Additionally on this letter:

■ Ola Cabs to close worldwide ops

■ Flipkart Web will get Rs 1,421 crore

■ ETtech Achieved Offers

Paytm Funds Financial institution MD & CEO Surinder Chawla resigns

Paytm Funds Financial institution managing director and chief government officer Surinder Chawla, resigned on April 8, One 97 Communications, an affiliate entity of the financial institution knowledgeable the inventory exchanges on Tuesday.

The rationale: Chawla despatched in his resignation citing private causes and to pursue ‘higher profession prospects’, the submitting talked about. His final working day might be June 26 of this yr.

Chawla had joined the funds financial institution on January 9 final yr. Previous to that, he was with RBL Financial institution as the pinnacle of department banking.

The share value of One 97 Communications closed at Rs 404.3, down 1.95% on the BSE. Paytm knowledgeable the bourses about Chawla’s resignation after buying and selling hours on Tuesday.

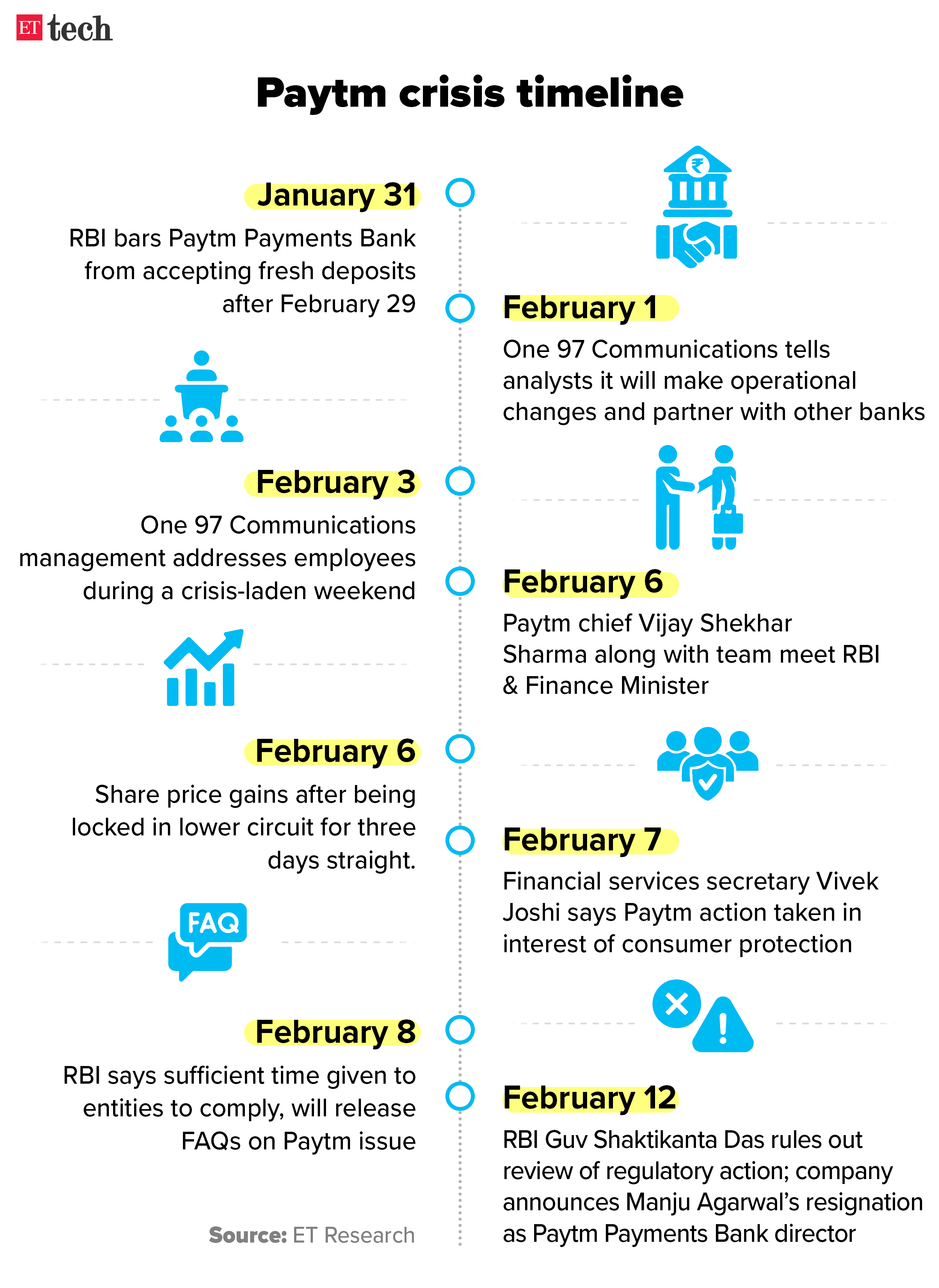

Amid turmoil: The resignation comes almost a month after Paytm Funds Financial institution stopped fundamental banking companies beneath directions from the Reserve Financial institution of India.

PPBL subsequently snapped all relations with Paytm and the board was reconstituted with 5 unbiased administrators and an unbiased chairperson.

Additionally learn | Elevation Capital’s large gamble on Paytm backfires

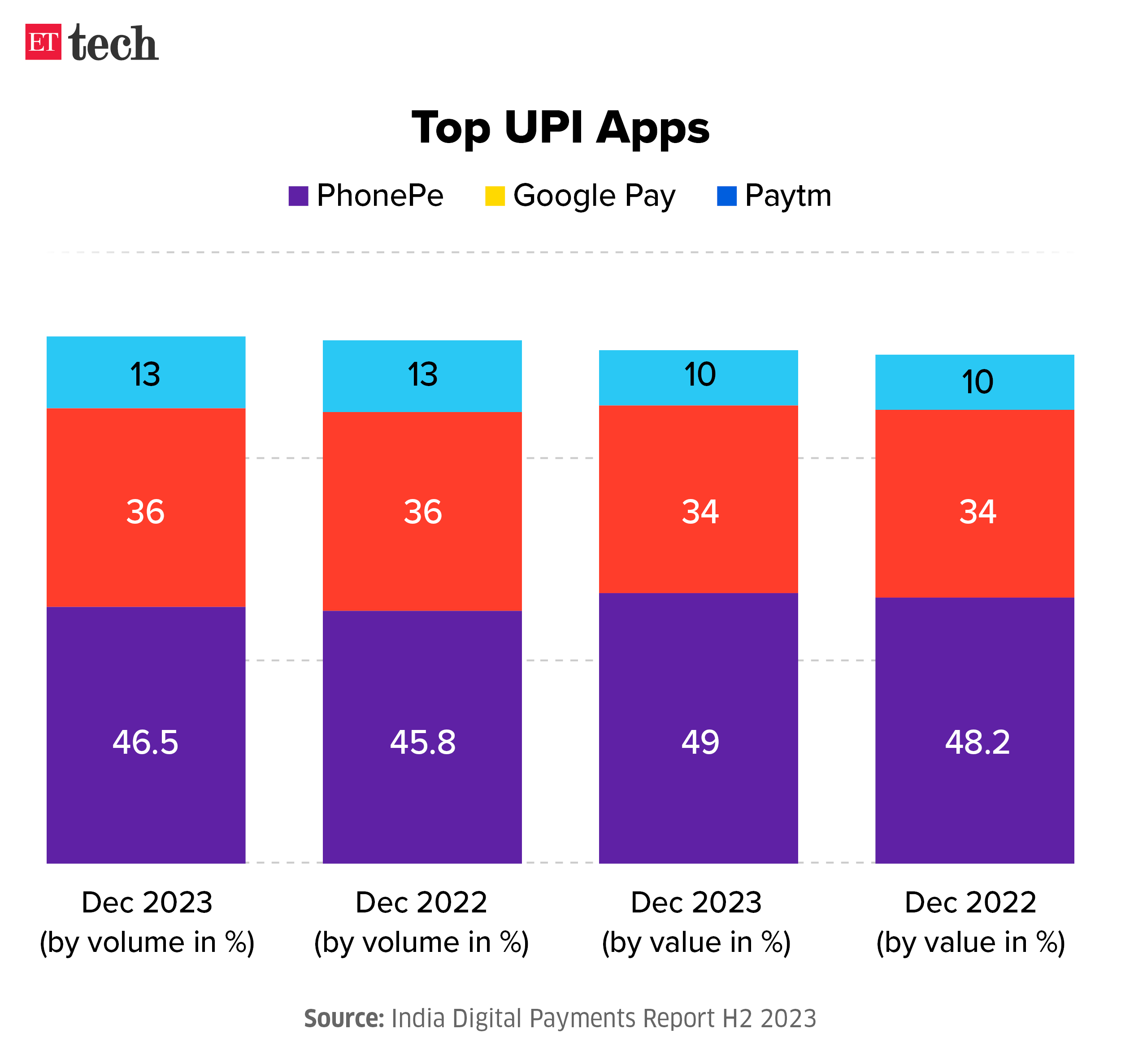

Dip in UPI funds: In March, Paytm processed round 1.2 billion Unified Funds Interface (UPI) transactions, down barely from 1.3 billion in February and 1.4 billion in January of this yr, knowledge launched by the Nationwide Funds Company of India reveals.

The amount rely has elevated additional for its two bigger friends PhonePe and Google Pay.

Additionally learn | Paytm’s woes set off contemporary worries on UPI market share duopoly

Catch up fast: One 97 Communications, which owned a 49% stake within the financial institution, moved most of its enterprise relationships to different lenders. Paytm now operates as a third-party fee utility on the UPI, identical to PhonePe and Google Pay. It really works with Sure Financial institution, HDFC Financial institution, State Financial institution of India and Axis Financial institution for this service.

Additionally learn | Paytm’s UPI funds: Two contrasting tendencies

Invesco marks up Swiggy’s valuation by 18% to $12.7 billion

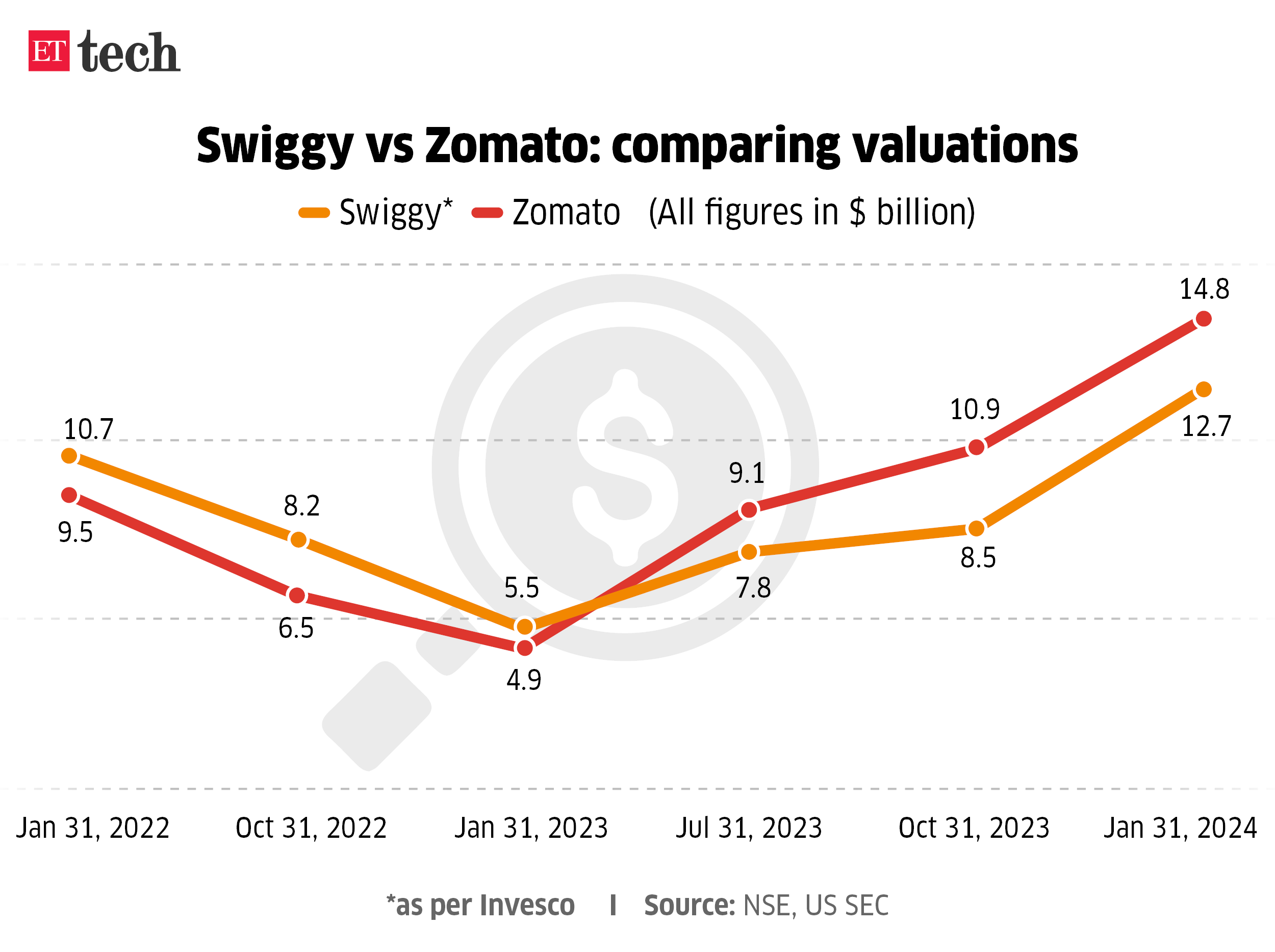

US asset supervisor Invesco has marked up the valuation of meals and grocery supply platform Swiggy to $12.7 billion, as per filings made with the US Securities and Change Fee.

Valuation graph: The most recent mark up in Swiggy’s valuation is up 18% from the $700 million funding spherical in January 2022 that valued the agency at $10.7 billion.

The most recent valuation ascribed to Swiggy by Invesco is as of January 31 this yr. This was the fourth consecutive valuation markup by Invesco for Swiggy.

Final month, Baron Capital additionally marked up the corporate’s valuation to $12.1 billion.

FY23 efficiency: Swiggy’s working income for the fiscal yr ended March 2023 surged 45% year-on-year to Rs 8,265 crore. Nonetheless, its internet loss widened by 15% to Rs 4,179 crore throughout the identical interval.

In line with Reuters, which cited an inside firm doc, Swiggy recorded a lack of round Rs 1,730 crore for 9 months ending December 2023. Throughout this era, the corporate recorded revenues of round Rs 8,490 crore.

Catch up fast: Swiggy lately transformed itself to a public restricted firm.

The change comes as the corporate is anticipated to file a draft purple herring prospectus within the subsequent few months, with plans for a $1 billion preliminary public providing of shares nearer to the top of the yr.

Ola Cabs to exit worldwide markets

Ola Cabs is about to exit all of its current worldwide markets, specifically the UK, Australia, and New Zealand by the top of this month. It has began sending out notifications to customers concerning the impending closure, with operations set to stop in Australia on April 12.

Quote, unquote: “The way forward for mobility is electrical – not simply in private mobility, but additionally for the ride-hailing enterprise and there may be immense alternative for growth in India. With this clear focus, we’ve reassessed our priorities and have determined to close down our abroad ride-hailing enterprise in its present type,” a spokesperson mentioned.

Electrification push: Ola Cabs’ chief government Hemant Bakshi had mentioned in January the agency would give attention to the electrification of its fleet and premiumisation of its choices for future development. The corporate has about 8,000 electrical scooters from IPO-bound sister agency Ola Electrical to supply bike-taxis companies.

Monetary highlights: The cab enterprise, whose dad or mum agency is ANI Applied sciences, had turned worthwhile on an Ebitda foundation in FY23, bringing in Rs 250 crore, towards an Ebitda-level lack of Rs 66 crore within the previous fiscal yr. The agency’s income grew 58% to Rs 2,135 crore in FY23, whereas general loss narrowed 65% to Rs 1,082 crore.

Additionally learn | Ola, Uber roll out subscription-based plans for auto drivers

Flipkart infuses Rs 1,421 crore in market arm

Walmart-owned Flipkart, via its Singapore holding firm, has infused Rs 1,421 crore (or round $170 million) in its Indian market entity Flipkart Web.

Transaction particulars: The infusion was made in two tranches on April 6 and March 23, in keeping with filings sourced from the Registrar of Corporations (RoC).

To make sure, that is an inside money switch and never contemporary funding at a dad or mum degree.

That is, nonetheless, the second main fund infusion obtained by Flipkart Web from its Singapore-based associated entities in 2024. In March, the corporate obtained $111 million.

Funding talks: Flipkart is in talks to lift as a lot as $1 billion, with dad or mum Walmart committing to inject $600 million, we reported on December 21. This could be the primary fundraise for the web retailer since 2021, when it closed a $3.6 billion funding spherical at a valuation of $37.6 billion.

For the yr ending March 2023, Flipkart Web reported a 42% development in its working income to Rs 14,845 crore, whereas its complete loss narrowed by 9% to Rs 4,026 crore.

ETtech Achieved Offers

Blue Tokai cofounders (from left) Shivam Shahi, Namrata Asthana and Matt Chitharanjan

12 Flags invests in Blue Tokai, its first in India: 12 Flags Group, the India-focused client fund arrange by former international chief of Reckitt Benckiser Rakesh Kapoor, has made its first funding in speciality espresso chain Blue Tokai Espresso Roasters. Kapoor confirmed the event to ET however declined to touch upon additional particulars of the funding at this stage.

Sprinto raises $20 million in funding: Sprinto, a danger and compliance automation platform for companies, has raised $20 million in an fairness funding spherical led by Accel, with participation from current buyers Elevation Capital and Blume Ventures. The funds might be used for analysis and improvement (R&D), enhancing buyer expertise and increasing into new markets.

Ghost Kitchens acquires Shy Tiger Manufacturers: Cloud kitchen startup Ghost Kitchens has acquired Ahmedabad-based cloud kitchen agency Shy Tiger Manufacturers. The acquisition is a part of Ghost Kitchens’ growth technique in Gujarat, it mentioned in a press release. Shy Tiger operates 5 multi-brand cloud kitchens in Ahmedabad and has an annualised income run fee (ARR) of Rs 5 crore, the assertion added.

At the moment’s ETtech Prime 5 publication was curated by Megha Mishra in Mumbai and Gaurab Dasgupta in New Delhi.