Additionally on this letter:

■ Flipkart’s q-comm head

■ Piyush Gupta quits Peak XV

■ Time sought to check digital competitors regulation

Unique: WeWork Inc to promote 27% stake held in India unit through secondary deal: sources

Almost seven years after coworking main WeWork US entered India by a three way partnership with the Embassy group, it’s now exiting the market. Listed below are all the main points

Driving the information: WeWork India, promoted by Bangalore-based Embassy group, is within the midst of offloading the stake held by its US dad or mum by a Rs 1,200 crore secondary transaction. Embassy group owns 73% in WeWork India and the remaining is with WeWork US. The India entity retains the branding rights for WeWork in India.

New traders check-in: Enam group’s household workplace led by Akash Bhanshali, funding fund A91 Companions, and CaratLane founder’s Mithun Sacheti are investing in WeWork India. This capital might be used to buyout WeWork Inc’s stake within the India unit. The three way partnership unit was arrange in 2017.

Deal particulars: Together with the 27% that’s being offered by WeWork Inc, the deal additionally entails one other 13% being offloaded by the Embassy group, stated an individual accustomed to the main points.

Additionally learn | ETtech Defined: WeWork’s downfall from $47 billion valuation to chapter

Background: Adam Nuemann and Miguel McKelvey based WeWork in 2010 and raised a number of billion {dollars} from high traders together with SoftBank. In November, nevertheless, it filed for chapter 11 chapter. Neumann, in accordance with studies, is planning to purchase again the corporate.

India enterprise thriving: Not like its collapsed US operations, WeWork India reported a 68% bounce in FY23 income at Rs 1,300 crore whereas losses lowered by 80% at Rs 146 crore. For the primary six months of FY24, it clocked a income Rs 831 crore income, up 40% on-year. It’s but to file its audited FY24 financials with the RoC (Registrar of Firms).

Additionally learn | WeWork India says enterprise not affected by US chapter

A yr on, Apple’s India shops emerge amongst its greatest globally

Apple’s two company-owned India shops, which accomplished their first yr of operations this month, are off to an excellent begin having posted income of Rs 190 and 210 crore every for the final fiscal yr.

Driving the information: The shops have joined the ranks of the iPhone maker’s top-performing retail shops globally.

“The shops have clocked month-to-month common gross sales of Rs 16-17 crore every constantly since their launch. It has met Apple’s expectations, matching a number of the best-performing retailer launches and they’re now aggressively scouting house for the subsequent three company-owned shops,” stated an trade govt conscious of the matter.

Enlargement plans: As per two trade executives, Apple is in superior talks to open shops in Pune and Bengaluru. It additionally plans to have one other outlet within the Nationwide Capital Area in Noida. All of those might be in distinguished malls, folks within the know informed us.

One of many executives stated the corporate was ready to finish a yr of its first two India shops earlier than finalising on the subsequent section of growth.

Catch up fast: The US-based tech firm opened its Mumbai retailer on April 18 final yr, adopted by the one in New Delhi two days later. Chief govt Tim Prepare dinner had flown to India for the shop inaugurations.

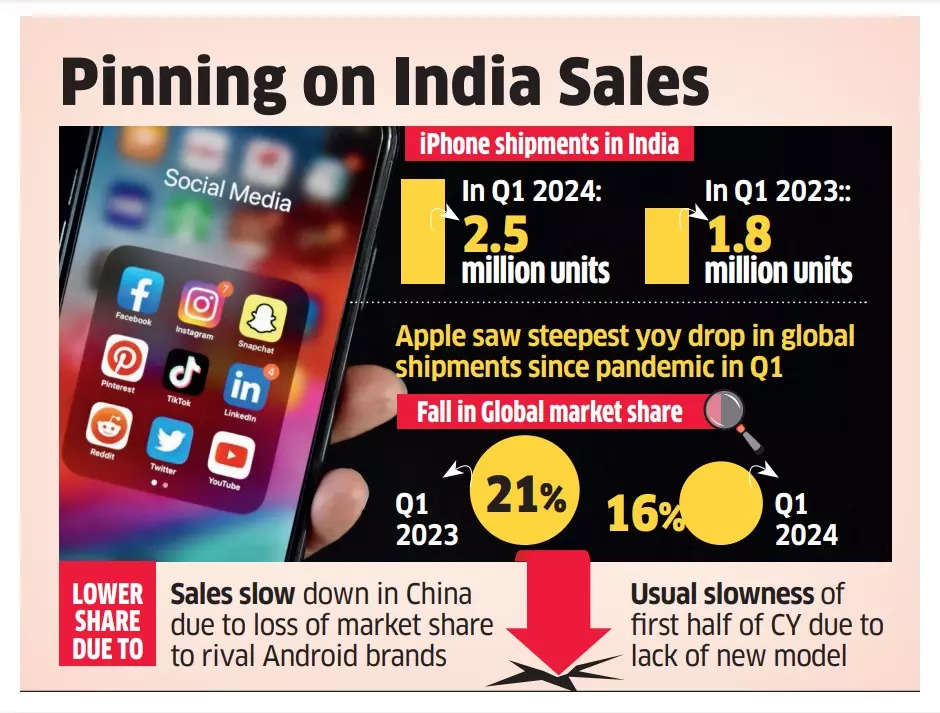

Apple of the I: The iPhone maker has been doubling down on India — the world’s second-largest smartphone market — amid geopolitical tensions and a droop in gross sales in the important thing markets of the US and China. It’s aiming to achieve a double-digit smartphone quantity market share in India as quickly as attainable, from round 7% in 2023.

iPhones powered an over 35% surge in India’s cell phone exports to a document $15 billion-plus in FY24, we reported earlier. Exports stood at $11.1 billion a yr in the past.

Flipkart picks provide chain head to steer fast commerce biz

Flipkart has picked senior vice chairman and group head for provide chain, Hemant Badri to steer its entry into fast commerce.

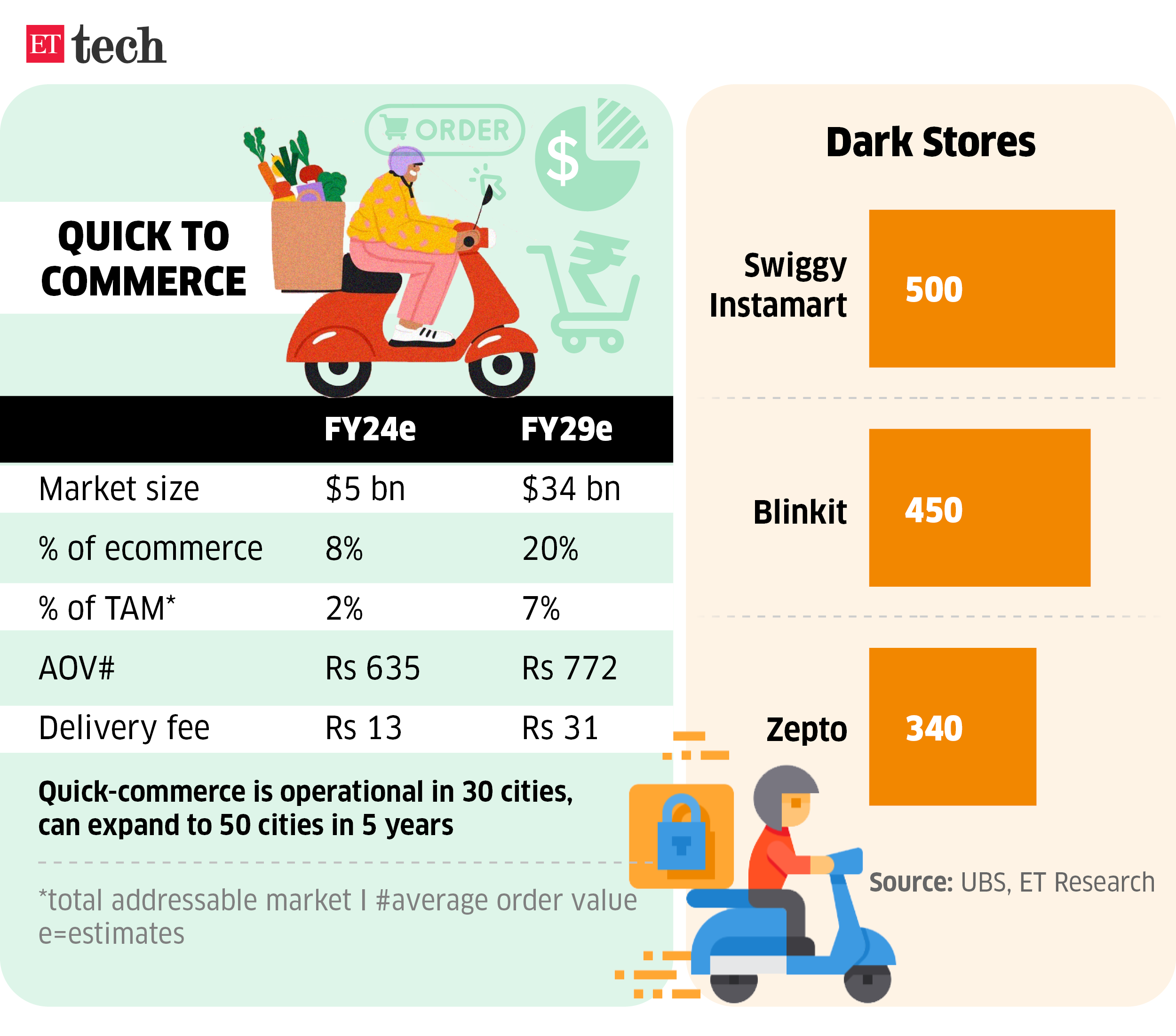

What’s taking place? The Walmart-owned firm is aiming to launch its fast commerce providing in July, ET had reported final week. It’s within the means of establishing a series of darkish shops to do the identical.

Badri joined Flipkart over three years in the past from fast-paced shopper items (FMCG) main Unilever, the place he spent practically 11 years, ending his stint there as vice chairman of worldwide planning, amongst different issues.

The large image: Flipkart’s transfer comes as fast commerce companies like Blinkit and Zepto are increasing the inventory retaining models (SKUs) of their darkish shops so as to add non-grocery classes like attire, electronics, kitchen home equipment and toys, which have historically been the area of ecommerce companies.

We earlier reported {that a} potential deal between Zepto and Flipkart fell by. Whereas Flipkart needed a big shareholding in Zepto with the founders operating the corporate, the latter determined to go for a monetary spherical over a strategic sale.

Flipkart had additionally held funding talks with cash-strapped Dunzo, by which Reliance Retail is the one largest shareholder, however these talks additionally didn’t progress.

Learn our intensive protection on the rise of quick-commerce:

Peak XV MD Piyush Gupta to go away VC fund

In what’s the first senior-level departure at Peak XV Companions since its break up from Sequoia Capital in June 2023, the enterprise funding agency’s managing director Piyush Gupta is leaving on the finish of this month.

What subsequent? Individuals conscious of the matter stated Gupta – who didn’t oversee investments for Peak XV however has been main its strategic improvement staff – is ready to launch his personal enterprise fund targeted on secondary transactions.

Additionally learn | VCs on the lookout for partial exits, traders eyeing IPO-bound companies push up secondary offers

Inform me extra: Singapore-based Gupta, a former banker with Deutsche Financial institution, has labored with Peak XV’s portfolio companies together with Zomato, Pine Labs, Go Colors and Indigo Paints over points equivalent to fundraising, mergers and acquisitions and preliminary public choices.

Zoom out: Gupta’s departure provides to a listing of accelerating churn at enterprise capital companies in India becoming a member of Nexus Enterprise Companions’ Sameer Brij Verma, Lightspeed Enterprise Companions’ Vaibhav Agrawal and Abhishek Nag, along with companions at companies equivalent to Orios Enterprise Companions, Trifecta Capital and Lightbox Ventures.

Advocacy teams search extra time to check proposed digital competitors regulation

A bunch of 21 trade our bodies, together with Broadband India Discussion board, Deepstrat, the Web Freedom Basis, and the Dialogue have written to the federal government in search of an extension to the Could 15 deadline to offer inputs to the draft of the Digital Competitors Invoice.

Time sought: Within the letter addressed to the ministry of company affairs, organisations in addition to some people have argued {that a} five-month extension was essential to permit stakeholders to conduct analysis, contain small companies, shoppers and gig staff in addition to research the affect of ex-ante rules the world over and its efficacies.

“It is usually prone to affect non-digital domains, owing to their inextricable relationship with digital counterparts, and thus may consequently affect jobs and revenue technology alternatives created throughout sectors,” the trade our bodies have argued within the letter.

Recap: Earlier this month in April, the federal government had prolonged until Could 15 the timeline for the submission of stakeholder feedback on the draft of the Digital Competitors Invoice. The unique deadline for submission of feedback was April 15.

In March this yr, the truthful commerce regulator proposed a digital competitors invoice that seeks to place in place a number of obligations for big digital enterprises, together with information aggregators, as a part of efforts to make sure a stage taking part in discipline and truthful competitors within the digital house.

Right this moment’s ETtech Prime 5 publication was curated by Megha Mishra in Mumbai and Jessica Rajan in New Delhi.