Additionally within the letter:

■ KYC spoiler for fee corporations

■ ETtech Achieved Offers

■ Musk to fulfill spacetech founders

Binance cash a brand new part in India

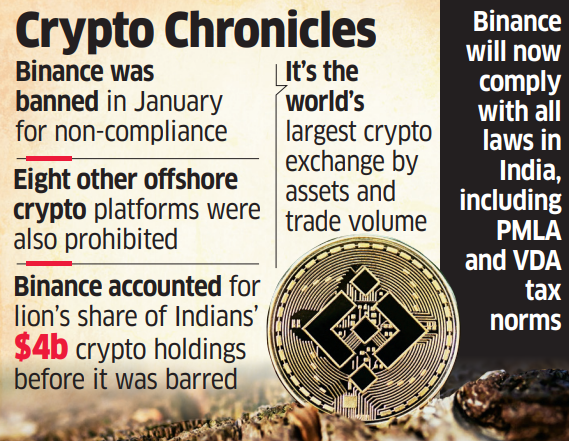

Cryptocurrency large Binance, banned by the central authorities in January, is in search of a return by registering with the Monetary Intelligence Unit (FIU) and paying a penalty of as much as $2 million, sources accustomed to the matter advised ET.

Driving the information: Binance will adjust to all different relevant legal guidelines together with the Prevention of Cash Laundering Act (PMLA) in addition to the VDA taxation, “which it had been sloppily flouting till now,” mentioned one particular person cited above.

Officers conscious of the matter mentioned that India’s stance “has all the time been clear to all international cryptocurrency exchanges, that’s, to adjust to all legal guidelines to proceed working in India.”

Inform me extra: It’s “unlucky that it took (Binance) greater than two years to grasp that there is no such thing as a room for negotiations and no international powerhouse can command particular therapy, particularly at the price of exposing the nation’s monetary system to vulnerabilities,” one particular person cited above mentioned.

Nonetheless, the official didn’t verify the $2-million penalty or the calculations behind it.

Tax leaks: Earlier than it was banned, Binance accounted for practically 90% of the estimated $4 billion crypto holdings by Indian nationals. The platform’s market dominance is especially attributed to its non-compliance with tax legal guidelines which allowed traders to commerce with out paying the 1% TDS (tax deducted at supply) relevant on registered exchanges.

Additionally learn | FIU points discover to Binance, 8 different offshore crypto platforms, writes to MeitY for blocking of URLs

Compliance grows: Binance would be the second offshore alternate to register in India after Seychelles-based Kucoin introduced FIU compliance final month following which the ban on its web site was lifted.

It additionally plans to supply localised fee options, construct a devoted India crew in addition to make investments additional within the nation’s blockchain system.

Additionally learn | Cryptocurrency comeback: Indian exchanges shine amid offshore challenges

D2C manufacturers cough up 30-45% fee for a spot on quick-commerce platforms

Direct-to-consumer (D2C) manufacturers dashing to get listed on quick-commerce platforms are shelling out between 30-45% as commissions, in comparison with the 10-20% that giant, extra established FMCG corporations pay.

Determined steps: Such manufacturers are additionally spending round 20% of their whole gross sales on advertisements on the platforms, and discounting their merchandise by about 20-25% on high of the commissions to get listed on such platforms. The push comes as quick-commerce platforms have seen unbelievable development, with a number of manufacturers saying they noticed gross sales develop three-fourfold in a matter of months after itemizing themselves on these apps.

Struggle for a spot: Going through a protracted and opaque itemizing course of amid excessive demand, such manufacturers are more and more leveraging private connections to interrupt by way of. For the platforms, a model’s scale and comparability with rivals are essential issues on the subject of new listings, senior executives at quick-commerce corporations advised ET. Components reminiscent of what individuals are looking for, gross sales on different platforms, buzz across the model, and the depth of that class on the platform are additionally necessary.

Additionally learn | On ‘fast’ path to profitability: Challenges for fast commerce corporations

Want for information: As smaller manufacturers get more and more reliant on such platforms for gross sales, the negotiating powers of the platforms continue to grow. On the identical time, manufacturers usually don’t have entry to information. Whereas each Instamart and Blinkit have vendor dashboards, they don’t present a lot info round which merchandise promote the very best and through which geography, a number of founders mentioned.

Additionally learn | Non-grocery gadgets ship brilliant development to darkish shops

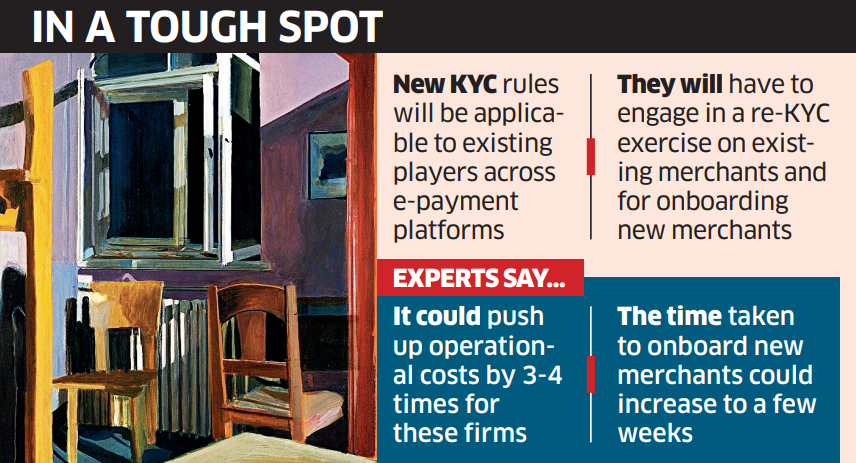

RBI’s stricter KYC guidelines could gradual service provider onboarding 90%: consultants

On April 16, the Reserve Financial institution of India unveiled draft pointers for fee corporations who deploy point-of-sales (PoS) terminals at shops. This was anticipated. However what stunned the fintech sector fully was the recent KYC recommendations which the regulator added for all fee aggregators.

First some context: Razorpay, Cashfree, Pine Labs and MSwipe constructed multi-million greenback companies working with banks and staying away from regulatory clutches. However all that modified in 2020 when the RBI first issued pointers to manage fee aggregators. First the web gamers bought regulated, now the PoS corporations are set to be regulated too.

Hidden surprises: The business had been participating with the RBI during the last six months on these pointers and had urged a graded KYC for these retailers. However with a compulsory video KYC or a bodily KYC, the tech-first fintech corporations have been taken for a shock.

RBI’s take: By these draft norms, the regulator has made its stance very clear. Anybody who’s a part of the monetary providers chain should undertake a KYC of their buyer. These corporations should monitor their enterprise actions commonly too. They might want to report suspicious transactions. General, fintechs who’re used to hyper development and fast cures at the moment are observing a development slowdown and a manifold leap in value of operations.

Additionally learn | On KYC compliance entrance, fee aggregators could also be second to some

Different Prime Tales By Our Reporters

Former Unacademy chief working officer Vivek Sinha

Former Unacademy COO raises $11 million for brand spanking new edtech enterprise: Former Unacademy chief working officer Vivek Sinha on Wednesday introduced the launch of a brand new enterprise, Past Odds Applied sciences, with a seed funding of $11 million in a mixture of fairness and debt. The Bengaluru-based startup is constructing for employability-led coaching, certification, and recruitment providers within the grey-collar workforce phase.

Circle of Video games raises $1 million: Multi-gaming platform Circle of Video games (COG) has raised $1 million in fairness funding from strategic traders Nazara Applied sciences FZ LLC and Swiss-based The Hashgraph Affiliation.

Dailyhunt dad or mum acquires Magzter, grows income from advertisements to subscriptions: VerSe Innovation, the dad or mum agency of on-line information aggregator Dailyhunt and short-video platform Josh, on Wednesday mentioned it has acquired New York-based digital journal retailer Magzter. The deal is a cash-and-stock transaction, cofounder Umang Bedi advised ET, however declined to share specifics.

Elon Musk to fulfill spacetech founders in New Delhi: The federal government has invited the founders of spacetech startups reminiscent of Agnikul Cosmos, Bellatrix Aerospace, Skyroot Aerospace, Dhruva House, Pixxel, SatSure and Digantara to fulfill Tesla and SpaceX chief Elon Musk in New Delhi on Monday.

Mysuru’s Kaynes to make 3,000 RUDRA servers for govt’s CDAC: Mysuru-based built-in electronics producer Kaynes Know-how will manufacture 3,000 indigenously-designed RUDRA high-performance computing (HPC) servers for government-owned Centre for Improvement of Superior Computing (CDAC).

International Picks We Are Studying

■ Why chipmakers are investing billions into ‘superior packaging’ (FT)

■ Musk’s Starlink cracks down on rising black market (WSJ)

■ Three causes robots are about to change into far more helpful (MIT Know-how Overview)