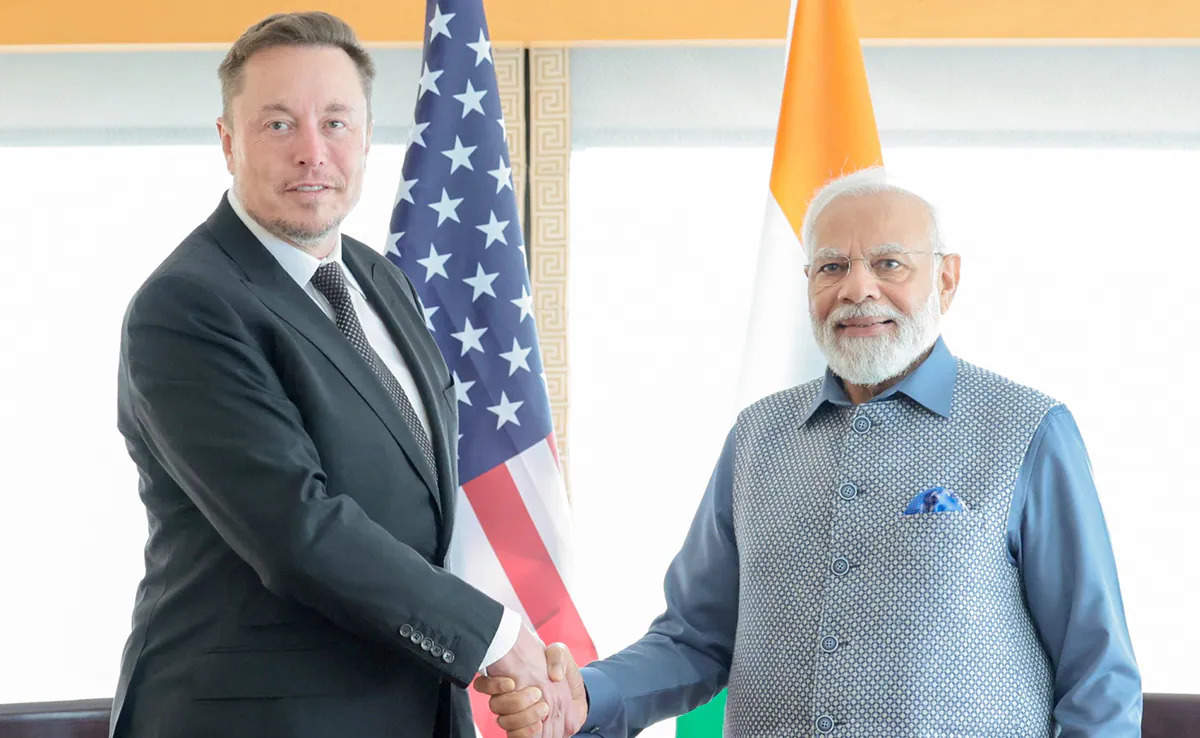

Elon Musk’s lengthy courtship of Indian officialdom might have lastly paid off. Prime Minister Narendra Modi wished him to open considered one of his Tesla “gigafactories” within the nation, as a part of its efforts to develop its long-moribund manufacturing sector; Musk, in the meantime, wished India to handle tariffs on electrical automobile imports that rendered foreign-made Teslas uncompetitive.

On March 15, the federal government introduced a brand new scheme to advertise funding in EVs. Any firm keen to speculate USD 500 million in a brand new manufacturing facility that begins manufacturing in three years (and with at the very least 1 / 4 of its elements added domestically, to start with) can even be allowed to import 8,000 high-end autos a 12 months at a decrease tariff of 15%. It’s usually assumed that this quid professional quo will likely be sufficient to get Musk — and, hopefully, one or two different corporations, like Vietnam’s Vinfast Auto Ltd. — to chew. Actually, the EV producers that at present dominate the Indian market are already bracing for competitors.

On the one hand, this seems to be like enterprise as ordinary. Officers have made a behavior of utilizing the supposed potential of the home market as an inducement for overseas buyers. The stick of excessive tariffs along with the carrot of potential client demand development must be sufficient to lure in folks like Musk, they suppose.

That stated, there’s a deeper story to be instructed right here. Measurement issues: The Indian authorities is a giant believer within the transformative potential of a single giant investor. Officers expended huge quantities of vitality wooing Apple Inc. They had been finally profitable, and now suppose a complete cell phone manufacturing ecosystem will develop up round Foxconn Expertise Co.’s factories in south India. For the previous few years, they’ve been working to persuade Taiwan Semiconductor Manufacturing Co. to do the identical. It’s an anchor investor technique: Get a whale like Musk in, and the minnows will comply with. If Apple and Tesla are each placing a whole bunch of hundreds of thousands into backing the India story, it’s one thing of an announcement in regards to the nation’s enterprise surroundings, proper?

This isn’t the primary time governments have tried this, in fact. China famously waived its home possession necessities to get Tesla to open a gigafactory in Shanghai. That appears to have paid off: Tesla says that over 95% of the elements that manufacturing unit makes use of come from native suppliers. And Musk’s declare that he couldn’t make investments massive in a rustic that didn’t enable him to get sufficient automobiles on the bottom first did have a sure logic. Importing autos to start with permits you to begin making a charging infrastructure, for instance. That in flip grows the home market sufficient to justify the funding you make in native manufacturing.There’s much more that India may do to assist this development alongside. For instance, EV makers who take up this supply must be inspired to spend money on interoperable charging. Land is scarce, and discovering area for a number of totally different sorts of EV charging stations would in any other case be a nightmare.

Tesla does have a bonus in terms of making offers like this: Its enterprise mannequin stresses vertical integration. That’s why its factories are giga-sized, in any case. It’s simpler for them to make guarantees about localization since they’ve better management over their provide chains than their rivals do.

How will native corporations cope with new entrants into India’s EV market? The optimistic take right here is that corporations like Tata Motors Ltd., in the event that they’re frightened about competitors from the Teslas of the world now that tariffs have come down, ought to argue extra strenuously for decrease commerce limitations all spherical. That’s the one factor that will hold them aggressive, given their extra expansive provide chains. The auto sector must turn into the loudest voice in favor of commerce offers like those the nation is at present negotiating with the UK and the European Union. Manufacturing will solely take off when the enterprise local weather actually improves — when tariffs are low and steady, and regulators are as welcoming to smaller corporations as they’re to whales.

India’s massive wager on massive corporations might repay. That is clearly the place its industrial coverage goes now: counting on trusted overseas companions to remodel complete sectors. However, you ask, are you able to belief Tesla with a activity of this magnitude? Or, particularly, Elon Musk, given his historical past of missed deadlines and impulsive enterprise selections? The federal government might have wager on Tesla, nevertheless it’s not taking any probabilities, both. Any firm selecting to take India’s deal can even must put up a financial institution assure in case it fails to comply with by on its guarantees of funding and native sourcing. Belief, however confirm financial institution particulars first.