Additionally on this letter:

■ Lenskart’s income jumps in FY23

■ HCLTech, Mphasis This fall outcomes

■ Capria closes India Alternative Fund

Swiggy confidentially recordsdata draft papers for $1.25 billion IPO

Sriharsha Majety, MD & group CEO, Swiggy

Meals and grocery supply firm Swiggy has taken the confidential path to file draft papers for an preliminary public providing (IPO) with the Securities and Trade Board of India (Sebi), folks within the know advised us.

Inform me extra: Below the confidential route, Swiggy is not going to need to publicly launch its draft pink herring prospectus ( DRHP). Responding to ET, a Swiggy spokesperson stated, “We don’t touch upon any market hypothesis or rumours.”

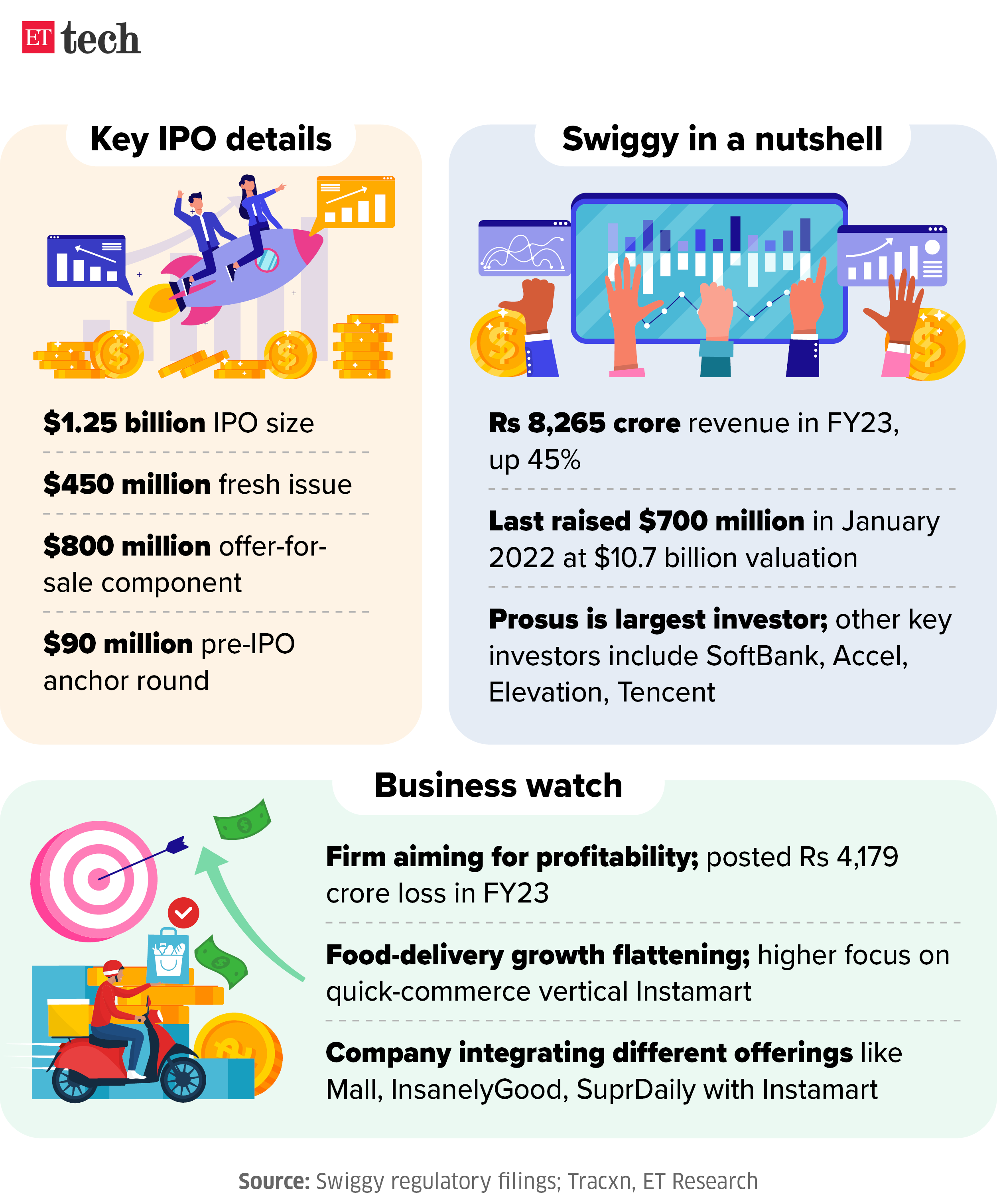

By the numbers: The corporate, which obtained shareholders’ nod for a $1.25 billion public itemizing earlier this week, proposes to boost Rs 3,750 crore ($450 million) in contemporary capital and as much as $800 million within the offer-for-sale part, we reported earlier.

Swiggy can be seeking to decide up about Rs 750 crore from anchor buyers in a pre-IPO spherical.

Additionally learn | Prosus could have promoter tag in Swiggy IPO

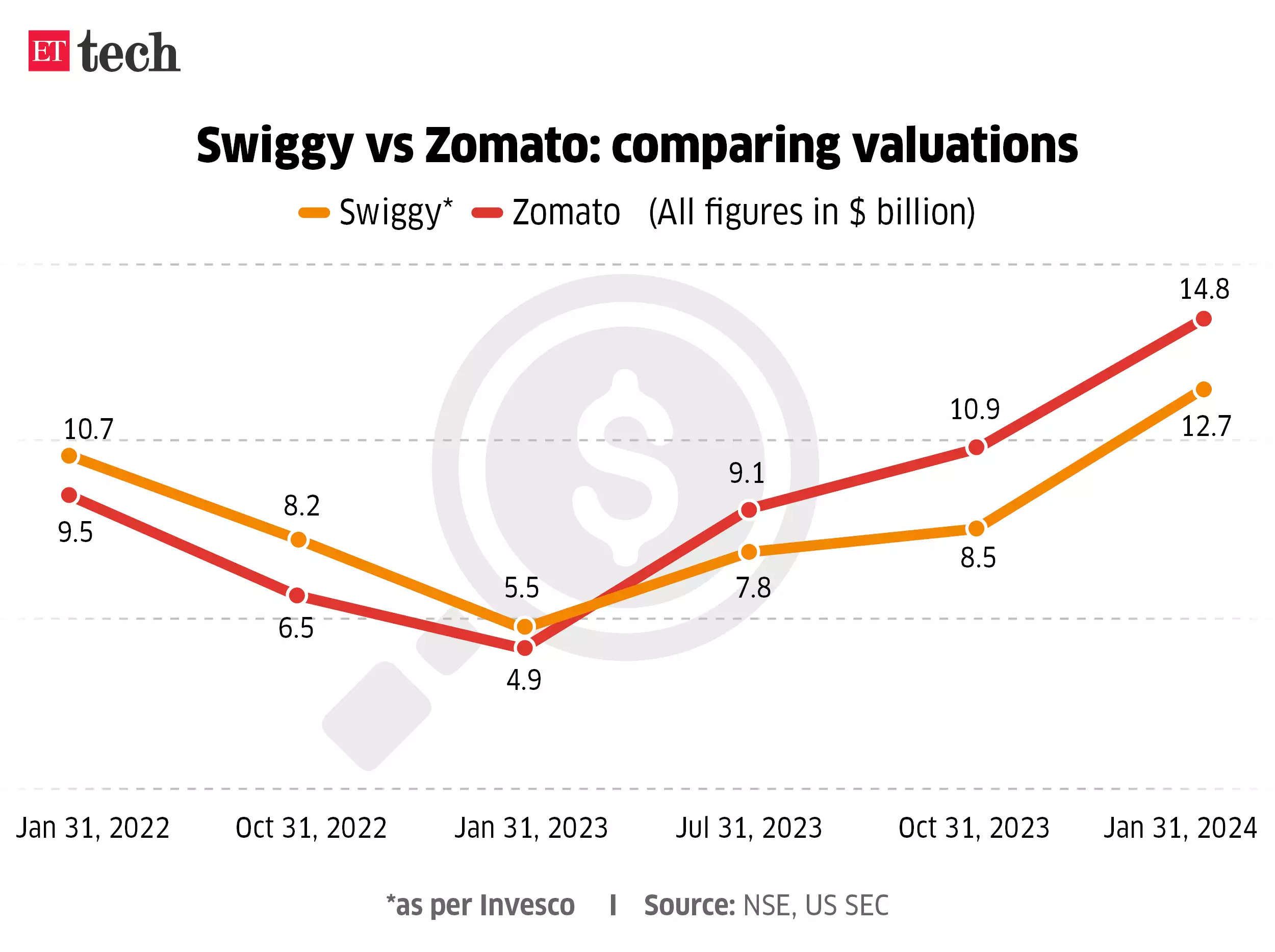

Comparability with Zomato: Swiggy’s important rival Zomato, which listed in 2021, had a market capitalisation of almost $20 billion on Friday.

As per a Reuters report, Swiggy recorded a lack of round Rs 1,730 crore for the 9 months ending December 2023, whereas income stood at Rs 8,490 crore. In the identical interval, Zomato reported a consolidated working income of Rs 8,552 crore.

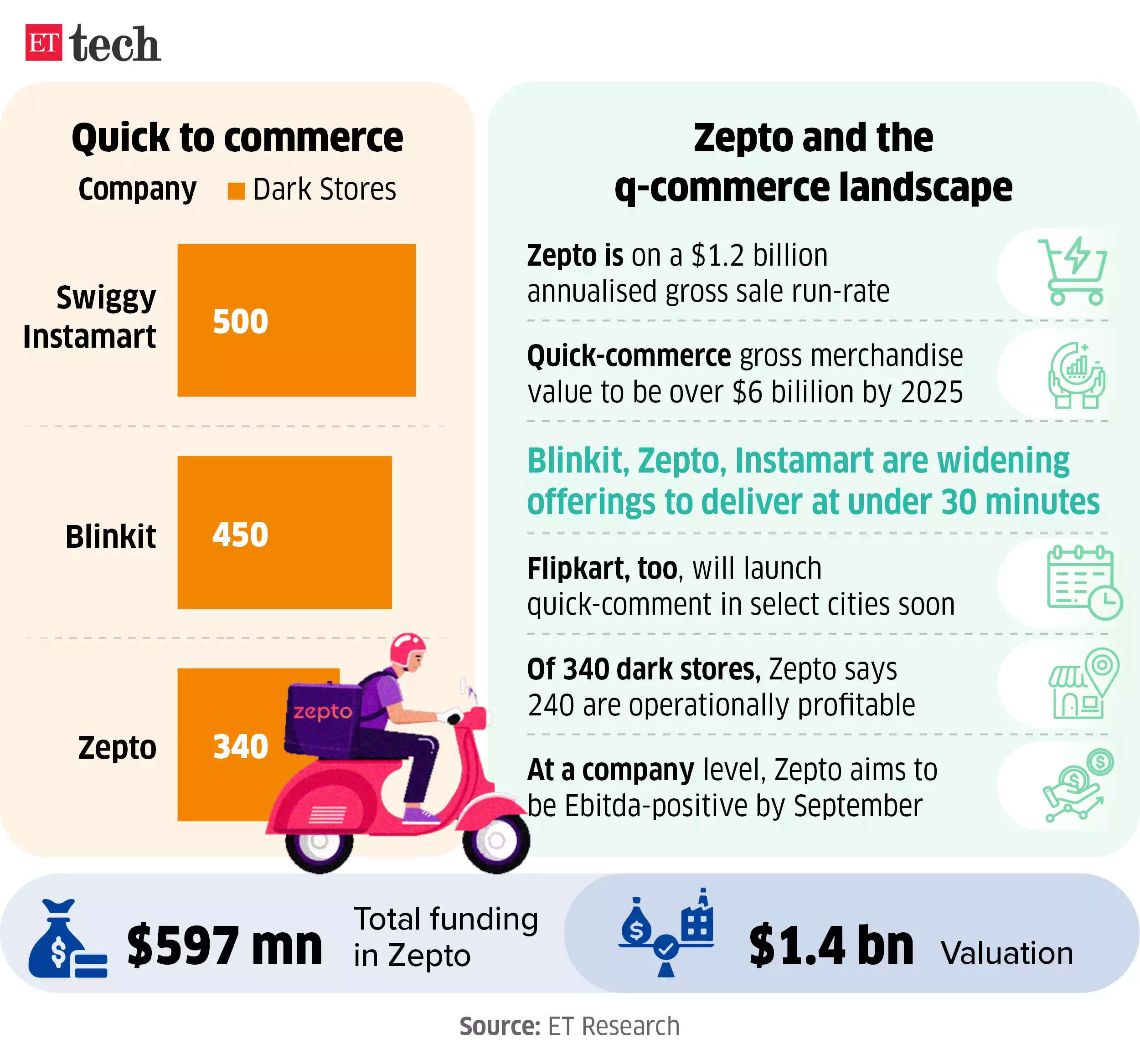

In addition to meals supply, the 2 firms compete within the fast-growing quick-commerce section. Whereas Zomato owns Blinkit, Swiggy operates Instamart.

Additionally learn | FirstCry to refile IPO papers submit Sebi order

Blinkit tops meals supply in Zomato market cap: Goldman Sachs

Fast commerce platform Blinkit’s contribution to guardian Zomato’s market worth has surpassed that of the mainstay meals supply enterprise, based on a Goldman Sachs report.

Key numbers: The implied worth of Blinkit, which Zomato acquired in 2022 for round $570 million, is Rs 119 per share, in contrast with Rs 98 a share for the meals supply enterprise.

This interprets to a contribution of $13 billion by Blinkit to Zomato’s worth, up from $2 billion in March 2023, as per the report.

Goldman Sachs expects Blinkit’s gross order worth and earnings earlier than curiosity, taxes, depreciation and amortisation (Ebitda) to be larger than that of meals supply by fiscal 2029. It sees the meals supply enterprise rising at 15-20% on yr within the foreseeable future.

Goal worth raised: The worldwide brokerage maintained its ‘Purchase’ score on Zomato and raised the goal worth to Rs 240 from Rs 170 earlier.

Following the improve, Zomato shares rose 3% to Rs 190.4 throughout Friday’s buying and selling session on the BSE, earlier than closing at Rs 188, up 1.84%.

Fast recap: In March, Zomato chief govt Deepinder Goyal stated that Blinkit might grow to be larger than the meals supply enterprise in a yr.

On April 17, ET reported, citing a report by HSBC World Analysis, that Blinkit’s market share rose from 32% in March 2022 to 40% in January 2024. In the identical interval, Instamart’s market share fell from 52% to 32%, whereas Zepto’s elevated from 15% to twenty-eight%.

Additionally learn | Zomato Q3 revenue skyrockets 283% QoQ to Rs 138 crore

Lenskart income jumps to Rs 3,788 crore in FY23; trims losses to Rs 102 crore

Peyush Bansal, cofounder and CEO, Lenskart

Omnichannel eyewear retailer Lenskart noticed its consolidated working income greater than double to Rs 3,788 crore in FY23 from Rs 1,502 crore a yr earlier. The Gurugram-based firm decreased its losses from Rs 102 crore in FY22 to Rs 64 crore in FY23.

Rising bills: Complete bills additionally elevated in step with the corporate’s rising scale, coming in at Rs 4,025 crore in FY23 in comparison with Rs 1,726 crore within the year-ago interval. A big a part of the expenditure was attributed to the price of supplies consumed, amounting to Rs 1,132 crore, together with different bills totalling Rs 1,438 crore.

Extra numbers: Lenskart has been worthwhile on a standalone foundation, posting a web revenue of Rs 138 crore in FY23, a 25-fold leap from the earlier fiscal. Standalone working income stood at Rs 2,375 crore.

However the loss on a web foundation, Lenskart reported Ebitda of Rs 404 crore in FY23, in comparison with Rs 1 crore within the earlier fiscal.

Going international: Lenskart operates round 1,500 stores in India, other than its on-line platform. In December 2023, ET reported that Lenskart is planning to open 300-400 shops in Southeast Asia over the subsequent two years. As of December, the corporate had 70 shops in Singapore, and plans to develop into Thailand and the Philippines.

Recap: On Thursday, ET reported that Singapore’s Temasek and US-based asset supervisor Constancy are in superior discussions to take a position round $200 million in Lenskart via a secondary share sale at a valuation of about $5 billion. Lenskart is estimated to have closed FY24 with a income of Rs 5,500 crore, however audited financials are but to be filed with the Registrar of Firms.

HCLTech This fall web revenue rises marginally to Rs 3,995 crore

HCL Applied sciences reported a web revenue of Rs 3,995 crore for the quarter ended March 31, 2024, a marginal uptick of 0.35% in opposition to Rs 3,981 crore reported within the year-ago interval. The board introduced an interim dividend of Rs 18 per share. Let’s dive in with all the small print.

Marginal income uptick: The consolidated income from operations was reported at Rs 28,499 crore, up 5.3% from Rs 27,059 crore in Q4FY23. In fixed foreign money (CC) phrases, income for the reported quarter was up 0.3% QoQ and 6.0% year-on-year (YoY). In the meantime, the USD income was reported at $3,430 million, up 0.4% QoQ and 6% YoY.

The revenue after tax was down 8% on a quarter-on-quarter foundation versus Rs 4,351 crore reported within the October-December interval.

Phase-wise income: Providers CC income elevated by 3% on quarter and 6.7% in comparison with a yr in the past, with notable progress in telecommunications, media publishing and leisure. The digital section CC income was up by 6.3% on yr, contributing 37.1% of providers.

Different key takeaways:

- Complete contract worth (TCV) for FY24 was up 10% at $ 9,759 million.

- The corporate added 3,096 freshers; final 12-month attrition price was 12.4%

- Ebitda for FY24 stood at Rs 20,027 crore, up 8.4%

- FY24 web revenue stood at Rs 15,702 crore and was up 5.7%

Mphasis This fall revenue falls 2.9%: Mid-sized IT providers agency Mphasis reported a 2.9% dip in web revenue at Rs 393.22 crore, from Rs 405.31 crore within the year-ago quarter.

For the total yr ended March 2024, web revenue declined 5% on yr to Rs 1,554.82 crore, whereas income fell 3.7% to Rs 13,278.52 crore.

Capria Ventures broadcasts remaining shut of India Alternative Fund

Early-stage funding agency Capria Ventures has concluded the fundraising for its India Alternative Fund at Rs 153 crore (round $19 million).

Inform me extra: This closure follows Capria Ventures’ announcement of a full-cash exit from job-tech startup Awign, during which Japanese HR agency Mynavi Corp acquired a majority stake.

Quote, unquote: “Via this exit, we shall be returning greater than 50% of the invested capital to the restricted companions (LPs) of our India Fund II and greater than 20% to the LPs of the now closed Alternative Fund,” Capria Ventures managing associate Surya Mantha advised us.

Portfolio firms: Beforehand often called Unitus Ventures, Capria has backed startups like workforce administration platform BetterPlace, on-line math class startup Cuemath, edtech platform Masai Faculty and schooling mortgage supplier Eduvanz via its Alternative fund.

At the moment’s ETtech Prime 5 publication was curated by Megha Mishra and Ajay Rag in Mumbai.