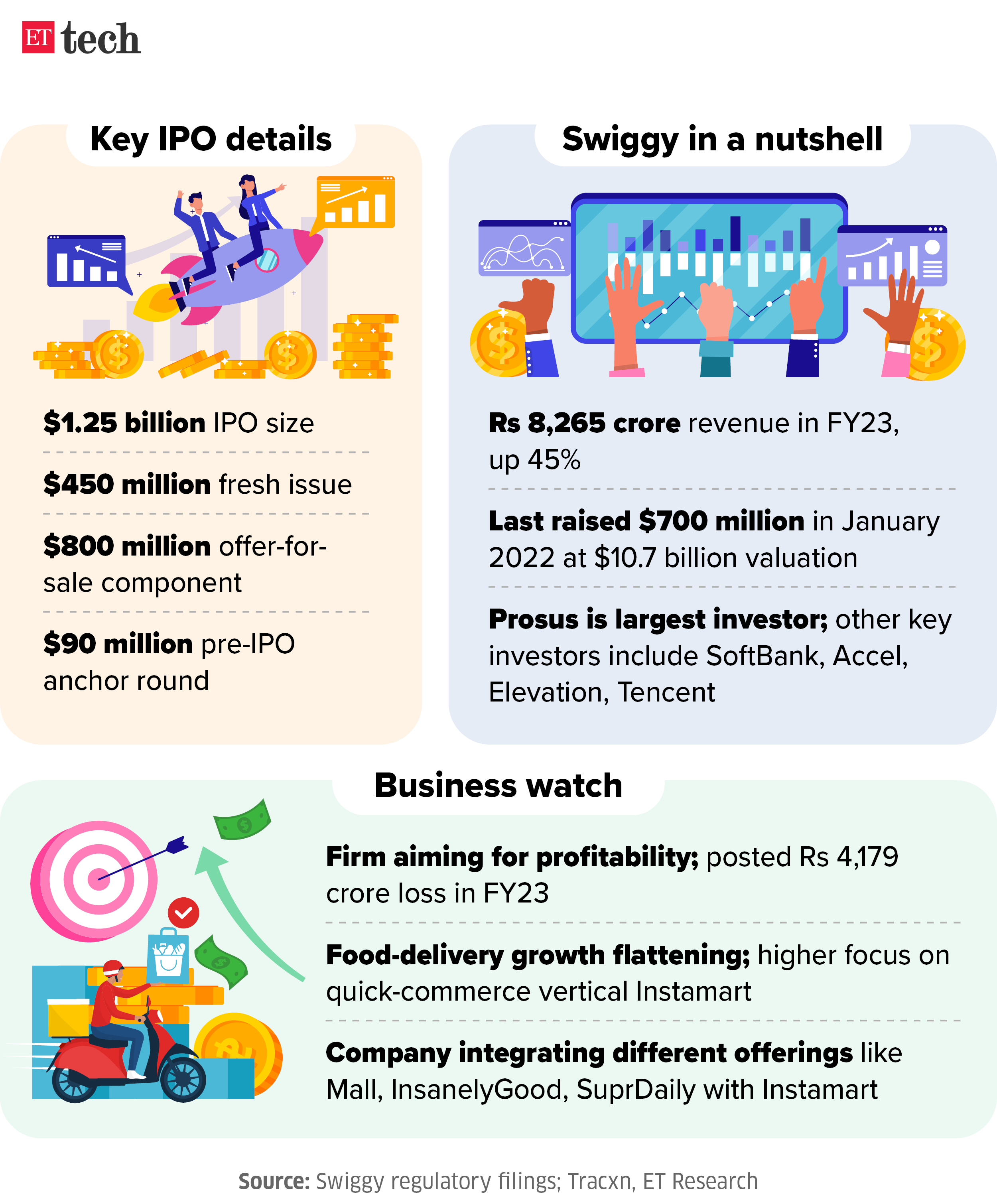

The Bengaluru-based firm has filed for a $1.25-billion public challenge by means of the confidential route, whereby draft purple herring prospectuses (DRHPs) will not be launched to the general public. This got here a day after Swiggy’s shareholders authorised its IPO plan, which features a contemporary share challenge of Rs 3,750 crore ($450 million) and a suggestion on the market (OFS) value Rs 6,664 crore ($800 million) by present shareholders.

On the flipside, FirstCry, an omnichannel retailer for child and mom care merchandise, is withdrawing its draft IPO papers, after being pulled up by the regulator for insufficient disclosures in its key efficiency indicators (KPI). The SoftBank-backed firm will replace the papers with the most recent financials, as of March 2024, and resubmit it for consideration.

Additionally learn | Workplace-sharing startup Awfis will get Sebi nod for IPO

The large image: What’s taking place with FirstCry just isn’t totally shocking. A number of web trade executives and bankers have instructed ET in regards to the market regulator’s more and more cautious strategy to disclosures. “Not simply FirstCry, latest new-economy IPO proposals over the past 12 months confronted the identical scrutiny. Sebi needs to know all key enterprise metrics in addition to why is an organization going for an IPO – what’s the break up between contemporary share challenge and divestment from present traders?” a senior trade govt stated.

“This isn’t only for new-economy companies however the regulator needs the identical info from all firms, so traders have the utmost quantity of data earlier than investing,” the individual added.

Sebi’s queries have led to firms shrinking their secondary share sale plans – particularly after massive IPOs like Paytm’s led to huge losses for retail traders, these folks stated.

FirstCry is eyeing $ 500 million (round Rs 4,163 crore) from its deliberate IPO. Nevertheless, the ultimate dimension will hinge on the valuation they set for themselves through the providing.

One investor stated that the regulator needs entry to all enterprise info that’s made accessible to shareholders of personal firms. “Sebi’s place is fairly clear, they need the smallest of particulars that non-public traders are aware about in regards to the enterprise.. which is why FirstCry has to refile.”

Prime Tales This Week

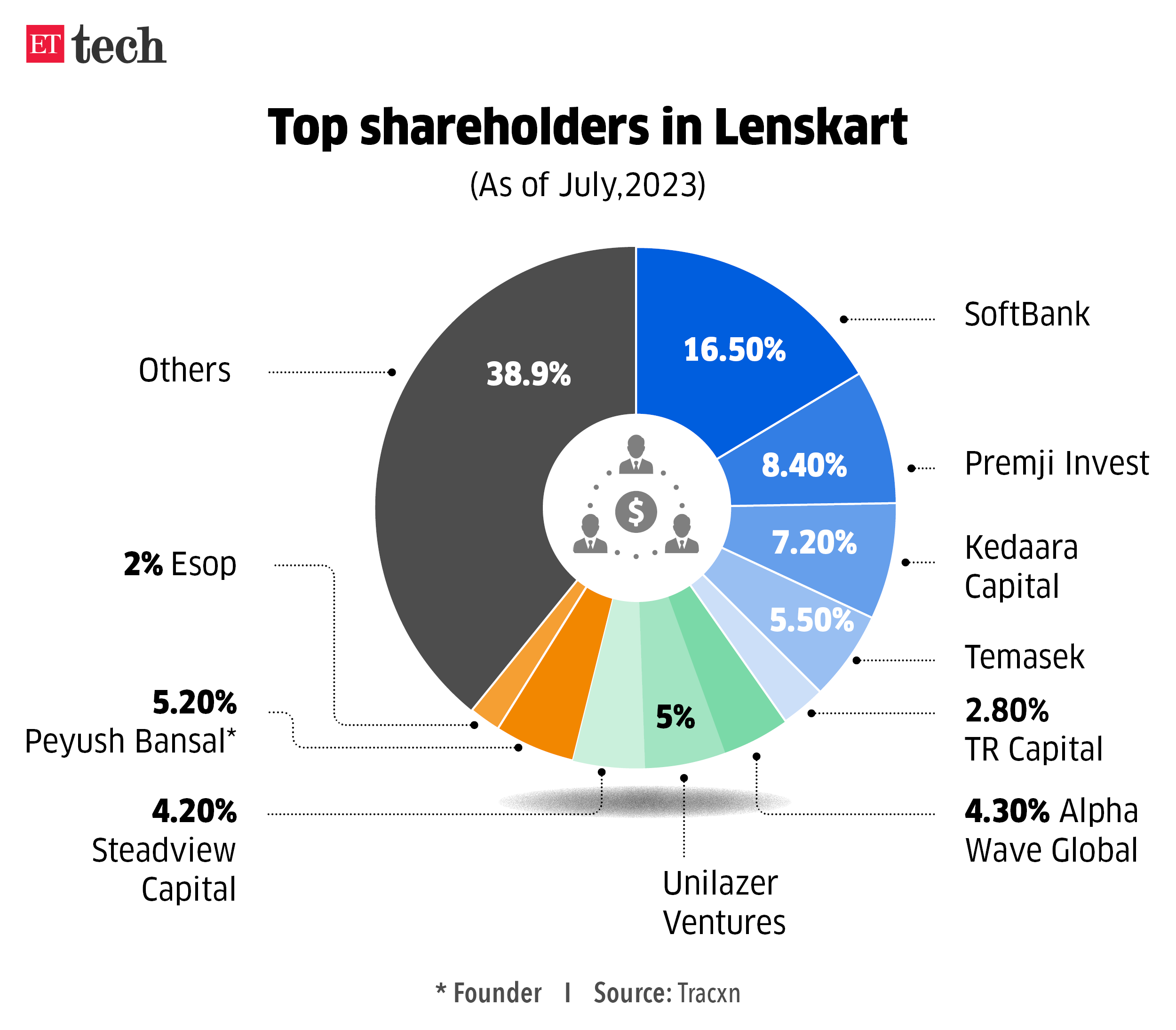

Temasek, Constancy could make investments $200 million in Lenskart at $5 billion valuation: Singapore’s Temasek and US’ Constancy are in superior discussions to take a position round $200 million in Lenskart by means of a secondary share sale at a valuation of about $5 billion, three folks conscious of the matter stated.

Lenskart’s secondary sale is going down at an 11-12% increased valuation than its earlier $4.5 billion, setting it aside from different such transactions that usually shut at a decrease valuation.

WeWork to promote 27% stake in India unit through Rs 1,200 crore secondary deal: US office-sharing firm WeWork Inc. is about to exit the Indian operations by promoting its whole 27% stake within the native unit by means of a secondary transaction. The estimated Rs 1,200 crore deal may even see Bengaluru-based property developer Embassy group pare its holding from 73% to 60%, stated the folks cited above.

Mohit Gupta, Mukesh Bansal’s omnichannel trend startup Lyskraft raises $26 million in seed funding: Former Zomato senior govt Mohit Gupta and Myntra founder Mukesh Bansal have raised $26 million in seed cash for his or her omnichannel trend startup Lyskraft, making it one of many largest early-stage rounds for an Indian startup amid the continuing funding crunch.

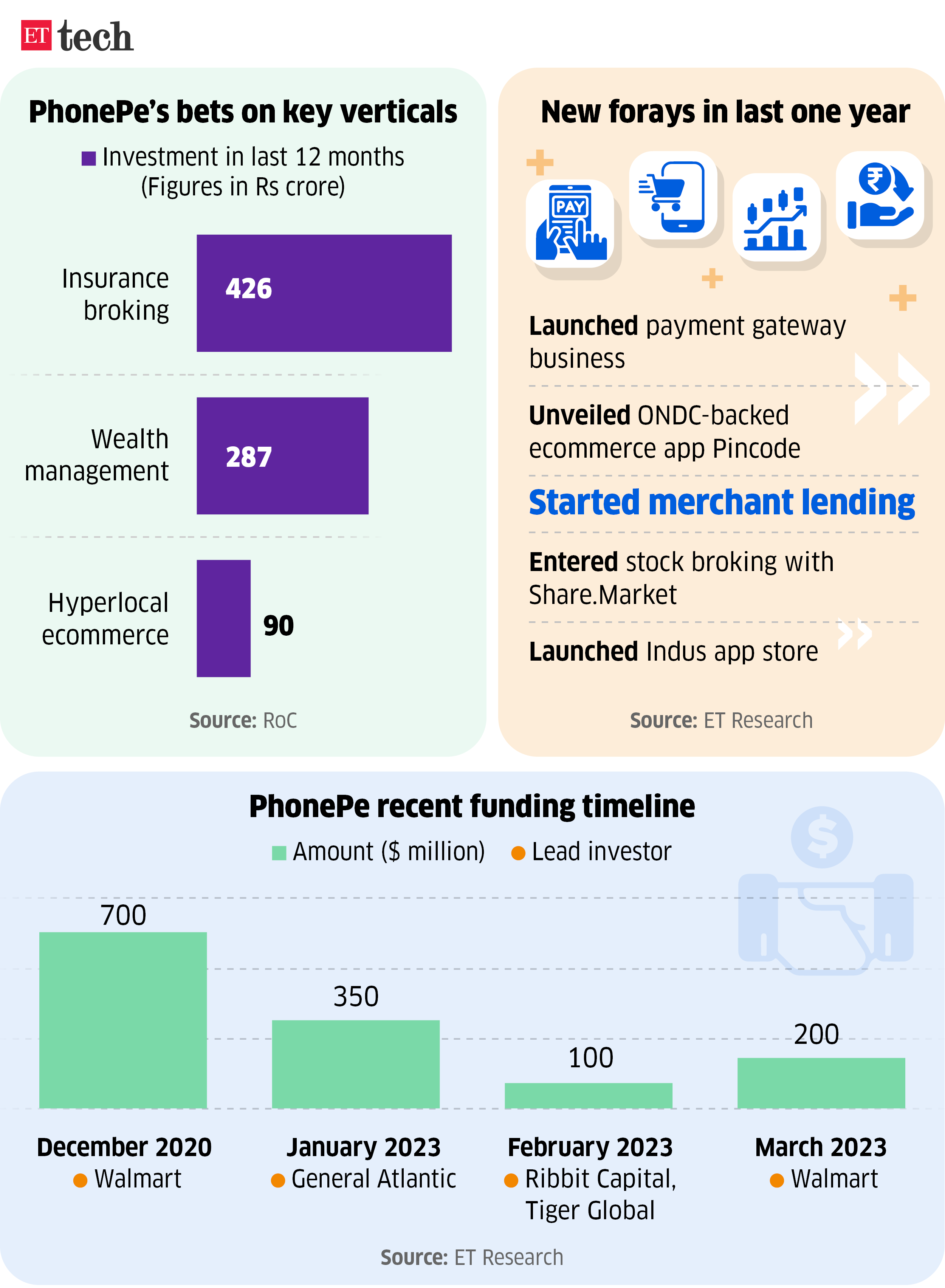

PhonePe poured bulk of Rs 800 crore investments into insurance coverage enterprise: Walmart-owned PhonePe has invested over Rs 800 crore in its subsidiaries over the last 12 months to develop companies starting from insurance coverage broking to wealth administration and hyperlocal ecommerce, regulatory filings present. Greater than half of this, or Rs 426 crore, went to PhonePe Insurance coverage Broking Providers — a transparent indication of the fee agency’s intention to construct a big retail cowl distribution enterprise.

PhonePe can be restructuring its ecommerce technique on the Open Community for Digital Commerce (ONDC). It has exited a number of classes like trend, grocery and electronics, however will proceed to supply meals supply companies on the community

Startups shuffle high deck, play to ace long-term profitability sport: Over a dozen new economic system ventures have appointed a brand new chief govt over the past 12 months, as a larger concentrate on profitability and governance positive aspects primacy throughout the sector.

Ather eyes new spherical, Nikhil Kamath buys massive a part of Sachin Bansal’s holding: Electrical two-wheeler maker Ather Power is in talks for elevating a “important spherical of funding” in a mixture of main and secondary share sale, stated folks with information of the event. Present investor, Flipkart cofounder Sachin Bansal, has offered a major a part of his holding within the firm to Zerodha cofounder Nikhil Kamath, they stated, including that Kamath could purchase out Bansal’s remaining stake within the agency.

Fintech Information

RBI tells on-line funds companies to trace fishy transactions amid Lok Sabha elections: The Reserve Financial institution of India has directed all regulated fee firms to trace high-value or suspicious transactions through the course of common elections, based on a number of senior executives within the know.

Govt groups up with SBI Playing cards, telcos to fight OTP frauds: India’s house ministry, SBI Playing cards and Cost Providers Ltd (SBI Card) and telecom operators have partnered to develop an revolutionary resolution for alerting about stolen one-time passwords as a part of a broader effort to fight the rising menace of cyber fraud and phishing assaults on the banking ecosystem.

IT Updates

Tech Mahindra This fall web revenue down 41% to Rs 661 crore; income tanks 6.2%: Tech Mahindra, nation’s fifth largest IT companies agency, reported a decline in web revenue of 40.9% year-on-year (YoY) to Rs 661 crore primarily pushed by slowdown in its telecom, communications, media and leisure enterprise, which is its largest vertical with 36.5% market share.

HCLTech This fall web revenue rises marginally to Rs 3,995 crore: IT main HCL Applied sciences on Friday reported a web revenue of Rs 3,995 crore for the quarter ended March 31, 2024. This was marginally increased by 0.35% as towards Rs 3,981 crore reported within the year-ago interval.

LTIMindtree This fall revenue falls 1.2%, income edges up: India’s sixth-largest IT companies agency LTIMindtree reported a 1.2% YoY decline in web revenue at Rs 1,100 crore for the March quarter of the monetary 12 months 2024 lacking road estimate of Rs 1,150 crore. The revenue stood at Rs 1,114 crore a 12 months in the past.

Additionally learn | Prime IT companies noticed wage payments rise 5.5% at the same time as income progress dips

With $11 million exit pay, Delaporte joins different CEOs in expensive exits: Outgoing Wipro CEO Thierry Delaporte is about to get a separation fee of Rs 92.1 crore (or about $11 million) after his ahead-of-schedule exit from India’s fourth-biggest outsourcing firm, becoming a member of a swelling listing of high executives within the nation’s most globalized trade to have inked iron-clad job contracts that assure hefty severance packages.

.jpg?resize=218%2C150&ssl=1)