Additionally on this letter:

■ Ola Electrical’s report registrations in March

■ Byju’s delays salaries but once more

■ Pocket FM closes first Esop buyback

Apple’s Indian ecosystem emerges as prime job creator, using over 1.5 lakh straight

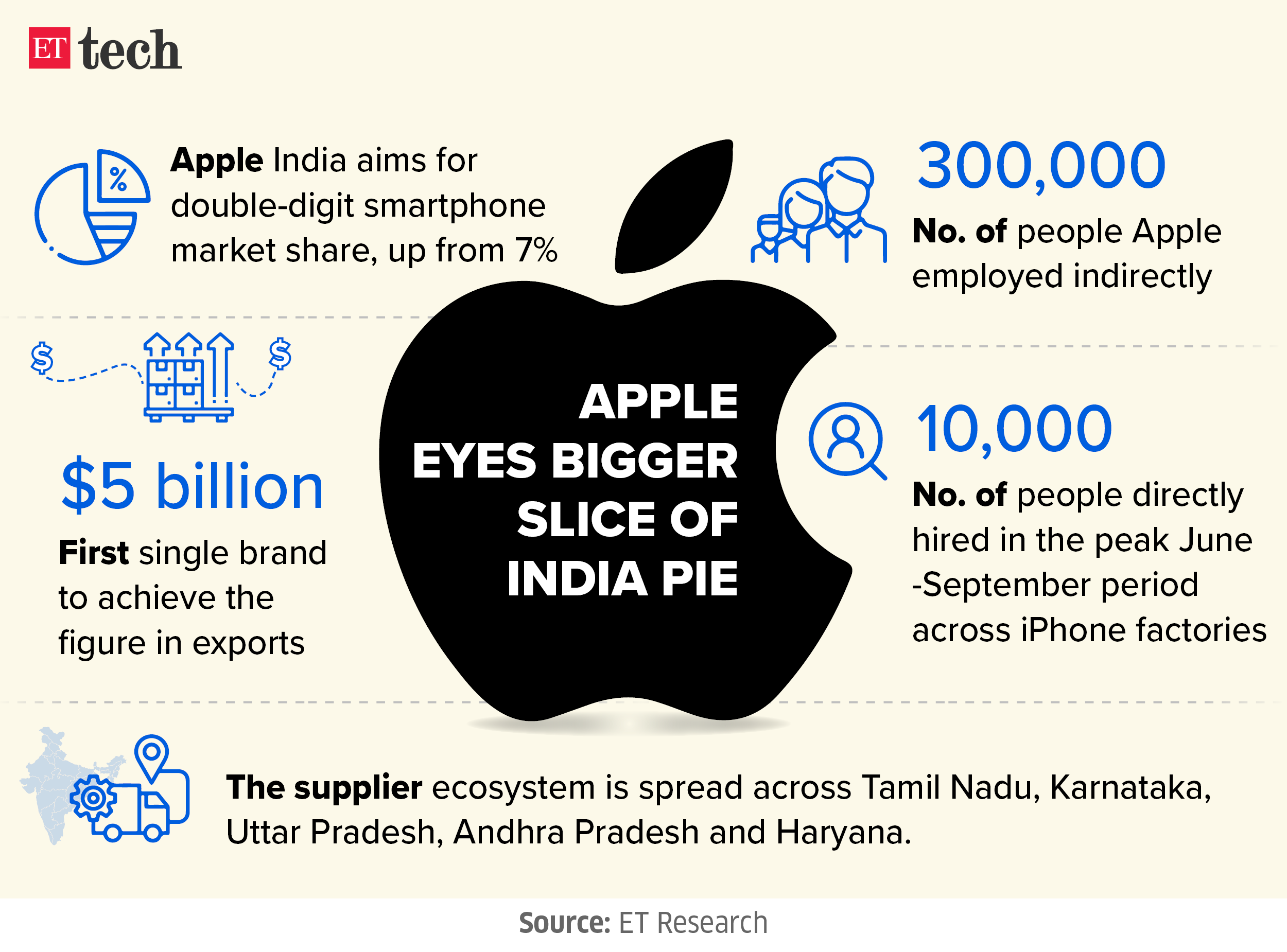

Tech big Apple and its allied ecosystem have emerged as the highest job supplier within the nation because the begin of the production-linked incentive (PLI) scheme for smartphones in August 2021. It’s now India’s largest blue-collar job creator.

Knowledge decoded: Of these employed, the bulk are first-time job seekers within the 19-24 years age group, authorities officers and consultants advised ET. Additional, about 300,000 individuals have been employed not directly, they estimated.

Apple straight employs practically 3,000 individuals in India, whereas iOS app improvement helps greater than one million jobs, the officers added.

Inform me extra: In line with the information, major job creators amongst Apple suppliers embrace Tata Electronics, which makes enclosures for iPhones at its Hosur facility, and Salcomp Applied sciences, which produces enclosures and energy adaptors. Other than these, Foxlink, Sunwoda, Avary Applied sciences, CCL Industries and Flex have contributed to this job creation.

Additionally learn | Smartphone market’s lengthy tail could develop longer in 2024

Extra hiring on the playing cards: Specialists mentioned the iPhone factories are set to rent greater than 10,000 individuals straight within the peak June-September interval when manufacturing will swell to a full three shifts to fulfill world demand for the subsequent iPhone. New fashions are usually launched in September.

Crackdown on on-line reductions: In the meantime, smartphone manufacturers equivalent to Xiaomi and Realme are cracking down towards scalper retailers trying to make a fast buck by promoting units cheaper on on-line platforms as the businesses guess huge on the offline channel to spice up progress on the earth’s second-largest smartphone market.

Additionally learn | Apple set to hit candy spot with Rs 70,000-crore India gross sales

Election merchandise makes ecommerce debut forward of polls

As India gears up for common elections this month, political merchandise is taking off in a giant manner for the primary time on the earth’s largest democracy. Ecommerce platforms equivalent to Amazon, Flipkart and Meesho are cashing in on the ballot fever with merchandise like t-shirts, caps and sweatshirts.

Driving the information: Impartial retailers and model licensee corporations are betting on newer and youthful voters and increase the voting hype to retail a diversified vary of political merchandise. This contains stylish, premium attire, mass-priced key chains, automobile and home flags, lamps and clocks.

Phrase for phrase: “No less than two dozen sellers have onboarded totally different ecommerce platforms with election merchandise. We’re constantly getting requests from sellers because the election momentum builds up,” an government at a big ecommerce platform advised ET. Particularly, Amazon is promoting merchandise underneath a ‘Put on Your Opinion’ franchise on the net platform.

Namo on an app: The ruling Bharatiya Janata Occasion (BJP), which can stake a declare for a 3rd consecutive time period, has begun promoting caps, t-shirts, and mugs on its Namo app. The app is promoting these merchandise together with stationery and attire with Prime Minister Narendra Modi’s title.

Not simply distinguished events such because the BJP, Congress and Aam Aadmi Occasion, smaller events have additionally joined the fray.

Studying from the West: Within the US, ‘election clothes’ merchandise with messages equivalent to ‘Vote Biden 2024’ and ‘Trump Info: 2024’ have already flooded on-line platforms forward of presidential elections in November.

Additionally learn | Ecommerce gross sales progress in gradual lane as mass market crowd thins

Ola Electrical ends FY24 with 115% progress on 12 months

IPO-bound Ola Electrical on Monday mentioned it noticed a report 53,000-plus registrations in March, its highest quantity for a fifth consecutive month. As per the Vahan portal, it additionally stays the market chief within the electrical scooter house.

Finer particulars: The corporate noticed 328,785 items being offered in FY24, as per the portal. That is greater than double the 152,741 recorded in FY23. Within the March quarter of FY24, the corporate noticed 119,310 registrations, as towards 84,133 items within the earlier quarter.

Catch up fast: ET reported on Monday that the EV maker raised Rs 410 crore (about $50 million) by non-convertible debentures from EvolutionX Debt Capital.

Earlier than this, the corporate had closed a $240 million debt financing from State Financial institution of India in October 2023 as a part of a $384 million financing spherical, which included fairness funding from Singapore’s sovereign wealth fund Temasek.

Raahi on the best way: The corporate can be within the closing phases of launching an electrical autorickshaw meant to be offered on to shoppers, ET had reported on March 13. The car is prone to be referred to as Raahi, and the corporate is anticipated to unveil it quickly, sources had mentioned.

Byju’s delays wage once more because of money crunch

Byju’s is as soon as once more delaying salaries for workers because it battles a extreme money crunch. The troubled edtech knowledgeable workers on Monday that their pay might be delayed because of actions by warring buyers which have restricted utilization of funds by a rights difficulty.

‘Misguided buyers’: In its observe, the agency expressed remorse a few delay within the disbursement of salaries.

“A number of misguided overseas buyers in Byju’s have obtained an interim order in late February which has restricted utilization of the funds raised by the profitable rights difficulty. This irresponsible motion by the 4 overseas buyers has compelled us to briefly maintain the disbursal of salaries till the restriction is lifted,” the observe mentioned.

Byju’s EGM: That is simply days after founder and CEO Byju Raveendran knowledgeable shareholders that the corporate has secured greater than 50% votes by postal poll in its contentious extraordinary common assembly (EGM) to extend the authorised share capital to account for the $200-million rights difficulty.

Raveendran additionally supplied the estranged buyers an opportunity to put money into the rights difficulty of the corporate in order that their shareholding just isn’t diluted.

Extra context: Final week, the Nationwide Firm Legislation Tribunal (NCLT), Bengaluru, refused to remain Byju’s EGM. The Karnataka Excessive Court docket additionally prolonged the interim keep on outcomes of an EGM referred to as by buyers to take away Raveendran as CEO in February.

Pocket FM completes first ever Esop buyback value $8.3 million

Pocket FM cofounder and CEO Rohan Nayak

On-line audio streaming platform Pocket FM has accomplished its first ever worker inventory possibility plan (Esop) buyback value $8.3 million.

Particulars: The buyback was open to each former and present workers holding vested Esops within the agency. Pocket FM presently has about 800 workers and a four-year vesting interval, underneath which 25% of Esops are vested within the first 12 months, after which they vest at a month-to-month price.

Funding information: This comes shortly after the agency raised $103 million from Lightspeed Ventures and Stepstone Group on March 20 at a valuation of $750 million. The newest spherical had introduced Pocket FM’s complete funding thus far to $196.5 million.

ET had additionally reported on March 22 that the agency was in talks with buyers just like the Abu Dhabi Funding Authority (ADIA) to finalise a brand new fundraise that was anticipated to worth it round $1.2 billion, making it a unicorn.

Inform me extra: Pocket FM joins a small set of companies which have instituted Esop buybacks lately. On March 13, Meesho introduced an Esop buyback programme value Rs 200 crore (round $24 million). On February 14, edtech startup Classplus introduced its second Esop buyback supply in three years.

Right this moment’s ETtech Prime 5 e-newsletter was curated by Gaurab Dasgupta in New Delhi and Vaibhavi Khanwalkar in Bengaluru.