Additionally within the letter:

■ Religious enhance to on-line gaming

■ WhatsApp Biz feels no Google menace

■ Byju’s defence in NCLT

Founders’ fortunes swing with inventory costs in previous 12-14 months

The fortunes of startup founders have mirrored the ups and downs of the inventory market performances of their corporations up to now yr. Whereas some like Deepinder Goyal of Zomato, and Yashish Dahiya and Alok Bansal of Policybazaar, have seen their wealth soar, Paytm’s Vijay Shekhar Sharma skilled a decline within the worth of his holding within the fintech.

Numbers sport:

- Goyal’s 4.2% stake in Zomato was value practically Rs 6,000 crore on February 27, virtually 3 times the Rs 2,200 crore it was value on December 31, 2022.

- Sharma noticed the worth of his 9.1% stake fall to beneath Rs 2,500 crore on February 27, in contrast with Rs 3,071 crore on the finish of December 2022.

- The inventory worth of Policybazaar guardian PB Fintech has greater than doubled up to now 14 months, as have the stakes of its founders Dahiya and Bansal.

.jpg)

Inform me extra: The share costs of new-age firms FSN E-commerce, the guardian of Nykaa, and logistics participant Delhivery have been beneath stress within the final a number of quarters. As an illustration, the worth of the Nykaa promoter group’s holding within the firm was at Rs 22,811 crore as of February 27, marginally down from Rs 23,094 crore as of December 31, 2022.

Driving forces: Zomato’s share worth has surged up to now 14 months, gaining 172% since December 31, 2022. It was among the many first listed new-age firms to make a quarterly revenue.

Paytm’s fall follows the Reserve Financial institution of India’s motion in opposition to Paytm Funds Financial institution for alleged non-compliance. Since January 31, the day when the RBI introduced its motion, One 97’s inventory dropped by greater than 50% earlier than making some restoration. PB Fintech additionally clocked its first quarterly revenue for the quarter ended December 2023.

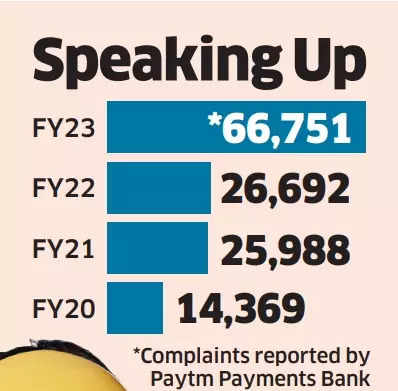

Person complaints spiked at Paytm Funds Financial institution even earlier than RBI motion

Paytm Funds Financial institution had seen a pointy soar in buyer complaints within the final monetary yr, effectively earlier than the RBI introduced its strictures, disclosures made by the corporate have revealed.

What’s the information? Within the fiscal yr ended March 31, 2023, Paytm Funds Financial institution reported 66,751 complaints throughout a number of classes, two-and-a-half instances increased than the earlier yr’s 26,692 complaints, and a progressive rise from 25,988 in FY21 and 14,369 in FY20. These have been principally user-generated, and sometimes solved by the financial institution itself, usually inside 5 to 6 days.

High quality print: The information exhibits that web and cell banking-related complaints stood at 39,000 in FY23, the best amongst all classes, adopted by 8,974 complaints associated to account opening and problem in operations of accounts.

Excessive soar: The soar in complaints between FY22 and FY23 was a lot increased in comparison with any of the prior years because the financial institution began its operations. Cellular banking complaints jumped 300% between FY23 and FY22, whereas wallet-related complaints jumped 94% and points with accessing the accounts went up greater than 700%.

Additionally learn | Paytm’s swap to compliance-first mode seen too little, too late

Newest on Paytm financial institution: Vijay Shekhar Sharma, the founding father of Paytm, introduced his resignation from the board of the funds financial institution, which changed its administrators with new inductees, principally from the banking and bureaucratic fraternity.

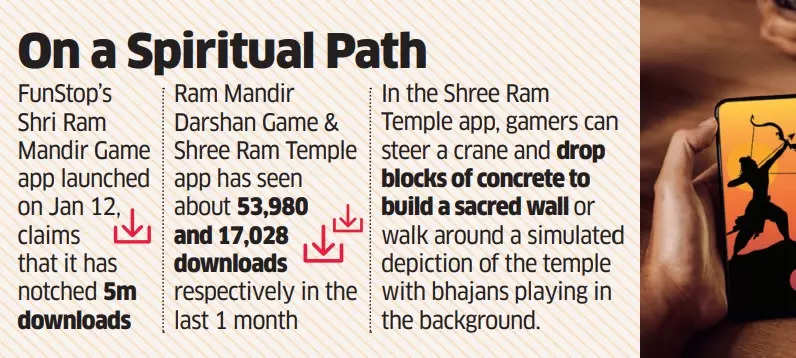

Ram Mandir sends gaming apps on a temple run

Mandir and cell are combining to ship an enormous alternative for Indian gaming firms which can be vying to launch a plethora of so-called “non secular video games” following the disclosing of the Ram Mandir in Ayodhya.

‘Mandir-focussed’ apps: Mandir-focused apps have witnessed a surge in downloads, practically doubling because the Pran Pratishtha ceremony on January 22. This has sparked pleasure in regards to the potential of gamification in non secular and non secular content material, with sport builders anticipating to draw new audiences who won’t have been all for digital gaming earlier than.

Outdated and new: InfoEdge Ventures-backed informal gaming studio FunStop Video games, which launched its Shri Ram Mandir Sport app on January 12, claims that it has notched 5 million downloads throughout app shops.

Not simply the brand new entrants, however outdated video games have additionally seen a resurgence in customers. Even video games just like the Ram Mandir Darshan Sport, which was launched on July 8, 2021 and has 100,000 downloads on the Play Retailer, clocked about 53,980 downloads within the final 30 days alone.

Profiting from it: “This upsurge will be attributed to the reignited enthusiasm for Ram Temple and Hindu tradition because the ceremony. Sport builders are desperate to capitalise on it by producing related video games,” mentioned Utkarsh Shukla, founding father of Yug Metaverse, which is a digital metaverse the place particular person creators, finish customers and small companies can create and monetise content material.

Additionally learn | Whereas Ayodhya traits, influencers take followers on digital pilgrimage

WhatsApp Enterprise shrugs off menace from Google’s RCS

WhatsApp Enterprise isn’t threatened by the entry of wealthy textual content messaging (RCS), which is being popularised by tech large Google, Tarcisio Ribiero, director of worldwide enterprise improvement at Meta, advised ET solely. He added that competitors will solely add worth to clients.

Verbatim: “We do not see RCS as a menace to our market share. We really welcome competitors. Our focus is on the patron the place we have to earn market share by doing one of the best for our shoppers and never by blocking or diminishing rivals,” Ribiero mentioned on the sidelines of the Cellular World Congress.

Ongoing competitors: Ribiero’s feedback include a battle brewing between Google and WhatsApp over the quickly rising enterprise messaging market in India. The US search large is pushing an alternate cell phone messaging system within the nation that some say may disrupt the rising use of WhatsApp by enterprises for speaking with clients.

Market development: The enterprise messaging service by Whatsapp is being utilized by practically 550 million clients in India. RCS adoption by companies, although, remains to be nascent at 300 million.

Additionally learn | Enterprise messaging, WhatsApp engines of development: Meta India Sandhya Devanathan

Different High Tales By Our Reporters

Byju’s US lenders invoke guardian firm’s assure in insolvency proceedings: The Nationwide Firm Regulation Tribunal (NCLT) on Wednesday advised Byju’s to reply to two separate insolvency petitions filed in opposition to the troubled edtech agency by US lenders and the Board of Management for Cricket in India (BCCI).

Lighthouse invests Rs 284 crore in jewelry model Kushal’s: Personal fairness agency Lighthouse, which has backed client manufacturers similar to Bikaji Meals, Wow Momos and Nykaa, has invested Rs 284 crore (round $34 million) in style and silver jewelry model Kushal’s.

Zerodha’s Rainmatter invests Rs 12 crore in foodtech startup TWF Flours: Zerodha-backed enterprise fund Rainmatter has invested round Rs 12 crore ($1.4 million) in foodtech startup TWF Flours. That is the primary institutional funding spherical for the Noida-based firm which was based in 2019.

RBI releases enabling framework for regulatory sandbox: The RBI has launched an in depth framework for a ‘regulatory sandbox’ which is able to present a secure and guarded surroundings for modern fintech startups to check their product speculation earlier than taking it to the market.

India’s presence will democratise electronics worth chain: Josh Foulger | The incoming president of electronics at Zetwerk, Josh Foulger, mentioned India’s presence within the electronics manufacturing ecosystem will democratise the worldwide worth chain and provides clients the world over extra choices.

ONDC apps flag Pai Platforms’ Bitsila acquisition: The acquisition of ecommerce platform Bitsila by Pai Platforms, which was earlier Paytm E-commerce, has raised some issues among the many vendor community contributors of the government-backed ONDC.

International Picks We Are Studying

■ Ransomware teams are bouncing again quicker from legislation enforcement busts (Wired)

■ The AI challenge pushing native languages to interchange French in Mali’s faculties (Remainder of World)

■ Why Google’s ‘woke’ AI drawback will not be a straightforward repair (BBC)