Additionally on this letter:

■ HCL-Foxconn chip JV hits a bump

■ PM Modi to attend Startup Mahakumbh

■ Sarthak Misra elevated to SoftBank India companion

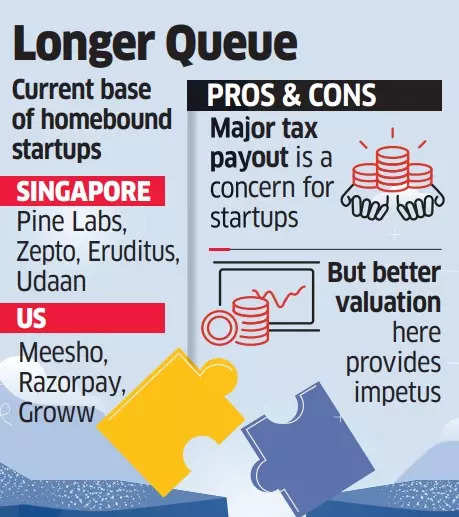

Startups ‘reverse flip’: Pine Labs, Zepto, Meesho in queue for India return

Indian expertise startups are actually appearing on plans to maneuver domiciles to India from abroad. Let’s dive proper in.

Driving the information: The $5-billion-valued Pine Labs has filed functions for a cross-border merger of its India and Singapore models with the NCLT (Nationwide Firm Regulation Tribunal) in addition to in Singapore, sources advised us. We first reported on January 2 on Pine Labs’ plans to strategy its board for shifting domicile to India.

There’s extra: Fast-commerce agency Zepto is within the closing phases of submitting the same utility in Singapore, whereas fellow Y Combinator alumnus Meesho is contemplating elevating new capital to account for tax payouts to flip its dad or mum firm to India.

India considerations: Startups, as a lot as they need to come to India, are discovering tax outgo a priority. Meesho, thus, might have to lift new capital because it needs to maintain its money reserves intact for operations solely.

Taxing occasions: Funds agency Razorpay can also be planning a comeback of its US holding firm to India. It might need to foot a tax invoice of $300 million, as reported by ET. “In hindsight, that is changing into a giant challenge,” a founder stated in regards to the massive tax payments.

Additionally Learn | Flipping tax is excessive, the corporate has accounted for it: Harshil Mathur

Why now? Apart from regulatory causes for fintechs, startups — which aren’t below any regulatory physique — are discovering the general public markets right here providing greater valuations on income and Ebitda multiples with a transparent path to earnings. “A client model or an ecommerce agency with a model recall in India might be valued far more right here,” a supply added.

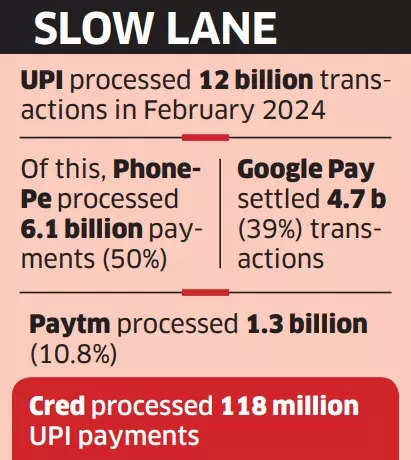

ETtech In-depth: Decoding the UPI development story by means of the eyes of a duopoly

Whereas the Indian digital fee story is driving the Unified Funds Interface (UPI) wave, there’s a focus danger build up within the ecosystem. Walmart-backed PhonePe and Google Pay collectively have a 90% market share amongst third-party fee apps within the ecosystem.

No slowdown in sight: The Nationwide Funds Company of India (NPCI) has a goal to implement a 30% market cap for a single third-party utility supplier (TPAP) by the tip of this yr. However trying on the tendencies, PhonePe and Google Pay are each rising their share of UPI volumes. The problems confronted by Paytm Funds Financial institution should not serving to both.

Regulatory motion: Business insiders advised ET there isn’t a readability from the NPCI or the RBI about how the cap might be applied. Smaller apps within the ecosystem should not prepared to take a position until they’ve readability available on the market cap technique. On high of that, the hole is so huge that it’s going to require huge advertising and marketing spends to bridge it, one thing no venture-funded startup is able to do on this local weather.

Additionally learn | Paytm disaster brings 30% market share cap plan again in focus

Some options: Senior business insiders stated the regulator may take a look at scale-based rules. Gamers with greater than 30% market share on UPI is likely to be declared systemically necessary fee gamers and topic to scrutiny when it comes to inner methods, fraud checks, and many others.

Others imagine that if non-public entities don’t adhere to the market cap tips, a penalty system will be formatted to discourage massive gamers from dominating the market.

Additionally learn | NPCI, startups brainstorm on methods to mitigate focus danger on UPI

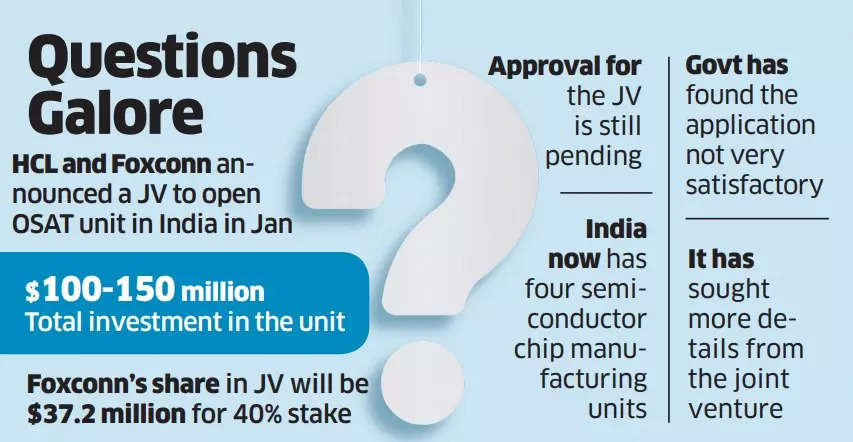

Govt spots lacking bits in HCL, Foxconn chip JV, seeks particulars

HCL Group and Foxconn’s three way partnership for a chip meeting unit has hit a pace bump. The federal government has discovered their utility for the unit unsatisfactory and has sought extra particulars. The applying is being thought of for incentives below the Indian Semiconductor Mission.

Extra particulars wanted: The extra particulars being sought embrace data on the expertise on which the outsourced meeting and testing (OSAT) unit will perform, the expertise companion being introduced on board, and the character of the expertise switch settlement between the companions, sources advised ET.

Verbatim: “The 2 firms (HCL and Foxconn) might want to get a expertise companion. Now we have additionally sought particulars in regards to the uptake of the output from the OSAT unit they’ve proposed,” a senior official from the IT ministry stated.

Know the context: In January this yr, HCL Group and Foxconn introduced their JV to arrange an OSAT unit within the nation at an funding of $100 million to $150 million.

Foxconn’s share within the JV might be $37.2 million for a 40% stake by means of Foxconn Hon Hai Expertise India Mega Improvement.

Want for tech companion: The queries to the HCL Group-Foxconn Group plan are a repeat of an earlier plan submitted by Foxconn, by which it had proposed to arrange a chip manufacturing facility with Vedanta. The sooner JV was dissolved attributable to a scarcity of readability over a expertise companion.

Startup Mahakumbh | PM Narendra Modi to handle gathering at this time

Prime Minister Narendra Modi might be talking on the Startup Mahakumbh occasion in New Delhi at this time, he stated on social media platform X.

Quote, unquote: “At 10:30 AM tomorrow, I might be talking on the Startup Mahakumbh, a discussion board which brings collectively stakeholders from the world of startups, innovators, and upcoming entrepreneurs. India’s strides on this planet of startups has been phenomenal in the previous few years,” Modi stated late Tuesday.

A fast recap of Day 2

Groww cofounder Harsh Jain (left) and Siddarth Pai, founding companion, 3one4 Capital

Throughout the second day of Startup Mahakumbh, Groww cofounder and chief working officer Harsh Jain stated fintechs ought to collaborate with regulators, and work collectively to carry change, slightly than bypassing or ignoring rules.

Quote, unquote: “It’s essential have respect for the foundations and rules round. You possibly can problem them if you happen to actually imagine that buyer behaviour or expertise goes in a distinct path,” Jain stated.

‘Regulator not the enemy’: Siddarth Pai, founding companion, 3one4 Capital, stated if an entrepreneur is passionate and proficient however disregards rules, then failing is “not a risk, it is an inevitability.”

“Do not take a look at the regulator as somebody to battle, he’s not your enemy… something that does nicely is all the time due to the business. And something that goes dangerous is all the time due to the regulator,” stated Pai whereas referring to the challenges regulators face.

Different High Tales By Our Reporters

B Capital cofounders Raj Ganguly (left) and Eduardo Saverin

B Capital closes second Alternatives fund at $750 million: World funding agency B Capital, which has backed the likes of Byju’s, Meesho and Pharmeasy in India, on Tuesday introduced the shut of its second Alternatives fund at $750 million. By B Capital Alternatives Fund II, the entity will make main and secondary follow-on investments in late-stage portfolio firms throughout core sectors of expertise, healthcare, and local weather tech.

SoftBank India elevates Sarthak Misra to companion function: SoftBank India has elevated its funding director Sarthak Misra to a companion, sources advised us. Misra joined the fund in 2019 from Matrix Companions India. He sits on the board of ecommerce agency Meesho and business-to-business etailer OfBusiness and likewise works intently with firms like Swiggy and Lenskart.

India-based leaders steer the wheels of worldwide tech: India isn’t any extra simply the again workplace or the fee centre of the worldwide tech business; it’s more and more changing into a rustic the place international management of multinationals relies, with groups reporting to them from throughout the globe.

Ola Electrical hires Jitesh Shah of Byju’s to guide after-sales: Ola Electrical has introduced in Jitesh Shah, the previous enterprise head of Byju’s examination prep and Aakash digital companies, as the pinnacle of its after-sales and companies division. Shah, who started working at Ola Electrical a number of months in the past, is spearheading an enlargement of Ola’s service centres and fast-charging community.

World Picks We Are Studying

■ What Occurs when a man and his AI girlfriend go to remedy (Wired)

■ Playtron: the startup hoping to Steam Deck-ify the world (The Verge)

■ Mind chips: the Sydney researchers ‘miles forward’ of Elon Musk’s Neuralink (The Guardian)