Additionally within the letter:

■ PayU’s Wibmo constructing a full stack

■ Tata Electronics engaged on iPhone casing

■ TechM, LTTS earnings

FirstCry to refile IPO utility following Sebi directive

Supam Maheshwari, CEO, FirstCry

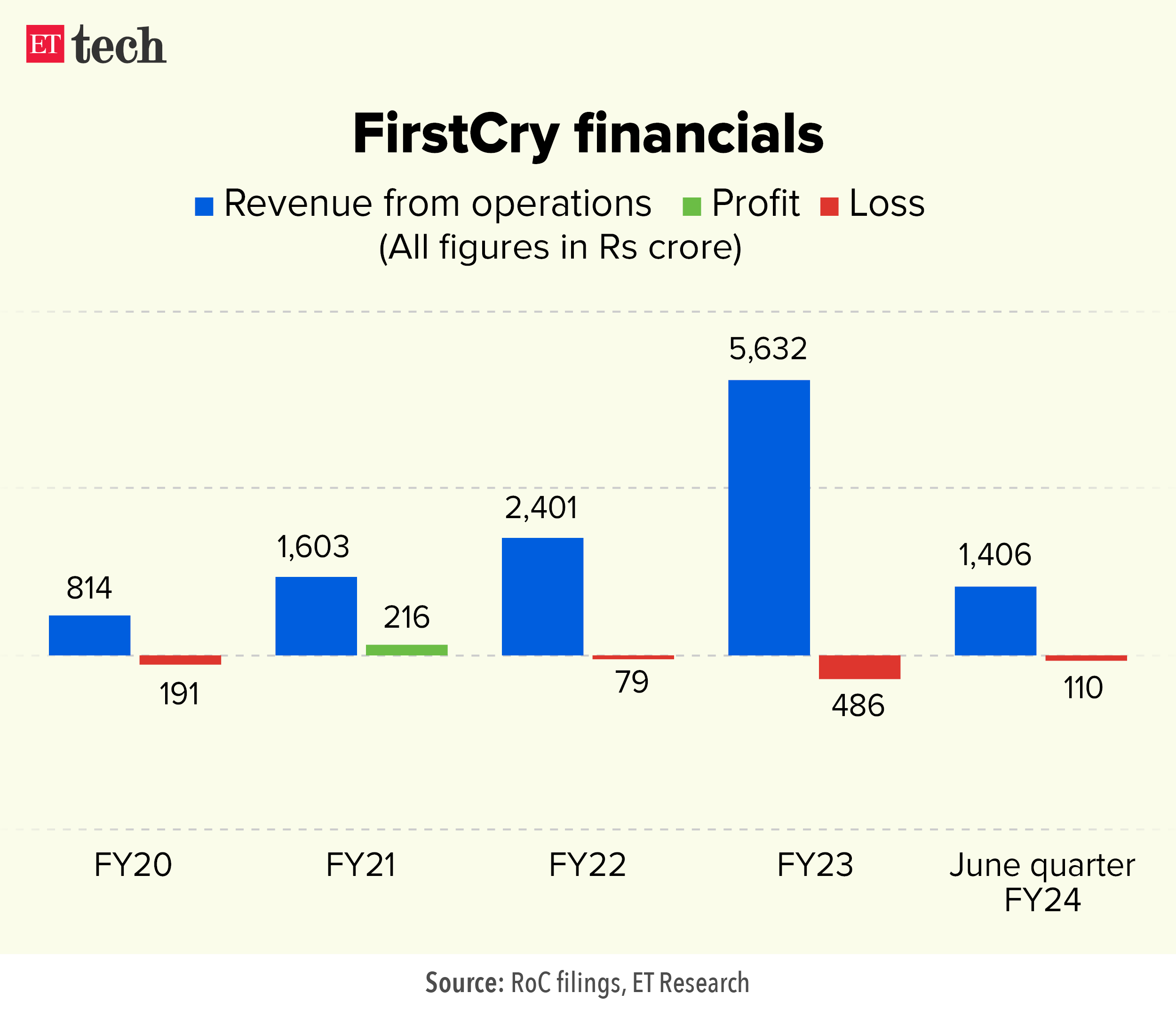

Going through queries from the inventory market regulator, FirstCry, an omnichannel retailer for child and mom care merchandise, is predicted to resubmit its draft IPO papers.

Driving the information: The Securities and Change Board of India (Sebi) has flagged lack of satisfactory disclosures in key efficiency indicators (KPIs) within the firm’s draft papers. Put up which the corporate plans to refile its IPO paperwork with the newest financials as of March 2024, sources instructed ET.

“They (FirstCry) had submitted a set of KPIs however Sebi needed extra data because it has been cautious about a number of new-age agency IPOs resulting in worth erosion for retail traders,” an individual conscious of the matter mentioned. FirstCry is predicted to make the adjustments in its filings over the approaching weeks, folks within the know added.

A banker instructed ET that the inventory market regulator has stored an in depth watch on KPI disclosures over the previous three years.

Background: The Pune-based agency filed its draft purple herring prospectus with Sebi in December final yr, in search of to boost $218 million in main funding by way of a difficulty of recent shares and divesting 54 million shares from current traders. FirstCry’s IPO is predicted to be $500 million in dimension, relying on the valuation it units for itself through the public providing.

Swiggy secures shareholder nod for IPO | ET reported on Thursday that Bengaluru-based Swiggy’s shareholders greenlit its IPO price $1.25 billion.

The corporate plans to boost Rs 3,750 crore ($450 million) in contemporary capital, along with an offer-for-sale (OFS) element of as much as Rs 6,664 crore ($800 million), in line with filings made with the Registrar of Firms. Swiggy is trying to additionally choose up about Rs 750 crore from anchor traders in a pre-IPO spherical.

Additionally learn | Prosus might have promoter tag in Swiggy’s $1 billion IPO

Mohit Gupta, Mukesh Bansal’s Lyskraft raises $26 million

Premium trend and life-style platform Lyskraft, based by former Zomato government Mohit Gupta and Myntra founder Mukesh Bansal final yr, has raised $26 million in one of many greatest seed funding rounds for an area startup lately.

Deal particulars: The fundraise was led by Peak XV Companions, whereas different traders corresponding to Prosus, Belgian funding fund Sofina, and companions of DST International have additionally pumped in capital. A big early-stage spherical for Lyskraft signifies investor urge for food for backing ventures founder by senior executives and repeat entrepreneurs.

What’s the plan? Lyskraft will construct an omnichannel play as a market for premium manufacturers, beginning with girls’s trend and subsequently increasing into different life-style classes. Gupta will lead the corporate as its CEO whereas Bansal gained’t have an operational function. He will likely be a strategic advisor and a key shareholder within the enterprise.

The corporate will tackle omnichannel gamers like Nykaa Vogue in addition to online-only corporations like Myntra and Reliance Retail’s Ajio. It has onboarded 15 premium girls’s attire manufacturers, and won’t go for in-house manufacturing.

Premium push: “The premium trend class in India must be handled otherwise which we consider over the subsequent 5-10 years goes to be massive sufficient to be handled as a vertical. Particularly, inside this, girls’s trend is a very onerous class, and we expect that the answer to that’s not solely on-line or offline however omnichannel, and that’s what now we have got down to construct,” Gupta mentioned.

PayU’s Wibmo constructing full-stack fee gateway options

Suresh Rajagopalan, CEO, Wibmo

Naspers-owned PayU went on an acquisition blitz between 2019 and 2020, rising inorganically into credit score (PaySense), funds authentication (Wibmo), fee gateway (Purple Dot Cost). Of all these investments, it’s Wibmo that’s turning out to be a trump card for the service provider funds main.

Constructing a full stack: Wibmo, which was primarily an authentication platform for on-line card transactions, is now changing into a full stack fee gateway. From fraud detection capabilities to pay as you go issuance, Wibmo is working with massive banks in India and overseas to energy their digital providers. PayU, which until not too long ago was below an embargo on including new clients, leveraged Wibmo’s capabilities to construct deeper relationships with banks.

Going international: Wibmo, based approach again in 1999, has relied totally on Indian banks for enterprise. In response to CEO Suresh Rajagopalan, even three 4 years again Wibmo would get round 96% of its revenues from India. Nonetheless, that’s altering now. At the moment Wibmo will get 36% revenues from outdoors the nation, and the administration goals to take this to 40% by the subsequent fiscal.

Catch up fast: In November PayU’s international head of technique, mergers and acquisitions and investments, Vijay Agicha, had instructed us that the funds main was trying to construct capabilities in B2B funds and provide chain financing.

Different High Tales By Our Reporters

Tata Electronics constructing hi-tech machines to make iPhone casing: After changing into a major participant assembling enclosures for Apple iPhones within the nation, Tata Electronics is now working to internally develop “very subtle” and complicated high-precision machines used to supply the casing of those iPhone, sources instructed ET.

Tech Mahindra This fall web revenue down 41% to Rs 661 crore; income tanks 6.2%: Tech Mahindra, nation’s fifth largest IT providers agency, reported a decline in web revenue of 40.9% year-on-year to Rs 661 crore primarily pushed by slowdown in its telecom, communications, media and leisure enterprise, which is its largest vertical with 36.5% market share.

Cyient’s revenue grew 22% to Rs 196 crore in This fall: Engineering service supplier, Cyient’s web revenue grew to Rs 196 crore within the ultimate quarter of FY24, up 22% sequentially. On a year-on-year foundation, the revenue for the Hyderabad-based agency grew by 20%.

LTTS’ web revenue grew 0.2% to Rs 341 crore: L&T Expertise Companies (LTTS) reported a web revenue of Rs 341 crore within the March quarter of FY24, up 1.4% quarter on quarter. The revenue for the corporate grew by simply 0.2% on-year.

International Picks We Are Studying

■ Advertisements for specific ‘AI girlfriends’ are swarming Fb and Instagram (Wired)

■ How TikTok’s Chinese language proprietor tightened its grip on the app (FT)

■ What it takes to boost a $300 million VC fund for Africa (Remainder of World)