemporary situation, other than an offer-for-sale (OFS) element of 95.2 million shares. Folks conscious of the matter mentioned the corporate’s founder Bhavish Aggarwal has been on a roadshow pitching the IPO to world traders.

Yet another factor: Individually, Ola Electrical Mobility – the mum or dad firm for Ola’s EV enterprise – will infuse Rs 500 crore into its wholly-owned subsidiary Ola Electrical Applied sciences Pvt Ltd (OET), RoC filings confirmed. The funding in OET, which may very well be in a number of tranches within the type of both fairness or debt, comes shut on the heels of Ola Electrical’s plans to enter the industrial EV section.

How interoperability oiled the wheels of cellular funds revolution

With interoperability in netbanking, the Reserve Financial institution of India (RBI) has managed to carry all cost programs within the nation inside a community infrastructure.

What’s interoperability? By means of this method, any financial institution and any cost methodology can settle transactions on one another’s platform. There isn’t any want for proprietary know-how to settle funds between particular person entities.

How does this assist? Interoperability offers fairly just a few advantages:

- Standardises settlement cycles throughout banks and fintechs

- Ensures higher buyer grievance redressal

- Helps the regulator preserve monitor of cost programs and collect information in actual time

Who advantages? Service provider funds benefited out of interoperability in a significant approach. Buyer acquisition grew to become cheaper due to interoperability. Additionally, person expertise on cost programs was higher, since clients may make transactions with out having to fret in regards to the cost methodology they had been utilizing.

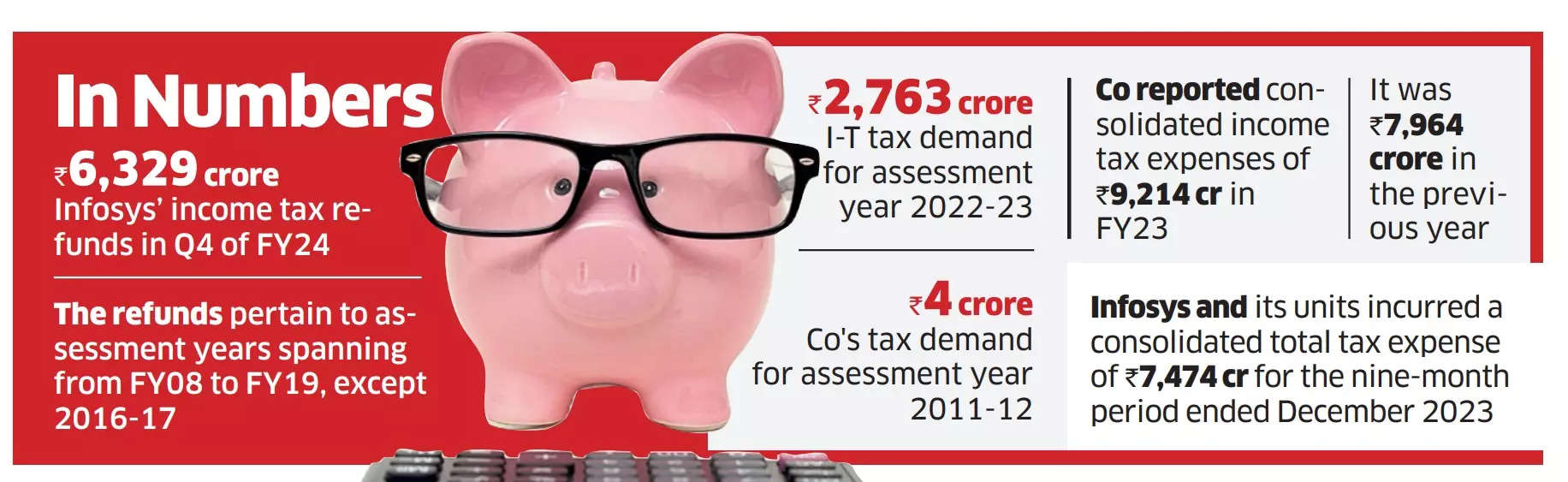

Infosys to get windfall tax refund of Rs 6,300 crore

India’s second largest software program companies exporter, Infosys, has made a windfall acquire of Rs 6,329 crore from revenue tax refund orders for 11 evaluation years.

Large acquire: The refunds, inclusive of curiosity, pertain to evaluation years spanning monetary years 2007-08 to 2018-19, besides 2016-17.

The corporate received the refunds within the fourth quarter of economic yr 2023-24, Infosys mentioned.

Tax discover served: Moreover, the revenue tax division has slapped a requirement of Rs 2,763 crore for the evaluation yr 2022-23, Infosys mentioned in a regulatory submitting late Saturday.

Infosys additionally has a tax demand of Rs 4 crore, together with curiosity for the evaluation yr 2011-12. The orders have additionally been despatched to a few of its subsidiaries.

Notably, Infosys and its models incurred a consolidated whole tax expense of Rs 7,474 crore for the nine-month interval ended December 2023.

Different Prime Tales By Our Reporters

Zomato will get tax demand order of Rs 23 crore: Meals-delivery firm Zomato mentioned it has obtained a tax demand, together with curiosity and penalty, aggregating to Rs 23 crore from the Karnataka industrial taxes authority. The tax discover has been issued for availing extra enter tax credit score underneath the products and companies tax (GST) guidelines, the Gurugram-based firm mentioned in a inventory change submitting on Sunday.

Meet the world’s first conversational AI with emotional intelligence: Synthetic intelligence can now perceive human feelings, pull off sarcasm, and even categorical anger. New York-based startup Hume AI final week launched the primary voice AI with emotional intelligence which may generate conversations for the emotional well-being of its customers. ET explains the tech behind Hume and what it means for customers.

14 years on, the marvel of DPI’s increasing universe: India’s Digital Public Infrastructure, which has obtained an enormous fillip as a result of Jan Dhan, Aadhaar and Cell trinity, has not simply elevated entry and inclusion for the nation’s poor however can be now making an attempt to repair urgent points associated to sustainability and AI compute energy. There are dozens of lesser-known digital public items (DPGs) and digital public infrastructure which have additionally been developed and deployed in India, a lot of that are being adopted globally.

World Picks We Are Studying

■ Contained in the Creation of the World’s Most Highly effective Open Supply AI Mannequin (Wired)

■ China’s ecommerce teams make inroads in South Korea with lure of low costs (FT)

■ Early Clues Emerge on Senate’s Plans for TikTok (WSJ)